BLK Q4 preview: BlackRock looks poised for another earnings beat

BlackRock, Inc. (NYSE: BLK), a large asset management company, is expected to publish its results for the fourth quarter of 2025 next week. The review is expected to shed light on how the company’s scale and diverse business model enable it to adapt to changing circumstances. In a major shift in its business model, BlackRock has expanded into private equity markets, as it continues to dominate the stock market.

The Bullish View

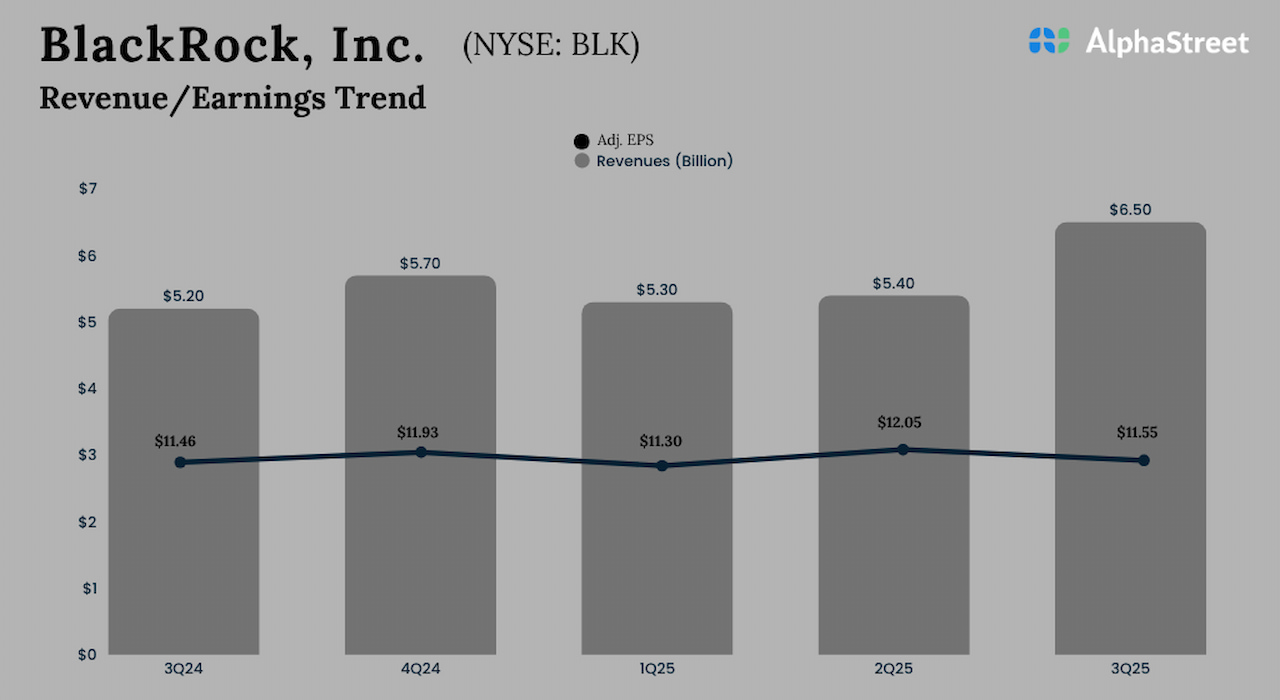

Market watchers forecast the New York-based company’s revenue to rise 19.4% to $6.78 billion in the fourth quarter ended December 31, 2025. Q4 consensus earnings estimate is $12.55 per share, excluding special items.. That compares to earnings of $11.93 per share in the year-ago quarter. The report is scheduled to be released on Thursday, January 15, at 6:00 am ET. The company has an excellent track record of quarterly profit margins, and the trend is expected to continue in Q4.

Over the past year, BlackRock’s stock has gained nearly 10% and hit record highs after reporting strong Q3 earnings in mid-October. While the stock has experienced high volatility in recent weeks, analysts are generally bullish on its prospects, with the consensus price target pointing to double-digit growth this year. Favorable global investment trends, supported by falling interest rates and economic recovery, mirror BlackRock’s business and translate into strong investor returns.

Record the AUM

In the third quarter, revenue rose 25% year over year to $6.51 billion, helped by increased biological foundation money again technical and registration services net worth. Assets under management hit a new high of $13.5 trillion in Q3, up 17% year over year. Earnings rose 1% year over year to $11.55 per share in the September quarter. Adjusted net income fell to $1.32 billion or $8.43 per share from $1.63 billion or $10.90 per share in the year-ago quarter. Both revenue and the bottom line exceeded Wall Street projections.

Commenting on the Q3 results, BlackRock CEO Laurence Fink said on the earnings call, “As we’ve grown our firm, we’ve also developed our leadership structure to help us meet client needs and develop our talent. We recently expanded our executive team to include a group of exceptional business leaders to better serve clients and advance our long-term strategy. Together, we’re both defining and fulfilling the future of asset management through a truly unique platform supported by Aldin’s privately held company. a culture of work and service of customers.”

What works

Recently, BlackRock has been diversifying beyond its core business into other divisions such as private markets and international assets. The company operates the world’s largest ETF family under its iShares brand, offering a wide range of ETFs across equities, fixed income, and commodities. The strength of this franchise, along with record assets under management, positioned the company for strong earnings growth in Q4. A few months ago, the company acquired private equity firm ElmTree Funds to further enhance its Private Financing Solutions platform.

The average price of BlackRock shares in the last 12 months is $1,037.29. On Wednesday, BLK opened lower and maintained a downtrend in the first hours of the session.