Ethereum Staking Queue At 1.4M ETH, ETH USDT At $4,000?

For many years, Ethereum used a proof-of-work system, similar to Bitcoin. Then, everything changed. As of mid-September 2022, developers have switched to a proof-of-stake method where miners are replaced by validators. Not much changed, only that Ethereum became more powerful, and validators had to block ETH to have a chance to win block rewards.

There are now more than 900,000 unique verifiers spread across different regions. This means that Ethereum is not only decentralized but there is no way to shut down the network. And it gets better.

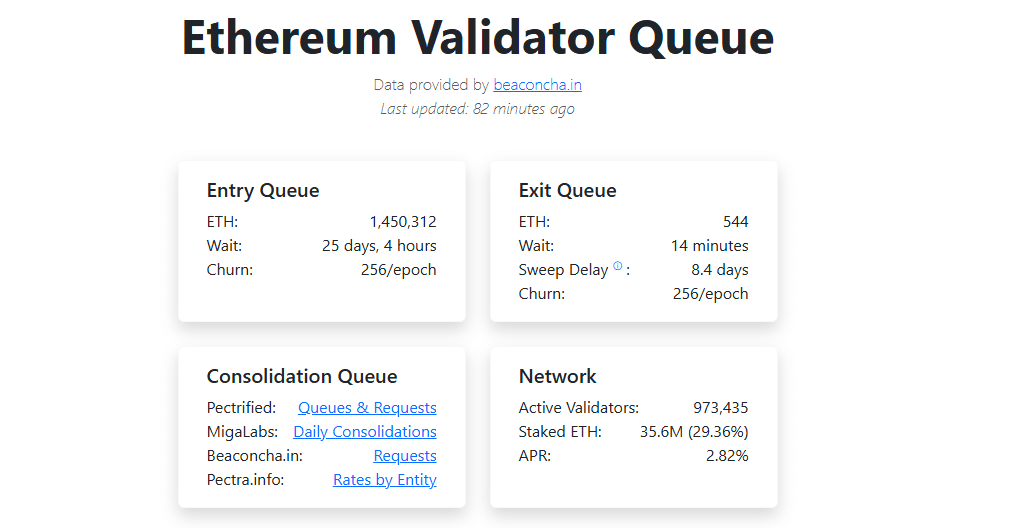

The latest data shows that Ethereum’s valid entry queue has recently reached about 1.4M ETH. The sign is clear: There is a rush of new investors locking in coins for yield.

(Source: Confirmation Line)

The demand has shifted to ETH USDT, which has a positive impact on other cryptos to explode. At the time of writing, the price of Ethereum is firm, and selling pressure is easing.

As more coins come out of the way, it fits a broader trend: Investors are now treating Ethereum as a trading chip and as a long-term income asset.

That change is important if you hold ETH or plan to buy. The more ETH is staked, the fewer coins remain liquid in the exchange. Limited supply often supports price stability during volatile markets.

DISCOVER: The Best New Cryptocurrencies to Invest in 2026

What is Ethereum Staking? Why is the ETH Confirmation Line Growing?

Proof-of-stake networks like Ethereum rely on operators, called validators, to hold coins, in this case, ETH, in exchange for an annual yield.

Staking is how Ethereum secures its network. Think of it like investing in a fixed deposit. You mine ETH, help run the blockchain, and earn rewards in return.

Currently, the Ethereum mainnet distributes around 3% in APR to validators.

The “entry queue” exists because Ethereum limits how quickly new validators can join. With 1.4M ETH pending, the need to earn stake yield now far exceeds the number of people exiting.

Interestingly, as more validators prepare to join, the exit queue has fallen to almost nothing; about 544 ETH, or a wait of 14 minutes. That decline shows confidence. People are lining up to commit, they’re not rushing to get in the door.

Institutions play an increasing role here. Earlier this week, BitMine staked over $604M of ETH, pushing the line higher.

BitMine came in at $604,500,000 $ETH today.

In just 10 days, BitMine has put $2,510,000,000 in Ethereum. pic.twitter.com/hxeJchcS7F

— Ted (@TedPillows) January 6, 2026

The question is, why now?

Staking offers a yield, as mentioned before, paid in ETH itself. With financial thinking over the years, that looks like the crypto version of earning interest while holding the principal asset.

This trend is also seen in products designed for ordinary investors. Recent developments in Ethereum ETF staking and ETH payments make it easy to earn a yield without using any technical infrastructure.

FIND OUT: 9+ Best High-Risk, High-Reward Crypto to Buy in 2026

Will ETH Price Fall?

When ETH enters staking, it leaves the exchange. That reduces sell-side pressure. Often, entry lines that outlast the exits have helped ease fears of a massive selloff.

However, there is another layer.

Staking growth supports the wider Ethereum economy. In general, stablecoins, meme coins, DeFi applications, and legacy tokens all rely on network security. Ethereum network activity is growing back to demand Ethereum itself.

For retail investors, this reinforces Ethereum’s “yield asset” narrative. You can hold ETH, earn rewards, and always face a rising price.

From the daily chart of ETH USDT, there are signs of strength.

Local resistance is the December 2025 high at $3,450.

$ETH create a double bottom pattern.

Although we have seen a rally, Ethereum is still not clear as it is still facing a strong resistance level, the bearish FVG.

However, if we see a breakout over the next few days, the next target is $3,937, right at 1.618… pic.twitter.com/Yj3Ex1gWp6

– BATMAN ⚡ (@CryptosBatman) January 7, 2026

On X, one analyst said that the price of ETH has made a “double bottom”, which is clear on the daily chart. Charts generally view this formation as a bullish signal. If the ETH USDT bulls take over, the analyst is confident that the next target will be around $4,000.

FIND: 9+ Best Memecoin to Buy in 2026

Follow 99Bitcoins on X For the latest market updates and subscribe to YouTube For Daily Expert Market Analysis.

Why you can trust 99Bitcoins

Founded in 2013, 99Bitcoin team members have been crypto experts since the early days of Bitcoin.

90+ hours

Weekly survey

100k+

Monthly students

50+

Professional contributors

2000+

Crypto projects reviewed

Follow 99Bitcoins in your Google news feed

Get the latest updates, trends, and information delivered right to your fingertips. Register now!

Register now