Hyperliquid Led $150M Bitcoin Close Down Below $90K

A sharp drop below $90,000 sent Bitcoin into a fast and heavy move on Thursday, January 8, 2026, clearing a large block of available long positions across the market.

CoinGlass data shows that about $145M in long-term outages were caused by two quick waves per hour.

The first wave arrived around 07:00 UTC with $88.23M cleared. The second followed at 08:00 UTC with another $57.02M as Bitcoin fell slightly below $90,000.

GET: Top Solana Meme coins to buy in 2026

Why Did Hyperliquid See $45M in Limits During the Sale?

Hyperliquid took a hard hit. The perpetual exchange logged nearly $45M in liquidation during the sale.

It also held the single largest forced order of the season, close to $3.63M.

Hyperliquid accounted for about one-third of the damage during that hour, showing how quickly the average can unwind in one place when prices drop without warning.

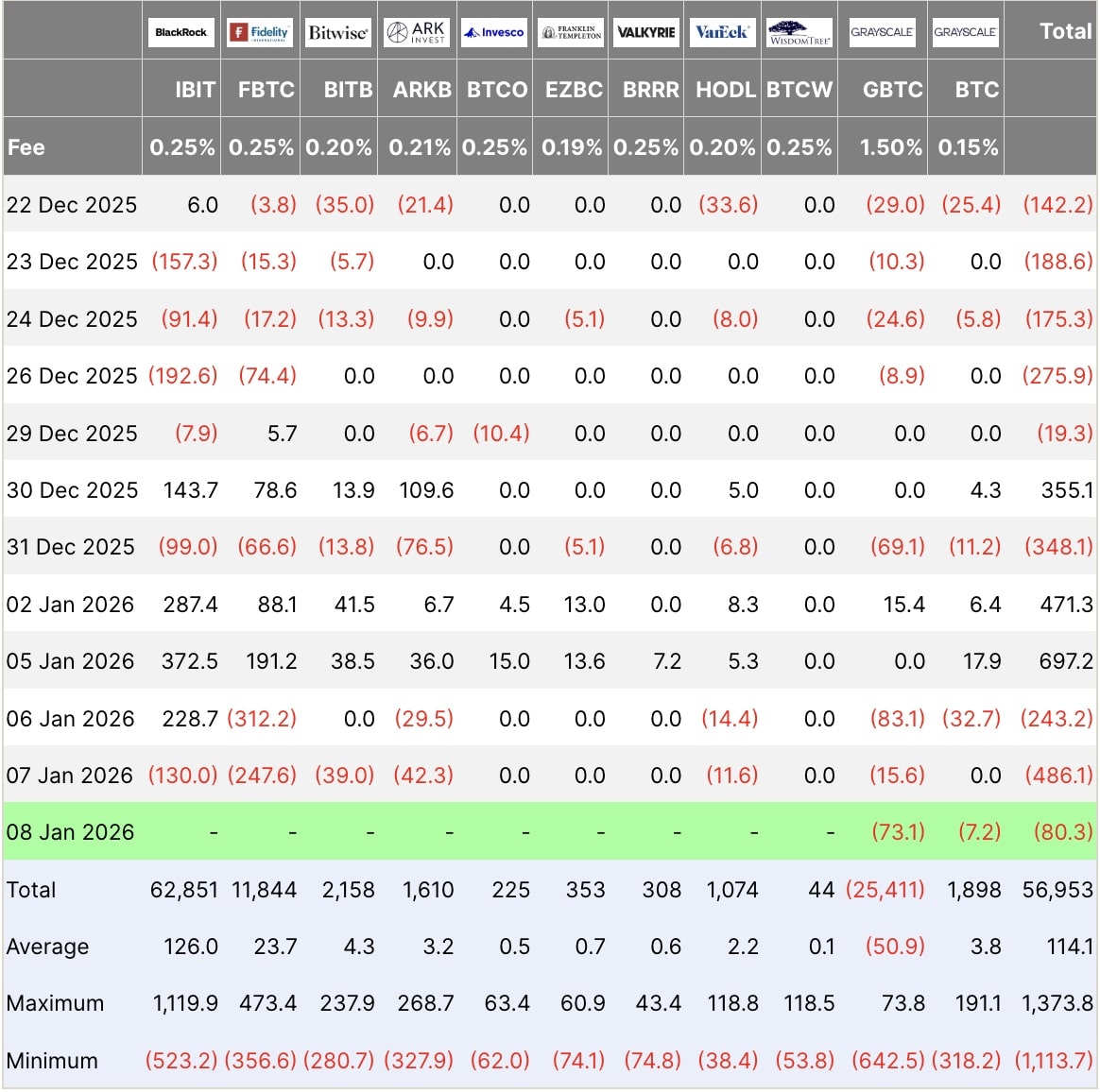

The pressure came as US spot Bitcoin ETF flows turned negative again. Farside Investors report $486.1M in gross output in Jan. 7.

The largest withdrawals came from BlackRock’s IBIT at $130M and Fidelity’s FBTC at $247.6M.

The market is now waiting to see if the decline is a short-lived swing or the start of a broader recovery as ETF demand softens.

GET: 9+ Best High Risk, High Reward Crypto to Buy in 2026

HYPE Price Prediction: Is Hyperliquid (HYPE) Forming a Bearish Flag on the 12-Hour Chart?

HYPE’s native token HYPE is losing momentum at peak times, based on a new chart shared by crypto analyst Ali Martinez.

The 12-hour chart shows HYPE forming what looks like a bearish flag after a sharp fall from the $36 area.

The price has been rising within a sub-channel since that decline, creating a high low and a high high between the two parallel lines.

This type of structure usually indicates a trend stop, not a full recovery. It suggests that buyers are trying to stabilize the market after heavy selling, but without strict control.

Hyperliquid $HYPE form a flag that could result in a move to $19. pic.twitter.com/ujBDmvzrWz

– Ali Charts (@alicharts) January 8, 2026

HYPE touched the upper edge of the flag near $28 and then pulled back, indicating that sellers are still active at that level.

Failure to stay above resistance has caused short-term momentum to decline again.

A clean break below the low line will confirm the continuation of the previous decline.

“If this flag is broken, Hyperliquid may go to the $19 area,” said Martinez, noting that this area is consistent with previous support.

In the meantime, sellers are watching if the pattern breaks to the bottom or if buyers can step in and find lost ground.

GET: 15+ Upcoming Coinbase Lists to Watch in 2026

Key Takeaways

Hyperliquid accounted for about one-third of the damage during the shutdown.

HYPE’s native token HYPE is losing momentum at peak times, based on a new chart shared by crypto analyst Ali Martinez.

Why you can trust 99Bitcoins

Founded in 2013, 99Bitcoin team members have been crypto experts since the early days of Bitcoin.

90+ hours

Weekly survey

100k+

Monthly students

50+

Professional contributors

2000+

Crypto projects reviewed

Follow 99Bitcoins in your Google news feed

Get the latest updates, trends, and information delivered right to your fingertips. Register now!

Register now