Bitcoin Mining Pressure Eases After First Year’s Difficulty Fixes

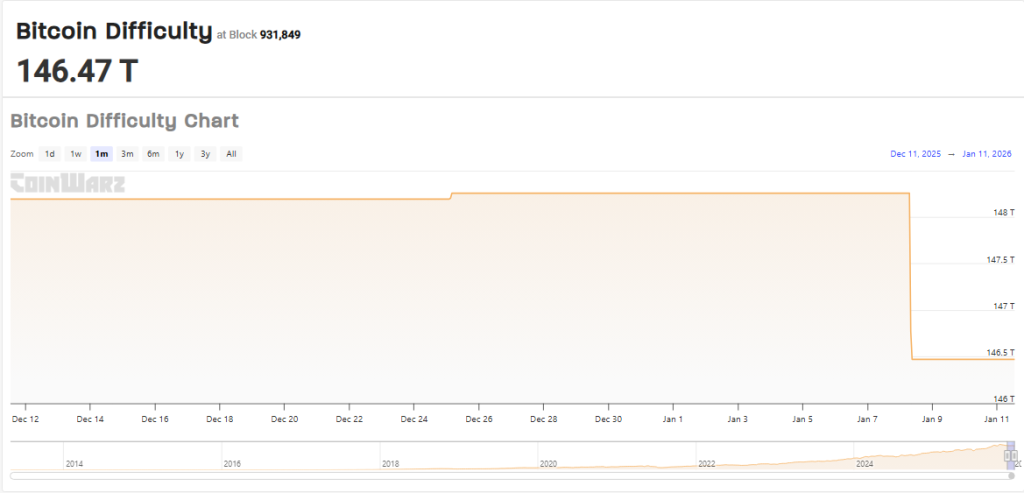

Bitcoin mining difficulty has dropped to just over 146 trillion in the first difficulty of the network overhaul in 2026, providing a small but measurable relief to miners. According to many reports, the correction completed in early January lowered the metric from the levels seen at the end of 2025.

First Amendment Provides Short Help

Average block times across the network were running at around 9.88 minutes during the transition – a touch faster than Bitcoin’s 10-minute target – which helped produce a slight drop in difficulty. That gap means the protocol briefly exposed a bottleneck for miners, because blocks were being produced faster than expected.

Reports noted that, even with this dip, the difficulty remains high compared to previous years and miners’ margins are under pressure following hardware investment in 2024 by half and heavy in 2025. Some miners reported less returns as the hash rate softened and energy and equipment costs remained high. A drop to 146.4T offers a short window of relief, not a reversal.

Source: CoinWarz

Next Fix Expected January 22nd

Based on estimates by CoinWarz and other trackers, the next difficulty calculation is expected to be on January 22, 2026, with a possible increase to 148 trillion as the average block times move back to the 10-minute target. If that pattern holds, the relief in difficulty will be short-lived and competition between miners may increase again.

Why Number Matters

The difficulty is a built-in mechanism of the protocol to keep block production stable: it changes every two weeks (2016 blocks) to match the amount of computing power protecting the chain. When more hash power joins, the difficulty increases; when it falls or the blocks come too fast, the difficulty is easy. These changes affect how quickly miners get blocks and how much work they have to do to earn rewards.

Miners will watch the trends of hash rate, energy cost, and Bitcoin price because those factors determine the profit in the days after the correction. Markets, on the other hand, tend to take these technical changes in stride, but sustained movements in difficulty or hash power can indicate broader changes in miners’ behavior that may impact supply volatility over time.

According to the latest report, the first correction of January reduced the difficulty to 146.4T and came as average block times of 9.88 minutes. Estimates point to a possible increase by January 22 to around 148.20T if conditions change as expected. Observers say the change provides temporary breathing space for miners but does not remove the financial pressures many face in 2025.

Featured image from Unsplash, chart from TradingView

Planning process because bitcoinist focuses on delivering well-researched, accurate, and unbiased content. We maintain strict sourcing standards, and each page is diligently reviewed by our team of senior technical experts and experienced editors. This process ensures the integrity, relevance, and value of our content to our readers.