Johnson & Johnson enters Q4 as the most focused healthcare leader

Johnson & Johnson (NYSE: JNJ ) is capitalizing on its transformation from a broad healthcare organization to a market leader in new therapies and medical technologies. The company continues to expand its portfolio through strategies such as diversification into all high-growth healthcare segments and reinvestment in the business, with a focus on advanced therapies and modern medical devices.

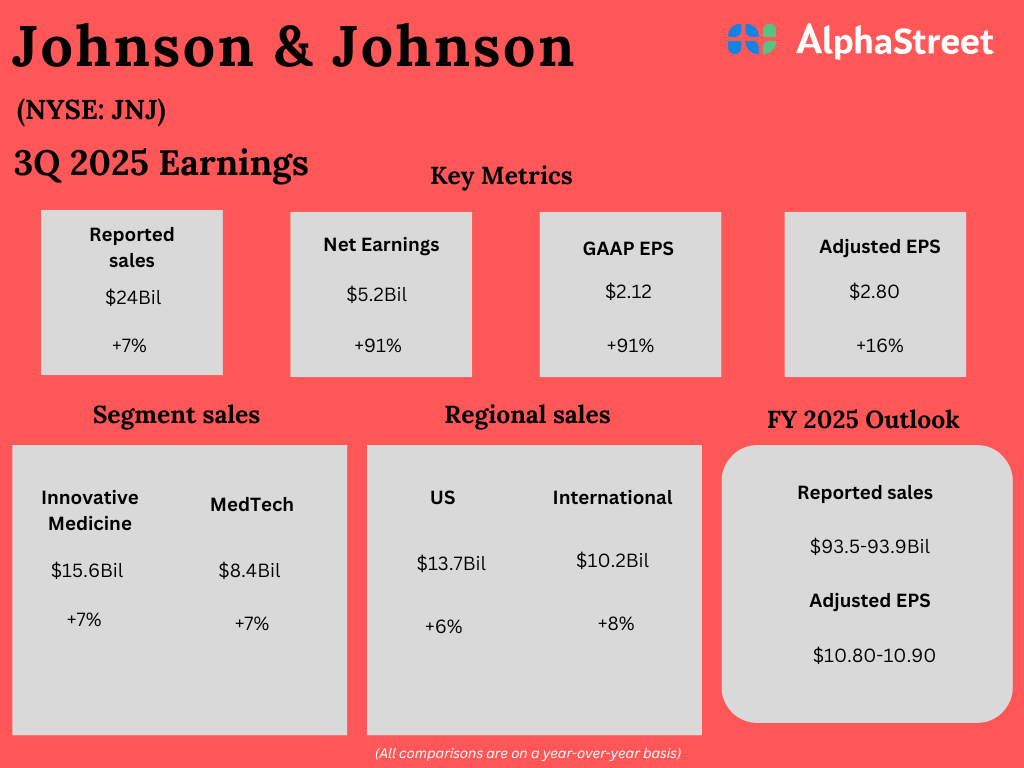

Measurements

Johnson & Johnson is expected to deliver good results in the fourth quarter, continuing the momentum seen since the beginning of the year. On average, analysts following the company forecast adjusted earnings of $2.49 per share for the quarter, higher than the $2.04 per share reported in the year-ago quarter. Q4 revenue is expected to be $24.16 billion, up 7.3% year over year. The report is scheduled for release on Wednesday, January 21, at 6:20 am ET.

JNJ is one of Wall Street’s best-performing stocks, growing more than 45% over the past year. In the past month, shares have set a new record, before paring back half of those gains in the following weeks. Over the years, Johnson & Johnson has maintained its commitment to returning capital to shareholders through a long-term plan of dividend growth. The company’s direct approach to revenue distribution and innovation-focused investments have enabled it to consistently increase payouts for decades.

Beat results

In Q3 2025, adjusted earnings rose 16% from last year to $2.80 per share, beating estimates. Over the past few years, quarterly earnings have often beaten estimates. Unadjusted net income increased 91% year over year to $5.2 billion or $2.12 per share. At $24 billion, reported third-quarter sales rose 6.8%, while operating sales grew 5.4%. The top line exceeded expectations. Sales were up 7% for both New Medicines again MedTechmain functional components. Geographically, In the US sales increased by 6% as well International sales increased by 8%.

“We continue to invest in the best in our industry and our portfolio while making the right decisions to exit businesses that we believe will be better able to thrive outside of Johnson & Johnson. In our Orthopedics business, planned diversification creates new opportunities. Operating as DePuy Synthes and led by Namal Nawana, it will be the largest, most comprehensive company, with an address of leading companies across orthopedics segments. $50 billion and market opportunity growing,” JNJ CEO Joaquin Duato said on the Q3 FY25 earnings call.

Outlook

Encouraged by the positive Q3 result, management raised its full-year sales guidance to $93.5-93.9 billion. The forecast is roughly in line with analysts’ expectations. Full-year earnings guidance was reaffirmed in the range of $10.80 per share to $10.90 per share, excluding special items. Continuous portfolio diversification has given the company a competitive edge in an evolving industry marked by technological breakthroughs and regulatory flexibility.. Also, the growing demand for personal care and value bodes well for business.

The stock has been trading mostly sideways since crossing the $200 mark two months ago. That’s above its 12-month moving average of $171.64. On Monday, JNJ traded higher during the session.