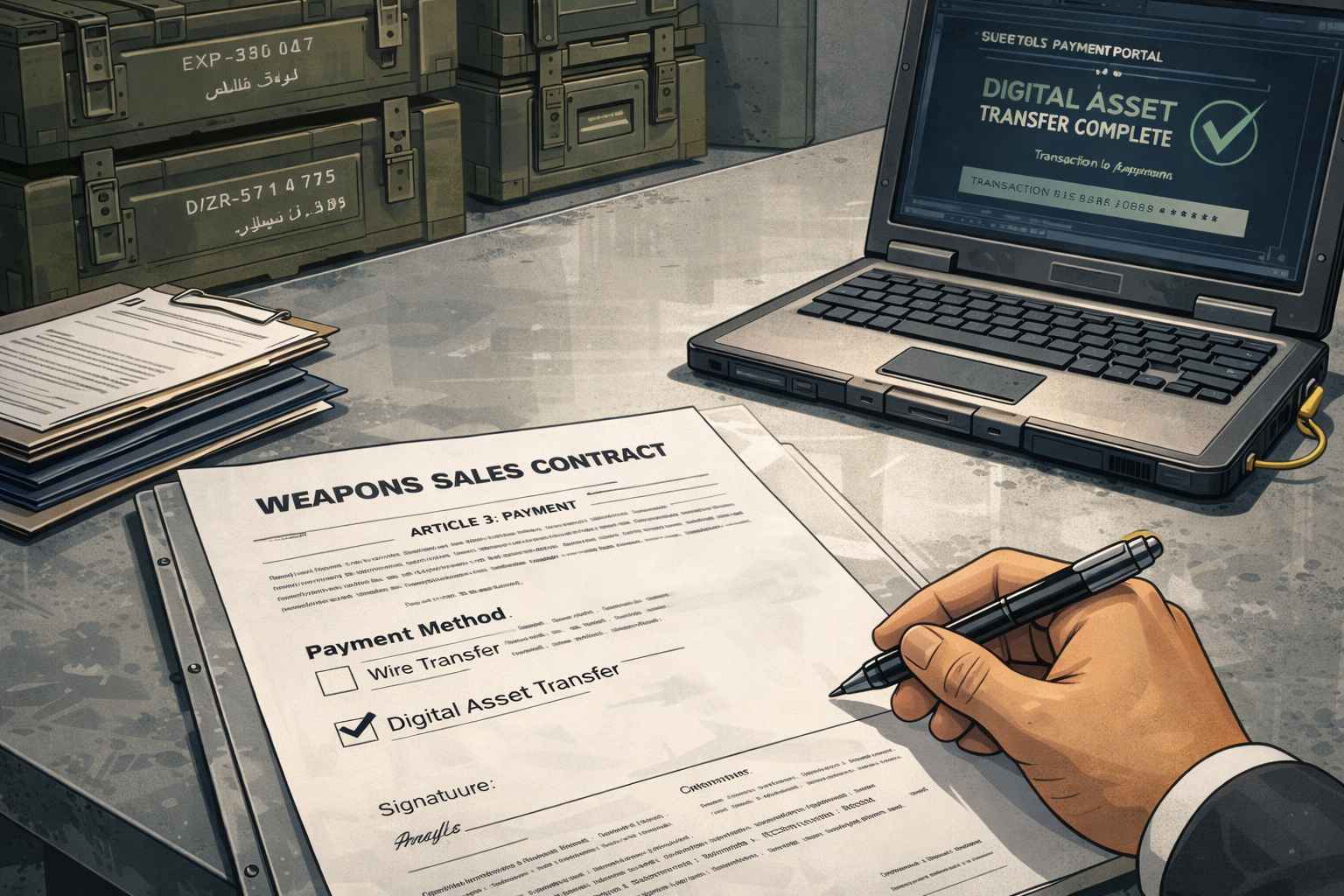

Iran Now Accepts Crypto Payments for Arms Shipments

Iran is now allowing foreign buyers to pay for advanced weapons using cryptocurrency, as well as exchange for local currency. Officials of the Ministry of Defense Export Center, known as Mindex, confirmed that digital assets are accepted as payment for overseas arms sales. Years of sanctions and isolation from the international banking system seem to have pushed Iran into these alternative ways of keeping military exports flowing.

