Youdao Returns to Profit in Q4 on Ad Revenue Growth

Youdao Returns to Profit in Q4 on Ad Revenue Growth

Youdao Inc (NYSE: DAO) shares are traded $9.72 in today’s closing market, representing a 1.04% intraday increase. The company, a provider of AI-powered learning and marketing solutions, released its financial results for the fourth quarter and full year for the period ended December 31, 2025, before the US market opened today.

Market Capitalization

As of February 11, 2026, Youdao Inc’s market capitalization is approx $1.18 billion (approx INR 99.12 billion).

Latest Quarterly Results

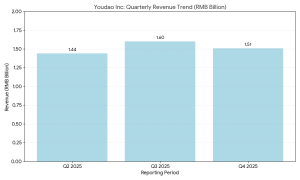

In the fourth quarter of 2025, Youdao reported a consolidated profit of RMB 1.51 billion ($207 million). Total income for the period RMB 5.8 millioncompared to the net loss for the corresponding quarter of the previous year.

- Learning Services: Income in this segment has been achieved RMB 610.5 million.

- Smart Devices: The segment’s revenue was RMB 230.2 million.

- Online Marketing Services: Income grew to RMB 669.3 millionmaintains its position as the main revenue contributor.

FINANCIAL MATTERS

Full Year 2025 Results Summary

For the fiscal year ended December 31, 2025, Youdao reported total revenue of RMB 5.68 billion. The company achieved an operating profit for the full year, marking an indication of the trend of profit growth compared to the previous financial year. Annual operating cash flow reached breakeven for the first time in the company’s history.

Business & Operations Update

The company consolidated its ownership The great language model of Confucius across its product range during the quarter. Key developments include the introduction of AI Simultaneous Interpretation again AI Photo Translation features within the Youdao Dictionary app. Smart device performance is focused on distributing the latest iteration of Youdao dictionary penwhich now includes natively integrated AI tutoring capabilities.

IM&A or Strategic Moves

No new mergers or acquisitions were announced in the fourth quarter. The company has continued its partnership with its parent organization, NetEase, Inc.especially within its online marketing services vertical. Pre-approved $33.8 million the share buyback plan has been confirmed as completed.

Direction & Outlook

The company said the focus for the next financial year will remain on the use of the Confucius model in learning and advertising contexts. Important things to look for include:

- The scaling of AI-driven subscription services.

- The impact of home locus of control on digital education tools.

- Good performance as the company’s goal is to maintain a quarterly profit.

Performance summary

Youdao Inc (DAO) closed on $9.72up 1.04%. Fourth quarter revenue achieved RMB 1.51 billion with the remaining profit of RMB 5.8 million. Online marketing remains the largest revenue category, while AI subscription services have reported year-over-year growth.