Can Microsoft’s AI and cloud momentum propel the stock higher?

Microsoft Corporation (NASDAQ: MSFT ) has emerged as one of the main architects of the new digital economy, capitalizing on the AI-driven digital transformation across industries. While the tech giant is spending heavily on artificial intelligence, the market is watching the business closely to see how well it is making money on the investment. Its cloud business is growing exponentially, as businesses from all industries spend more on AI tools and services hosted in the cloud.

The Stock

Over the years, Microsoft has remained an attractive investment option for institutional and retail investors alike. A stock often serves as a barometer of the performance of the broader technology sector. In 2025, performance was very positive, with shares hitting record highs in October. The stock has grown more than 15% in the past year, but slower than the S & P 500. This week, it traded close to the levels seen in the last six months, after a series of ups and downs.

The company pays consistent quarterly dividends, with ten years of strong growth reflecting its financial strength and commitment to returning value to shareholders. Last month, the board declared a quarterly dividend of $0.91 per share, payable on March 12, 2026. Analysts following the business see strong growth in 2026, with their consensus price target suggesting growth of 30%. Azure’s rapid growth and rapidly growing AI business, bolstered by Microsoft’s deep partnership with OpenAI, is poised to enhance shareholder value in the coming months.

A Strong Start

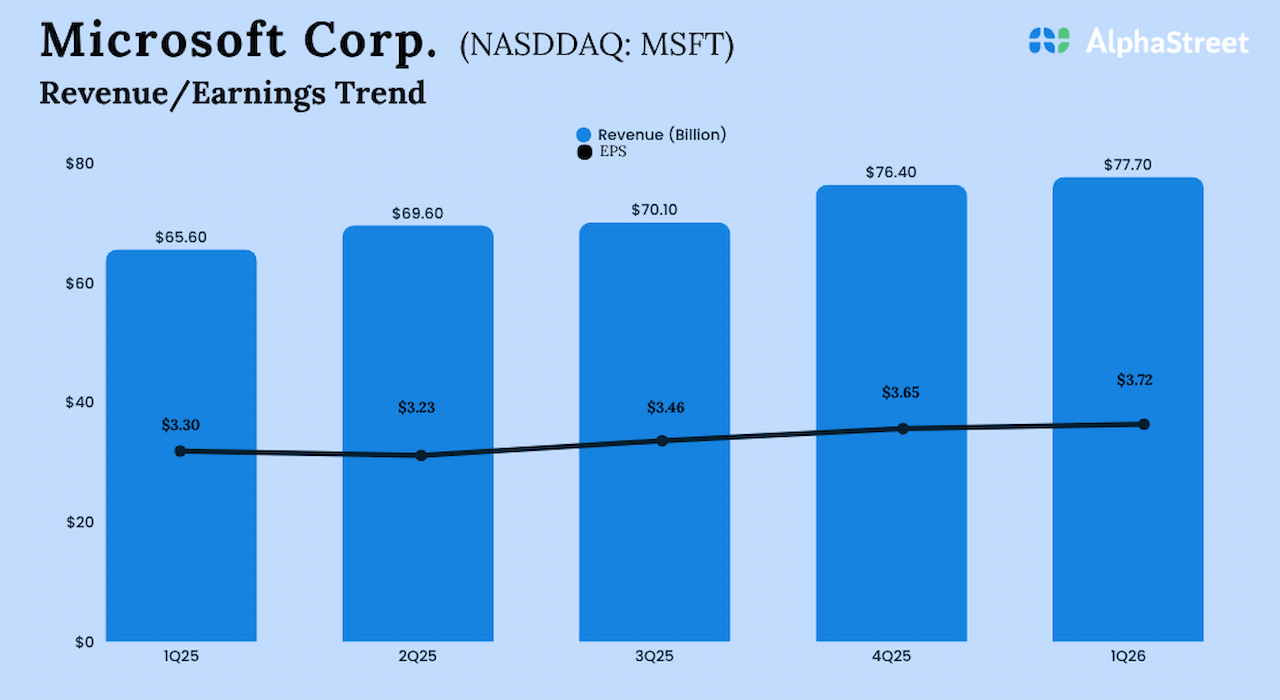

For the first three months of FY26, Microsoft reported net income of $27.7 billion or $3.72 per share, compared to $24.7 billion or $3.30 per share in Q1 2025. The earnings came in above analysts’ forecasts. The key point has been beating ratings for almost three years. First-quarter revenue rose 18% year over year to $77.7 billion, beating estimates, led by The Intelligent Cloud a segment that continues to be a key driver of growth. The second quarter report is expected to be released on January 28, after the closing bell.

Commenting on the company’s AI strategy, CEO Satya Nadella said on the Q1 FY26 earnings call, “We are building a fleet of frustrations that are continuously being modernized and include all stages of the AI life cycle, from pre-training to training, to artificial data generation and inference – and it goes beyond genAI’s load of recommendation engines, databases, and distribution. We fully optimize this ship in all silicon, systems, and software to improve efficiency and effectiveness. It allows us to deliver the best ROI and TCO to us and to our customers.”

AI Push

The company relies on its highly distributed cloud business and integrated AI computing platform to drive future growth, making cloud and AI tools widely available and usable in everyday life. Having invested heavily in AI data centers, the company is focused on translating that into long-term margins amid macroeconomic uncertainty and changing interest rates. Management aims to increase its AI capacity by 80% this fiscal year and nearly double its total data center footprint over the next two years.

For Microsoft shares, the average price over the past twelve months is $464.78. Extending the volatility seen during the week, the stock lost momentum immediately after the open on Friday and traded lightly in the morning hours.