INTC Stock: Where does Intel stand in the semiconductor race?

Intel Corporation (NASDAQ: INTC ) is working to regain dominance in the semiconductor market, while evolving from an integrated chip maker to a global innovator player. The turnaround plan involves a major capital investment to re-establish its core business. After years of losing market share and falling behind in manufacturing technology, 2026 marks an important year for the company as important technological and operational milestones are expected to converge.

Stock Rallies

In the latter half of 2025, Intel stock pulled back from a slump that lasted several months. Last week, stocks gained momentum and entered 2026 on a positive note. Notably, the number has more than doubled in the past year after sitting near a multi-year low for a long time. The recovery reflects investor confidence in the turnaround strategy – the company is widely viewed as an industry giant due to competitive and strategic challenges.

Last year, INTC was one of the best-performing technology stocks, but its value remains below many of its industry peers. It appears that stakeholders have turned more optimistic about Intel’s prospects after the appointment of Lip-Bu Tan as the new CEO, succeeding Pat Gelsinger who left abruptly after a failed turnaround plan. Overall, the company now appears to be in a better position to capitalize on emerging opportunities in the semiconductor market, such as the growing demand for AI chips. Recent funding from the US government, Softbank, and Nvidia is expected to contribute to this.

Returning

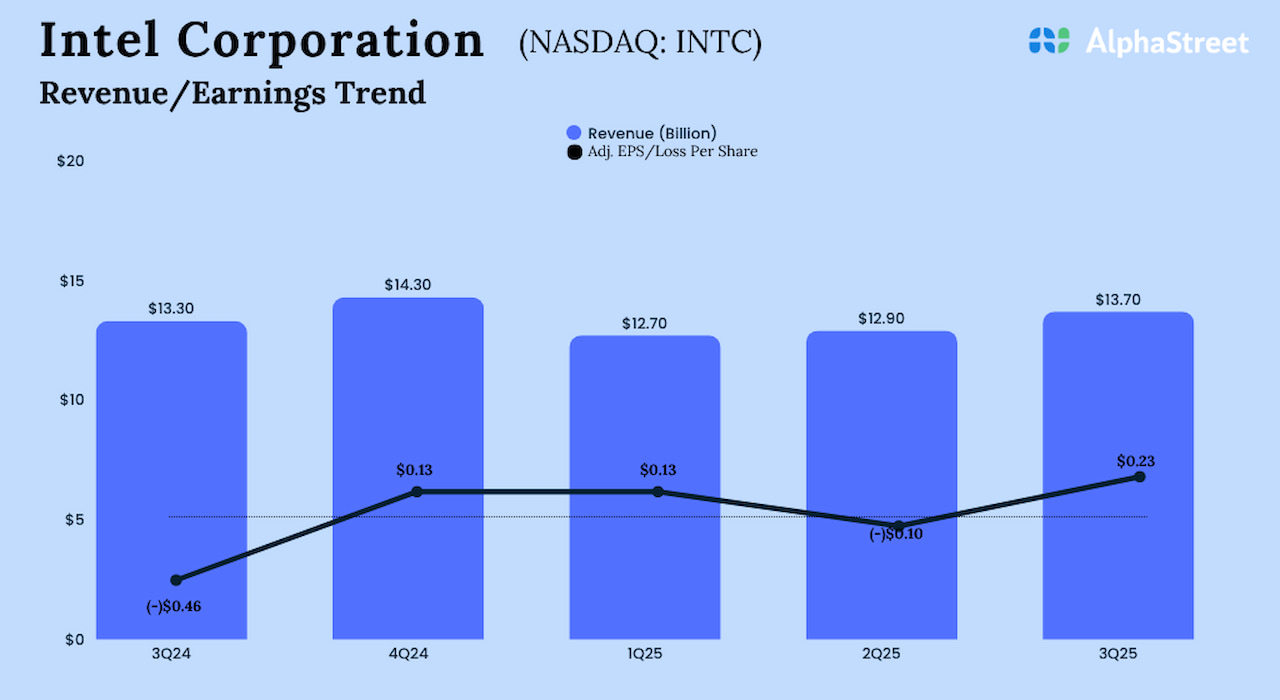

In the third quarter of FY25, Intel’s revenue increased 3% year-on-year to $13.65 billion. Client Computing revenue increased 5%, while Data Center and AI revenue decreased 1%. Adjusted earnings were $0.23 per share in the September quarter, excluding special items, compared with a loss of $0.46 per share in the year-ago quarter. Ratings go beyond salaries. On a reported basis, net income came in at $4.06 billion or $0.90 per share in Q3, compared to a loss of $16.6 billion or $3.88 per share last year. The fourth quarter report is scheduled to be released on January 26, after the closing bell.

Lip-Bu Tan said in his interaction with analysts after the lead, “As we look forward, my focus remains on the long-term opportunity in all the markets we serve today and those we will enter tomorrow. Our strategy is rooted in our unique strengths and value proposition, supported by the urgent and unprecedented need to integrate in the AI-driven economy. Our leadership continues to strengthen. Our culture is becoming responsible, collaborative and increases my confidence“

Fab Power

The company is betting big on its fab business, providing a full-stack solution that combines chip design with advanced integration and testing. Intel Foundry is positioned as an alternative to Taiwan Semiconductor Manufacturing Company, the semiconductor giant that dominates the market. As manufacturing plants ramp up production and begin operating at full capacity, the manufacturing business should be profitable — it posted an operating loss of more than $2 billion in the most recent quarter.

Intel shares opened higher on Monday and traded near $40 mostly during the session. The stock price average over the past 52 weeks is $26.36.