Procter & Gamble will report Q2 earnings next week. Here’s what to expect

The Procter & Gamble Company (NYSE: PG ) is preparing for its latest earnings report as it navigates a challenging market environment marked by intensifying competition and consumer behavior. Over the years, the consumer goods behemoth has maintained its market leadership, supported by its highly efficient supply chain, product superiority, and strong digital push. Notably, P&G’s exposure to recent import costs is low compared to many consumer-focused peers due to its long-term strategy of keeping the US manufacturing sector local.

Q2 Report Required

When the company reports its second quarter results on January 22, before the opening bell, the market will be looking at net sales of $22.33 billion and earnings of 1.87 per share. In Q2 2025, the company earned $1.88 per share on sales of $21.88 billion. In the past two quarters, both sales and earnings exceeded expectations, and the trend is expected to continue this time.

After starting 2026 on a weak note, Procter & Gamble shares have gained momentum and have been trending higher since last week. It remains to be seen whether this momentum will continue ahead of next week’s earnings. The company has faced a difficult situation for more than a year, following a sharp decline from a high at the end of 2024. It has lost about 5% in the past six months. Having grown its dividends consistently for more than six decades, P&G is one of the longest-standing members of the S&P 500 Dividend Aristocrats index.

Q1 result

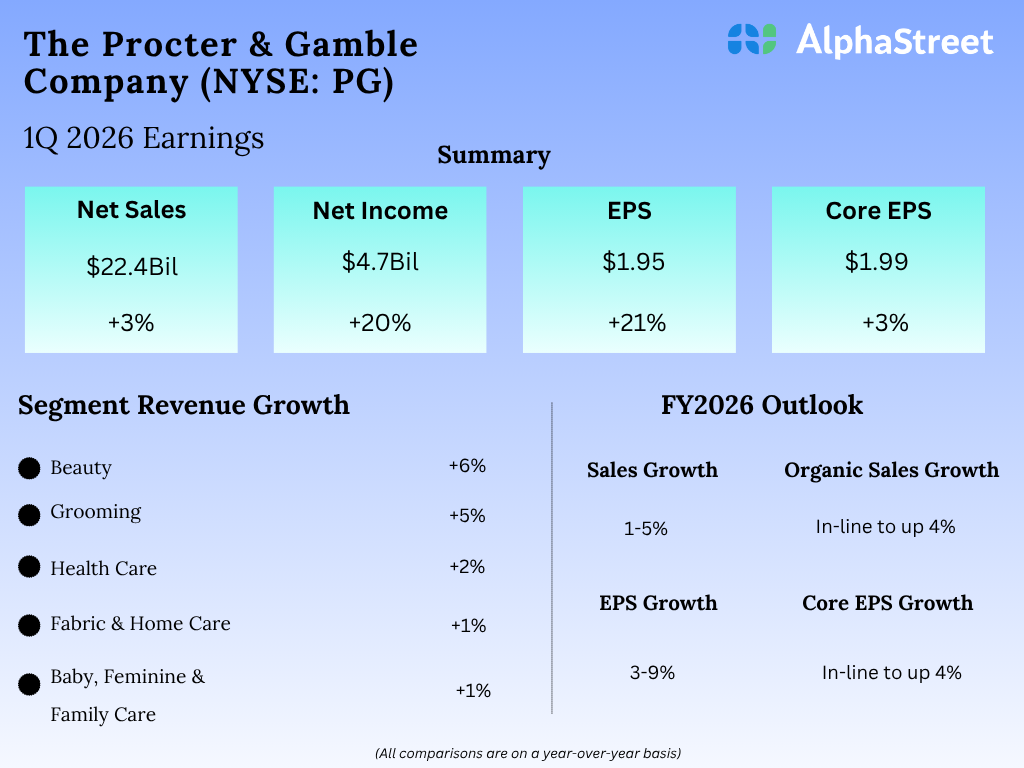

IP&G reported higher sales and earnings for the first quarter. Net sales rose 3% year over year to $22.4 billion in Q1, with organic sales growing 2% amid flat volumes and moderate price and mix increases. Core earnings, which exclude special items, rose 3% from a year ago to $1.99 per share in the September quarter. On a reported basis, the company’s net income increased by $4.75 billion or $1.95 per share. Both sales and profits exceeded Wall Street expectations.

From P&G’s Q1 2026 Earnings Call:

“We will continue to accelerate productivity in all areas of our operations, including the recently announced restructuring activity, to drive higher investment, reduce costs and capital gains, and drive scale expansion. We aim to increase savings in cost of goods sold, up to $1.5 billion before tax, enabled by global platform systems across all stages with Supply Chain 3.0. We have a vision to maintain improved productivity, more efficiency, greater efficiency, avoid excess frequency, and reduce waste while increasing access.“

The Way Forward

In a recent statement, P&G management said they expect full-year 2026 sales to increase 1-5% year-over-year, while organic sales growth is expected to reach 4% compared to the previous year. Core earnings are forecast to decline to 4% in FY26. The business is constantly in the midst of restructuring focused on reducing costs, right-sizing, and simplifying the product portfolio. The company also appointed COO Shailesh Jejurikar as its new CEO, effective January 1, 2026, succeeding Jon Moeller.

The average price of Procter & Gambles for the last 12 months is $157.75. On Wednesday, stocks traded higher during the session.