FTSE 100: can boring become trendy?

Image source: Getty Images

With S&P 500The three most important companies are each worth more than the rest FTSE 100it’s easy to see why UK stocks are often overlooked. But with uncertainty over how artificial intelligence (AI) will affect our lives, could the lack of tech stocks among Britain’s leading blue-chip companies index actually be its strength?

And is it time to consider a company that has been operating in an industry that has been around for over 10,000 years? Let’s take a closer look.

Ups and downs

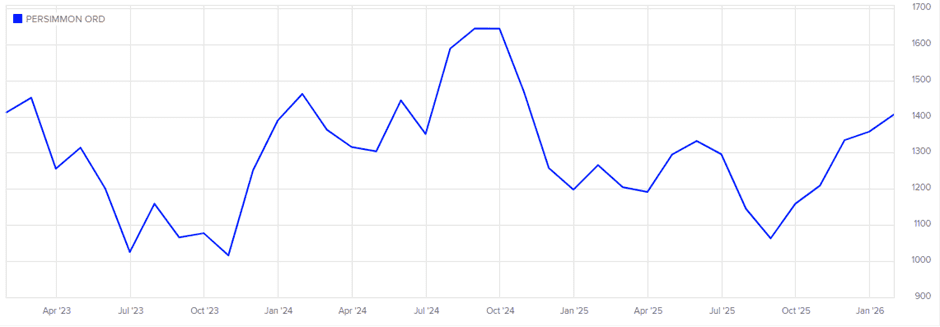

Suffering from post-pandemic supply-side inflation, rising mortgage rates, and a squeeze on consumer incomes, Persimmon‘s (LSE:PSN) share price has been on a roll.

And over the past three years, there have been a number of false dawns in the rehab market. A combination of stubborn inflation, interest rates failing to fall as quickly as expected, and general economic uncertainty, quickly stunted the green shoots of recovery.

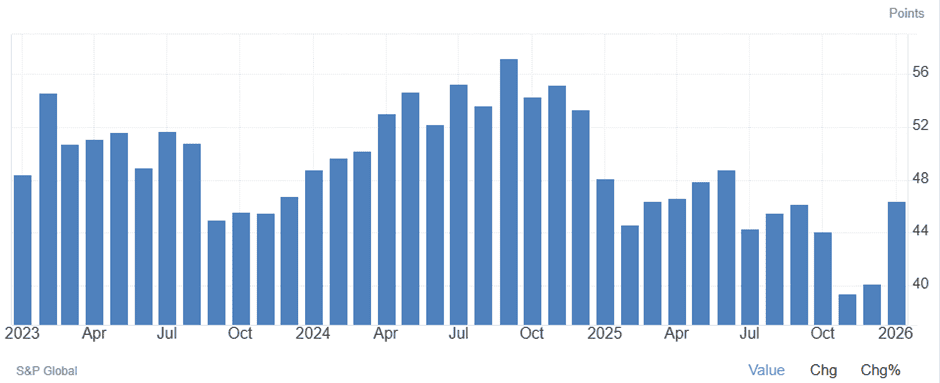

The topsy-turvy nature of the sector is well illustrated by the S&P Global UK Construction PMI (Purchasing Managers’ Index), a monthly survey of over 150 companies. A number over 50 indicates an increase. The last time it was above this level was December 2024.

Surprisingly, the Persimmon price has matched the movement in the PMI since January 2023.

Uncertain times

However, while I can’t predict when, I think the housing market will recover. That’s because history suggests it will.

Indeed, there is an endless supply of buildings at the moment. And the appetite for first-time buyers to get on the housing ladder seems as strong as ever. If liquidity increases and consumer confidence starts to grow, I think Persimmon will be one of the first to benefit because it has a lower average selling price than its closest FTSE competitors.

| Company | Average sales price (£) |

|---|---|

| Persimmon | 278,000 |

| The Vistry Group | 283,000 |

| Taylor Wimpey | 313,000 |

| Bellway | 316,412 |

| Barratt Redrow | 343,800 |

| Company Berkeley Group Holdings | 570,000 |

And the recent upheaval in data and software stocks reminds us that the winners and losers from Artificial Intelligence (AI) may not be as clear as we first thought.

Until the picture becomes clearer, now would be a good time to consider investing in traditional industries such as mining, banking, utilities, and construction. The type of stock that dominates the FTSE 100 and, a bit like Persimmon, has developed a reputation for paying healthy dividends. Currently (9 February), the house builder’s yield is 4.3%.

Could AI be a problem?

But I don’t have it. I know that the construction industry is not immune to the impact of AI. However, it seems to me that it will be one of the many beneficiaries.

When it comes to construction, AI is likely to lead to more efficient office operations, better project planning, safer sites, and better construction quality. Another piece of evidence that technology may not be as disruptive as it is feared is that jobs in this sector are often among the least likely to have an impact.

A final thought

With its healthy balance sheet (no debt) and large global bank, I think Persimmon is a stock to consider. In my opinion, it looks to be in a good position to benefit from the housing market recovery.

But even if it lags or resells, a stock’s above-average dividend (no guarantees, of course) can attract incoming investors. Suddenly, an ‘old’ stock can become fashionable.