Sell Pressure On Binance Falling Off A Cliff

Bitcoin’s exchange-side supply signal is showing a significant change: whale-sized transfers on Binance have dropped significantly since panic levels in late November, suggesting that major holders are no longer relying on the sell button with the same urgency.

Selling Pressure From Bitcoin Whales Is Fading

CryptoQuant contributor Darkfost said the current data shows “a clear decline in whale sales,” especially the entry of BTC into exchanges, which means “major holders are sending much less BTC to trading platforms than before.”

In the post, the focus of the chart was Binance’s entry divided by transaction size, including transfers from 100 BTC to the largest prints of more than 10,000 BTC, a flow that is often interpreted as a potential selling point on the exchange.

Related Reading

An important background to the Darkfost thread is how quickly whale behavior changed in the late 2025 market. “December has been particularly challenging, even for these investors,” the analyst wrote, adding that whales are generally “more cautious” and “less sensitive to market movements than retail participants,” often exercising “more discipline and patience.”

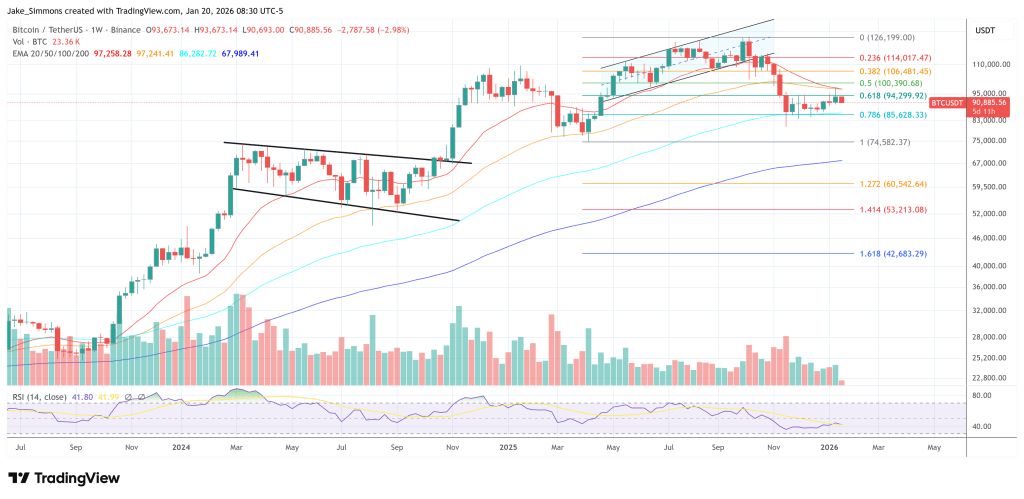

That order appeared to be cracking as Bitcoin tumbled from its recent highs near $126,000. Darkfost described an increase in whale inflows into Binance at the end of November as BTC “continued its correction,” with “total monthly volume” reaching “nearly $8 billion” during which time BTC “dropped below the $90,000 level.”

“This section clearly created a panic-driven movement,” the post said. “Transactions between 100 and 10,000 BTC increased significantly, especially since the price broke below the $85,000 level. This behavior shows real stress among some whales, who chose to sell quickly to minimize losses, thus intensifying the selling pressure on the market.”

The crux is what has changed since that collection. “Today, the situation looks very different,” wrote Darkfost. That Binance entry “has been divided by three and is now close to $2.74 billion,” the “daily movement” being “much less than during the cluster seen at the end of November.”

Related Reading

The analyst represents the decline as a visible behavioral pivot rather than a one-day frenzy. “These changes suggest that whales have changed their behavior,” Darkfost wrote. “They are no longer selling aggressively and now they seem to prefer to wait.”

Institutional Needs Side Remains Strong

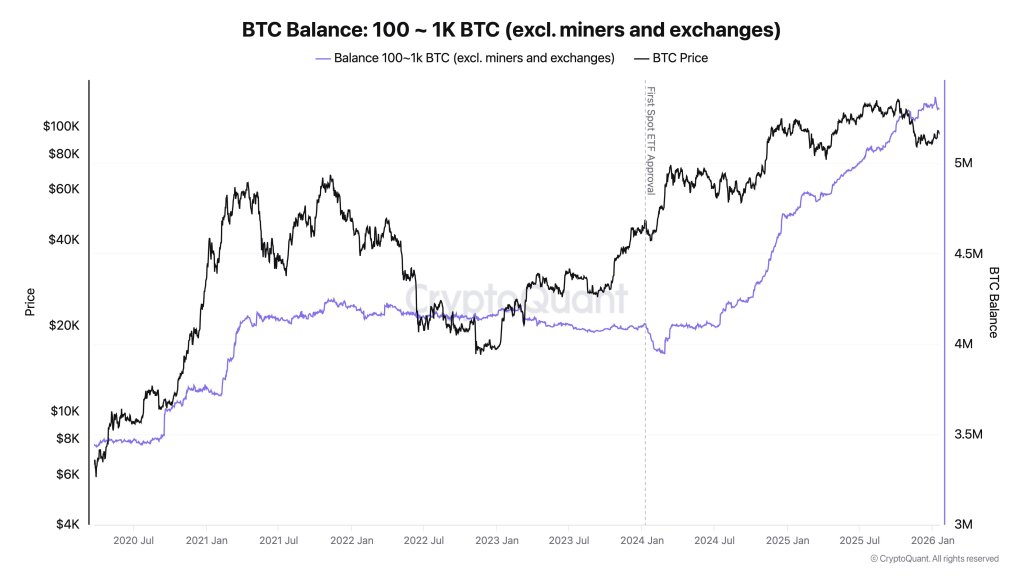

While Darkfost’s post focused on whale-related inflows as a proxy for potential selling pressure, CryptoQuant CEO Ki Young Ju pointed investors to the other side of the ledger: institutional accumulation.

“The institutional demand for Bitcoin remains strong,” Ki wrote on X. “US escrow funds typically hold 100–1,000 BTC each. Without trading with miners, this provides a rough reading of institutional demand. ETF calculations include.”

Ki added “577K BTC ($53B) [was] added over the past year, and it’s still going in,” which describes the trend as continuing rather than a finished wave.

At press time, Bitcoin traded at $90,885.

The featured image was created with DALL.E, a chart from TradingView.com