Bitcoin Sharpe Ratio Currently Declining Faster Than Price — What’s Happening?

If there was any doubt about the arrival of a bear market, the recent drop in the price of Bitcoin to around $81,000 somehow made it more believable. While various competitors, including the country’s tensions, Microsoft’s lack of income, and the decline in the liquidation rate, are attributed to this decline, the first cryptocurrency seems to be struggling to catch any break at the moment.

Interestingly, the recent decline has not only damaged the remnants of Bitcoin’s price structure but also tilted the on-chain structure towards an even more bearish outlook. With both technical and on-chain data looking less optimistic, the bears seem to be winning the battle for dominance in the BTC market.

This Metric Changes First, BTC Price Reacts Later: Crypto Founder

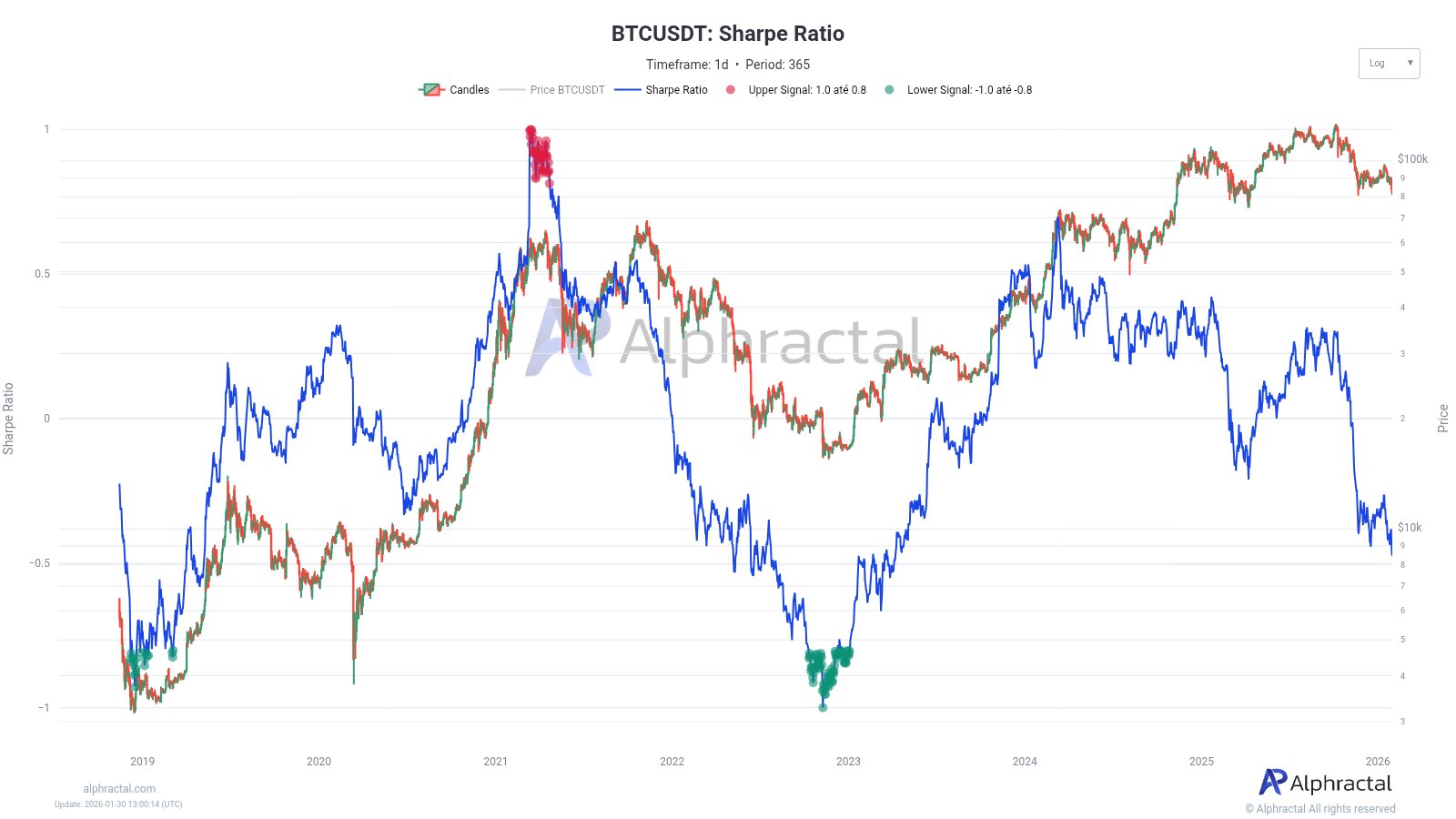

In a January 30 post on X site, Alphractal founder and CEO, Joao Wedson, revealed that the Bitcoin Sharpe Ratio is decreasing faster than the BTC price. The relevant indicator here is the Sharpe Ratio, which assesses the risk-adjusted return of a particular cryptocurrency (Bitcoin, in this case).

This on-chain metric basically tracks the amount of return an investment provides per unit of risk (assuming risk is weighted by volatility), with a higher value indicating higher risk-adjusted performance. Meanwhile, a negative Sharpe Ratio indicates that the return earned on the investment is not commensurate with the risk taken.

Wedson wrote in his post on X:

Simply put: the market is taking too much risk for too little return.

Source: @joao_wedson on X

Indeed, the Bitcoin Sharpe Ratio dropped into negative territory a few days into the new year. However, BTC’s price action still enjoyed a remarkable performance – rising to $97,000 – after this change, which puts little importance on on-chain observations.

What is more interesting is that the Sharpe Ratio is decreasing and weakening at a faster pace than the price of Bitcoin. Historically, this level of decline is often accompanied by extended periods of losing momentum and sideways price movements. In fact, Wedson concluded that risk-adjusted metrics need to change before price can react properly.

Bitcoin Price Could Drop To $65,500 If This Happens

In the event that the first cryptocurrency continues its decline, Wedson revealed the price target for BTC. In an old letter on X, the founder of Alphractal stated that the price of Bitcoin cannot lose the level of $ 81,000 under any circumstances.

The on-chain expert said that a contribution phase similar to the one seen in 2022 may occur if the market leader breaks below the $81,000 level. Based on the Fibonacci-Adjusted Market Mean Price, Wedson identified $65,500 as the next major support level.

$ 81,000 began to focus as the price of Bitcoin approached this level during its decline on Thursday, January 29. As of this writing, however, BTC has recovered above the 83,000 mark, and the price has fallen by about 8% during the weekly period.

The price of BTC on the daily timeframe | Source: BTCUSDT chart on TradingView

Featured image from iStock, chart from TradingView

Planning process because bitcoinist focuses on delivering well-researched, accurate, and unbiased content. We maintain strict sourcing standards, and each page is diligently reviewed by our team of senior technical experts and experienced editors. This process ensures the integrity, relevance, and value of our content to our readers.