Binance Takes Most of the Discharge

XRP is trading above the $2.20 level after several days of relief-driven price action, giving bulls a temporary break following months of sustained selling pressure. The rebound eased the short-term pressure, but the conviction remains fragile. Analysts are increasingly divided on what’s next. Some caution that the broader market structure still points to a prolonged bearish phase, while others say XRP may be in the early stages of a recovery if key levels continue to hold.

Related Reading

As the market awaits a clear direction, the new exit data adds another layer to the outlook. A recent analysis by CryptoQuant highlights the turmoil in the XRP futures market, where the leverage position was forcibly rearranged in a short period of time.

The data shows an unusual sequence in which the short positions were issued first, followed immediately after by the long side. This type of two-sided closing event usually shows high uncertainty, traders on both ends are not well aligned with short-term price movements.

Instead of confirming a clean trend, the closing pattern suggests that XRP is moving into a balanced but volatile phase. Excess utility has been cleared, which can reduce the immediate risk, but it also reflects the reluctance among participants to commit strongly to any method.

Binance Futures Data Explains XRP’s Choppy Price Action

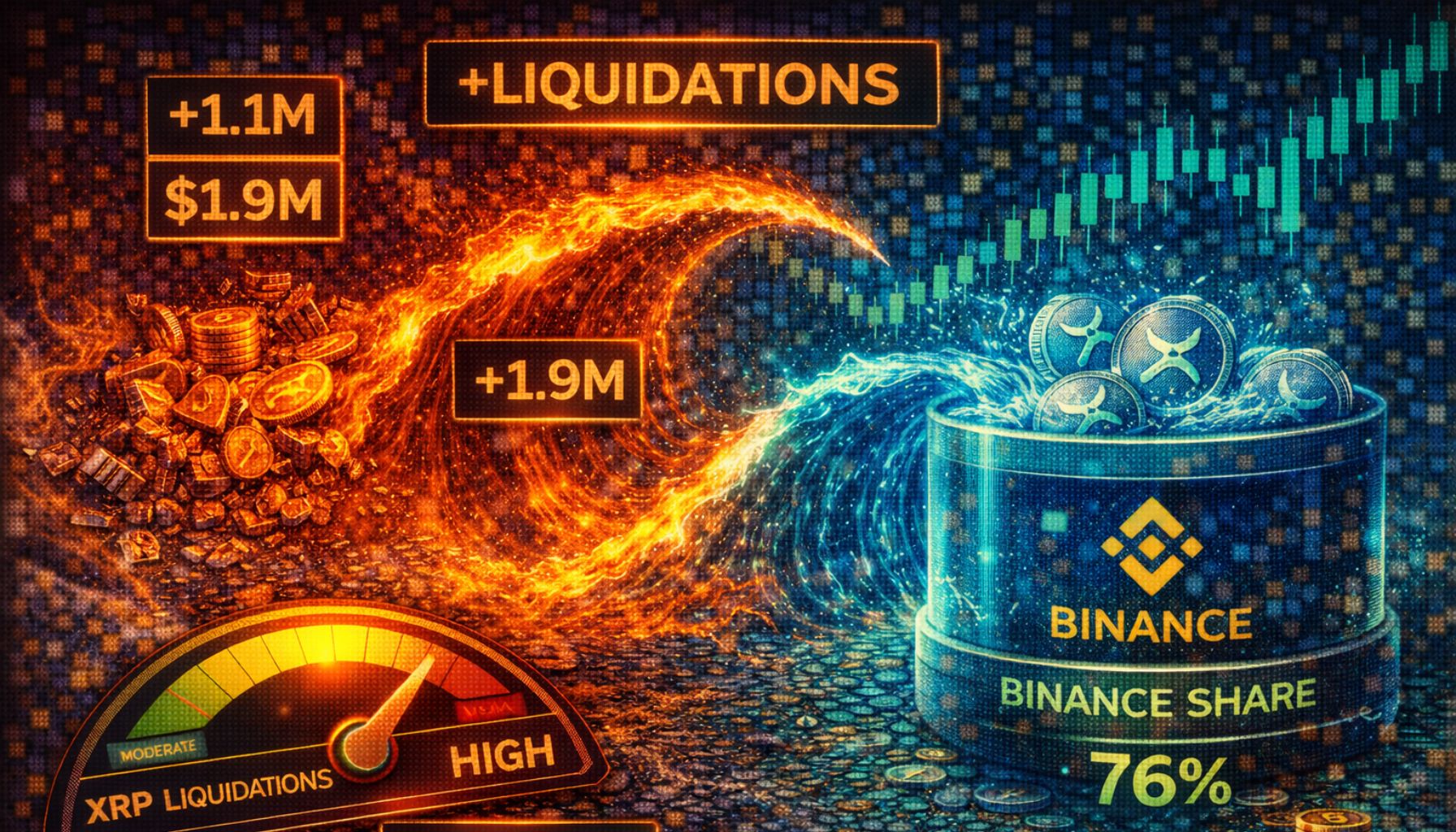

XRP’s recent price behavior becomes clearer when viewed through the lens of Binance Futures activity. According to CryptoQuant analysis, the market experienced a rapid succession of liquidation events that changed the short-term momentum and explained why the momentum faded after the initial rally.

On January 5, XRP saw a sharp short pressure, caused by a short amount of more than $4.4 million. Binance accounted for most of that figure, ensuring that short positions were heavily focused on its derivatives platform. This forced buying helped push the price higher and fueled a move to the $2.40 area. However, this circle proved to be uncertain.

On January 6, price action was modestly reversed, and the market began to point to the opposite side of the book. A wave of long liquidations followed, totaling nearly $4 million, including nearly $1 million in Binance. Shortly thereafter, another additional closing spike of approximately $1.5 million came in long positions, indicating that late buyers chasing the event were being pulled out.

Heatmaps of low-temperature closures reinforce this sequence. Price action initially removed short-side liquidity before rotating downward to suppress recently opened long positions. With the short squeeze largely over, XRP now appears to be testing long-term owner conviction.

Binance continues to dominate XRP derivatives activity, and these two-sided closing events often precede sharp reversals. In the near term, the price is likely to remain volatile as the market adjusts its position.

Related Reading

XRP Price Faces Key Resistance After Supportive Breakout

The 3-day chart of XRP shows the market trying to stabilize after a long correction phase, but still facing clear structural resistance. The price has risen sharply since the end of the year 2025 to decline near the $1.80–$1.90 region, a level that has served as a demand zone along the long-term red moving average. This bounce suggests that momentum has weakened, at least temporarily, as sellers struggle to push the price below that support.

However, the recovery meets resistance around the $2.25–$2.30 area. This zone coincides with the decline of the blue and green moving averages, which previously served as dynamic support during the uptrend and are now serving as resistance. A rejection near these levels highlights that XRP remains in a broad correction rather than a confirmed trend reversal.

Related Reading

Although the rebound was brisk, volume did not increase meaningfully compared to earlier stages of the spread. The short cover and closing flow drives the move above the strong local accumulation. Structurally, the sequence of lower highs from the mid-2025 peak remains the same.

XRP should hold above $2.20 and reclaim the $2.40–$2.60 region to change momentum accordingly. Failure to do so increases the risk of further consolidation or reassessment of low support. In short, XRP shows the potential to help, but confirmation is not yet available.

Featured image from ChatGPT, chart from TradingView.com