Bitcoin Futures Flush 31% Open Interest: The Low Thesis Takes Shape

The Bitcoin derivatives market is showing signs of a reset after the 2025 forecast year, with Binance open interest down more than 31% from its October peak as futures-led selling pressure cools, a combination that CryptoQuant contributor Darkfost often argues is a meaningful cyclical downturn.

In a series of posts on X, Darkfost said the 2025 economy was fueled by record activity on Binance, where futures trading volumes “exceeded $25T,” helping push Bitcoin’s open interest (OI) to “over $15B on October 6.”

“To clarify this, during the previous bull cycle in November 2021, when Bitcoin hit the ATH, open interest in Binance reached $5.7B,” wrote Darkfost. “In other words, OI will almost triple by 2025. Since then, open interest has fallen by more than 31%, settling today at around $10B.”

Darkfost labeled the move as a bearish phase that has developed during a “big close,” when OI drops below its 180-day moving average, a situation the analyst says has historically been more important than the raw level of leverage.

“These reduction periods are important, as they help remove market forces,” Darkfost wrote. “Historically, they often mark important bottoms, effectively repositioning the market and creating a solid foundation for a potential recovery.”

Related Reading

The logic is straightforward: when profits are forced out, the market is less vulnerable to cascade-style closures and volatile selling. In that sense, a low OI position can reduce the lateral impact of the futures position on the position, at least compared to the late “heavy trade” conditions that precede the sharp drawdown.

But Darkfost warned that the downgrade signal is not the same as the confirmed downgrade. “This may be so, but caution is necessary,” said the analyst, adding that if Bitcoin “continues to slide and fully enters a bear market,” OI may “continue to contract,” pointing to “a deeper reduction and possible extension of the correction.”

Bitcoin Traders Lose Momentum

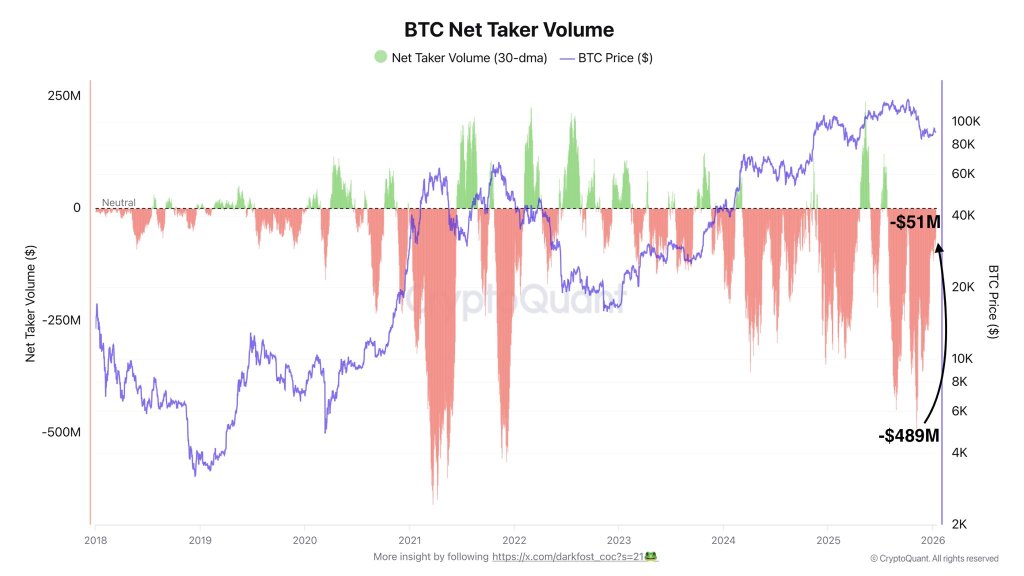

In addition to resetting open interest, Darkfost pointed to a significant decrease in futures-driven selling pressure, using Net Taker Volume – a measure intended to capture who dominates future order books.

Related Reading

“Selling pressure on BTC from the futures market is decreasing significantly,” writes Darkfost, noting that after the month hit “$489M” at its peak, the number is now “divided by ten.” “Currently, retailers still dominate the order book, at $51M,” the analyst said.

The main nuance is that the indicator did not turn, but moves in that direction. “We’re not back in good territory yet, but we’re getting closer,” Darkfost wrote. “It is very encouraging to see traders starting to change their approach, especially given the large future impact we have on price action. Notably, since this decline in selling pressure began, BTC’s price action has stabilized.”

For the “bottom thesis” to conclude on a strong reversal call, Darkfost focused the trigger on that signal change: “If the Net Taker Volume were to change again, it would clearly light the fuse for the bullish reversal.”

At press time, BTC traded at $95,131.

The featured image was created with DALL.E, a chart from TradingView.com