Crypto Added to Payment Options for Foreign Arms Buyers

Mindex has updated its terms to officially include digital currency as a payment option. The list also allows for exchange deals and payments in Iranian Rials, giving buyers more flexibility in how they pay. These changes are designed to counter the impact of international banking restrictions, which have made it difficult for Iran to move money through traditional channels.

🇮🇷 NEED AN ARROW? Iran will sell you ONE FOR BITCIN

Iran recently opened its weapons store to anyone with enough digital currency, offering everything from deadly drones to warships.

No banks, no questions, just crypto or trading agreement.

There’s even a chatbot to help you choose… pic.twitter.com/sL3IAp4NNl

— Mario Nawfal (@MarioNawfal) January 1, 2026

The Mindex website has a full catalog of military offerings. These include Emad ballistic missiles, Shahed drones, Shahid Soleimani-class warships, air defense systems, cruise missiles, rockets, again small arms. The agency has made it clear that any of these can be paid for using crypto, barter, or national currency.

Sanctions Made Crypto More Attractive

For many years, Iran has been under heavy sanctions from the United States, the European Union, again others with its nuclear program and regional activities. These measures have blocked access to international banks, forcing Iran to find new ways to complete transactions. Digital currencies, with their peer-to-peer structure and resistance to traditional financial regulation, have been part of that strategy.

According to Mindex, the sanctions will not interfere with the delivery of weapons. The organization says its general policy is to bypass restrictions entirely, giving assurances that consumers will receive their purchases without delay. The website also includes multilingual support and a chatbot to guide consumers through the process.

FIND OUT: 9+ Best High-Risk, High-Reward Cryptos to Buy in January 2026

Who Can Buy

Mindex says it has relationships with 35 countries, although it does not disclose who they are. Analysts say this is in line with the larger trend for countries under sanctions to find new ways to keep their trade flowing. Governments working with Iran, using the standard finance risk of disconnection from the US, EU, or UK systems. That threat has led some to explore crypto and exchanges as safer avenues.

Security analysts also note how rare it is for a country to openly advertise crypto payments for strategic military equipment. Instead of hiding it, Iran lists crypto payments on the official government website with clear terms, rates, again delivery details.

FIND: Next 1000X Crypto: 10+ Crypto Tokens That Can Hit 1000x by 2026

Implications of Global Arms Sales

The decision to accept crypto in official arms sales signals a potential change in the way arms deals are structured and tracked. Sanctions and financial restrictions have long shaped Iran’s economy. The use of digital currency is a way around that, and may encourage other countries in a similar situation to explore a similar approach.

Iran already ranks among the top 20 arms dealers in the world. Adding crypto to its accepted payment methods would make that business even more difficult to control. It also raises concerns from international watchdogs about how digital currency can be used in the global arms trade.

The move is likely to draw scrutiny from regulators and governments alike. With crypto now part of Iran’s defense export strategy, the overlap between digital currencies and global security has taken another step forward.

GET: 20+ Next Crypto to Explode in 2025

Follow up 99Bitcoins in X with the latest Market updates and Subscribe to YouTube Daily Expert Market Analysis

Key Takeaways

again small arms

Why you can trust 99Bitcoins

Founded in 2013, 99Bitcoin team members have been crypto experts since the early days of Bitcoin.

90+ hours

Weekly survey

100k+

Monthly students

50+

Professional contributors

2000+

Crypto projects reviewed

Follow 99Bitcoins in your Google news feed

Get the latest updates, trends, and information delivered right to your fingertips. Register now!

Register now