Fresnillo was the best performer of the FTSE 100 in 2025. Should investors consider buying it?

Image source: Getty Images

In 2025, a silver mining company Fresnillo (LSE: FRES) was i FTSE 100who is doing very well (by a wide margin). Its share price jumped from 603p to 3,334p – a gain of around 450%.

Should investors consider buying this stock while it’s hot? Let’s talk.

Why Fresnillo stocks are on fire

It’s not hard to see why Fresnillo’s stock is on the rise in 2025. The company is widely considered to be the largest silver mine in the world. And silver prices rose last year. After starting the year near $30 per ounce, the price of the precious metal rose to $84 per ounce by the end of the year.

When precious metal prices jump this way, it usually leads to higher profits for producers. Because these companies tend to have fixed operating costs (meaning that price increases tend to fall flat).

Looking at forecasts, analysts expect Fresnillo to post revenue of $1,145 million in 2025, up from $141m in 2024. That would represent a 712% increase.

Given such a large increase in expected profits, it is not surprising that the share price has soared.

Is it worth looking at in 2026?

As for whether the shares are worth a look today, that really depends on an investor’s view of where silver prices are headed next.

There are several reasons for silver’s strong rise at the moment. Another thing is that gold is going up. When it goes up, silver tends to go along with the ride. Another is that silver is needed in a variety of industrial applications including electric vehicles (EVs), solar panels, and data centers. And right now, there is a shortage of the precious metal.

Now, looking ahead, gold could continue to rise and demand for silver could remain strong. So silver prices could continue to rise (some experts target $100 per ounce by 2026).

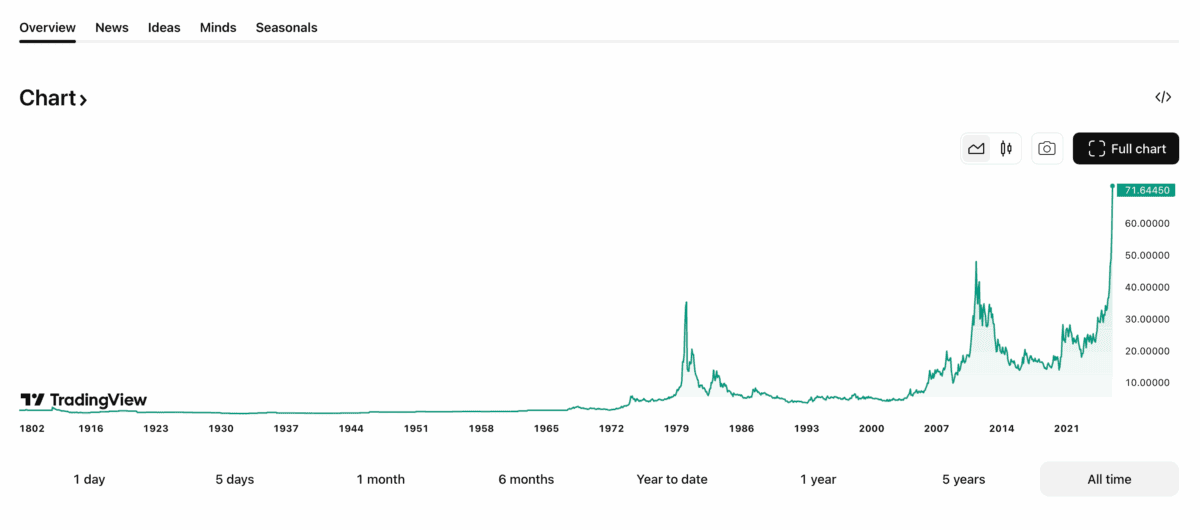

However, looking at the silver price chart, it looks a little scary to me.

Recently, the price has been parabolic. That doesn’t look sustainable (I think there are some overestimations at the moment). I have seen that type of chart many times before. And it almost always ends badly. Just look at how silver prices fell in 2011. The fall was bad.

If the price of silver were to drop from here, investors in Fresnillo could be looking at serious losses. That’s a situation you should consider.

High rating

Rounding out the stock itself, it currently trades at a forward price-to-earnings (P/E) ratio of about 21. That’s a relatively high multiple for a precious metals producer.

For reference, Newmontthe world’s largest gold producer, currently trades at a P/E ratio of about 13. So Fresnillo looks more expensive in comparison.

Note that the average target price for Fresnillo is around £24. That’s about 30% below the current share price.

The best opportunities in the market today?

Given the parabolic silver price and high value here, I think caution is warranted on Fresnillo shares right now. If an investor is really into silver, stocks may be worth considering.

But if I weigh the risks, I think there are better opportunities in the research market as we start 2026.