Earnings preview: What to watch as Intel (INTC) prepares to report Q4 results

For Intel Corporation (NASDAQ: INTC), 2025 marked a year of recovery, as the company made significant progress toward its technological and operational milestones. After losing significant market share to competitors in recent years, the company is looking to reinvent itself. It is actively working to capitalize on the AI-driven rise in computing demand by expanding its portfolio and productivity.

Careful Observation

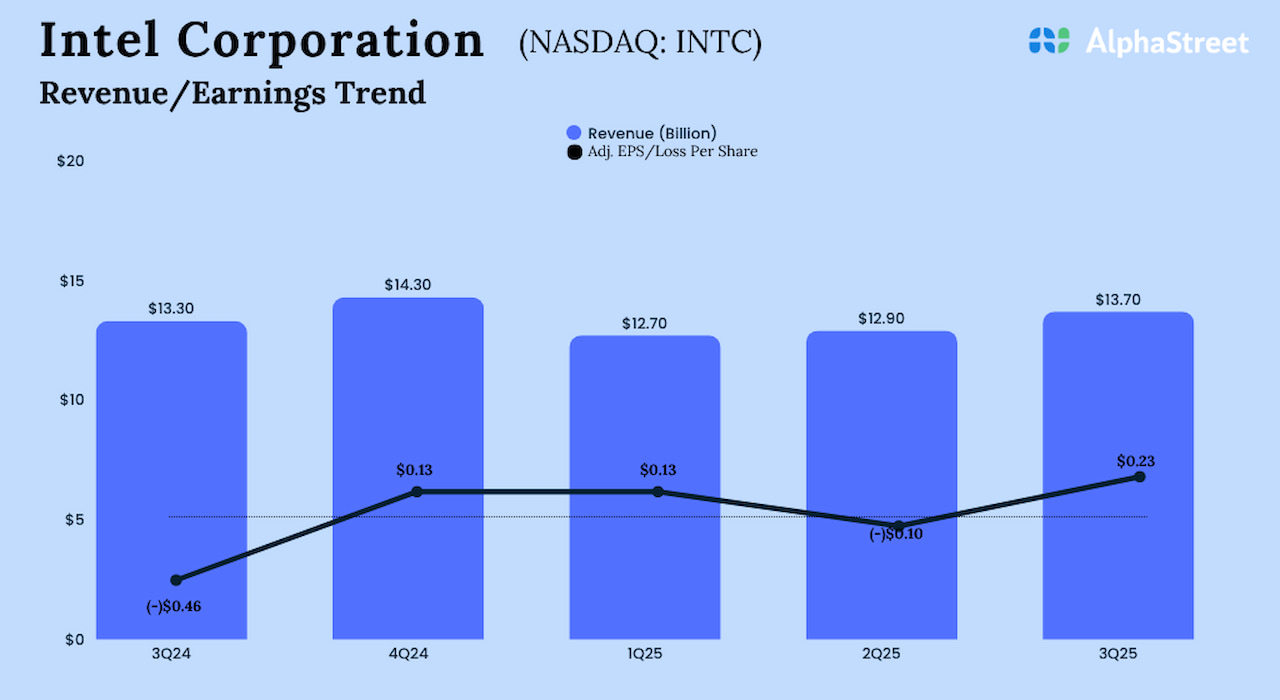

It is estimated that the technology behemoth delivered a modest performance in the last months of FY25. Wall Street analysts expect fourth-quarter earnings to fall to $0.08 per share, adjusted for one-time items, from $0.13 per share in the corresponding quarter last year. The Q4 revenue forecast is $13.37 billion, vs. $ 14.26 billion last year. The company has scheduled an earnings announcement for January 22, after regular trading hours.

In the past six months, Intel’s stock price has nearly doubled, outperforming the broader market after trading largely sideways in early 2025. However, the latest closing price remains well below the stock’s peak. It seems that investors are optimistic about Intel’s growth strategy, which is focused on strengthening its innovation business and is supported by large investments from the US government and large companies such as Nvidia and Japan’s SoftBank.

On the Road to Recovery

In the third quarter, Intel’s revenue increased 3% from a year ago to $13.65 billion. Client Computing revenue increased 5%, while Data Center and AI revenue decreased 1%. On a per-share basis, earnings came in at $0.23 in the September quarter, excluding special items, compared with a loss of $0.46 per share in the year-ago quarter. On an adjusted basis, total revenue was $4.06 billion or $0.90 per share, compared to a loss of $16.6 billion or $3.88 per share in Q3 2024. Both revenue and earnings exceeded Wall Street expectations.

From Intel’s Q3 2025 Earnings:

“We are in the early stages of the AI revolution, and I believe Intel can and will play a very important role as we transform the company. This starts with our core x86 franchise, which continues to play a key role in the age of AI. AI is clearly accelerating the need for new computing architectures, hardware, models, and algorithms. The resulting insights continue to rely heavily on our existing products.”

The Tech Ramp

The US government has provided significant financial support to Intel as part of efforts to encourage domestic production of advanced microchips, reducing reliance on Asian suppliers such as the Taiwan Semiconductor Manufacturing Company. Although the company seems to be benefiting from strong demand for data centers from large enterprises this year, the main bet is on its advanced semiconductor production node, 18A. Billed by Intel as the first truly advanced process made in the United States, the first shipments of 18A-based products began last year.

On Tuesday, shares of Intel opened at $45.89, well above its 12-month moving average of $26.87. Shares have gained an impressive 22% in the past 30 days.