Should I buy Fundsmith Equity for my stocks and shares ISA in 2026?

Image source: Getty Images

Last year, I thought about adding Fundsmith Equity in my shares and ISA shares. However, I’ve come to the conclusion that I need more proof that manager Terry Smith can return to market-beating form after four straight years of underperformance.

Last week, Fundsmith published its results for the year 2025. Based on this, is now my time to invest?

Working

For those unfamiliar, Fundsmith invests in high-quality businesses with strong products or competitive approaches, high returns on capital, predictable cash flow, and the ability to grow profits without requiring significant debt.

Smith breaks this down to a simple three-step mantra: “Buy good companies. Don’t overpay. Do nothing.”

Using this, Smith presents a fund benchmark (MSCI World Index) between 2010 and 2020. Since then, however, Fundsmith has now underperformed for five years in a row.

In 2025, it returned just 0.8% compared to a 12.8% rise in the MSCI World Index. In a strong year where most indexes are up, that’s very disappointing.

What went wrong?

Smith said three factors help explain this underperformance:

- Extreme S&P 500 index concentration

- Passive index investing

- Dollar weakness

The last one doesn’t really affect me. But Smith projects the 10 largest stocks will account for 39% of the S&P 500 by the end of 2025, delivering 50% of the total return.

Despite having Magnificent Seven stocks as large positions, the fund manager says it has been very difficult to do well in recent years.

Although it is true that it is difficult, it is not impossible. For example, Bill Ackman (Pershing Square) and Chris Hohn (TCI Fund Management) have successfully outperformed the S&P 500 over the past five years without ownership. Tesla, Meta, an appleor Nvidia.

Additionally, he argues that passive index funds distort the markets by buying stocks without regard for quality or valuation, essentially creating an impulse-driven bubble.

[E]even if we are right in assessing this move to target funds as one of the causes of our recent poor performance and laying the foundations for a major investment crisis, I don’t know how it will end anytime without saying it badly..

Terry Smith

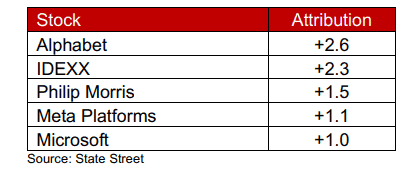

It is worth noting that Fundsmith has three shares of the Magnificent Seven (MicrosoftMeta, too Alphabets), and all were among the top five in 2025 performance.

Indeed, Meta ranks among Fundsmith’s top contributors for the fifth time, while Microsoft makes its tenth appearance. So, while Big Tech helped drive the fund’s long-term performance (which is still strong), Smith never had enough exposure to it.

The maker of Wegovy

Novo Nordisk (NYSE:NVO) crashed nearly 40% last year, easily becoming Fundsmith’s worst performer. The maker of Wegovy fell behind a competitor Eli Lilly in the GLP-1 drug race, which led to the ouster of its CEO.

However, I note that the stock is down 17% so far this year, driven higher by news that its Wegovy treatment has been approved in the form of a daily pill by US regulators.

As well as improving its competitive position, this can also get sales growth back in the right direction. The biggest risk with this business is that Eli Lilly strikes again with an improved GLP-1 drug.

However, trading at 16.7 times forward earnings, I think Novo Nordisk stock is worth considering.

As for Fundsmith, though, I’ll miss it. The constant underperformance still bothers me.