Earnings preview: Intuitive Surgical (ISRG) looks poised for a strong Q4

Intuitive Surgical, Inc. (NASDAQ: ISRG) is a pioneer in robotic-assisted surgical technology, developing advanced systems that enable healthcare professionals to perform minimally invasive procedures with greater precision and efficiency. After successfully marketing and scaling its robotics platform, the company has more than 10,000 da Vinci systems—its flagship product—installed worldwide. Building on this established footprint, Intuitive Surgical plans to transition to direct sales in parts of the European market in the first half of 2026, a move aimed at strengthening market presence and improving margins.

Measurements

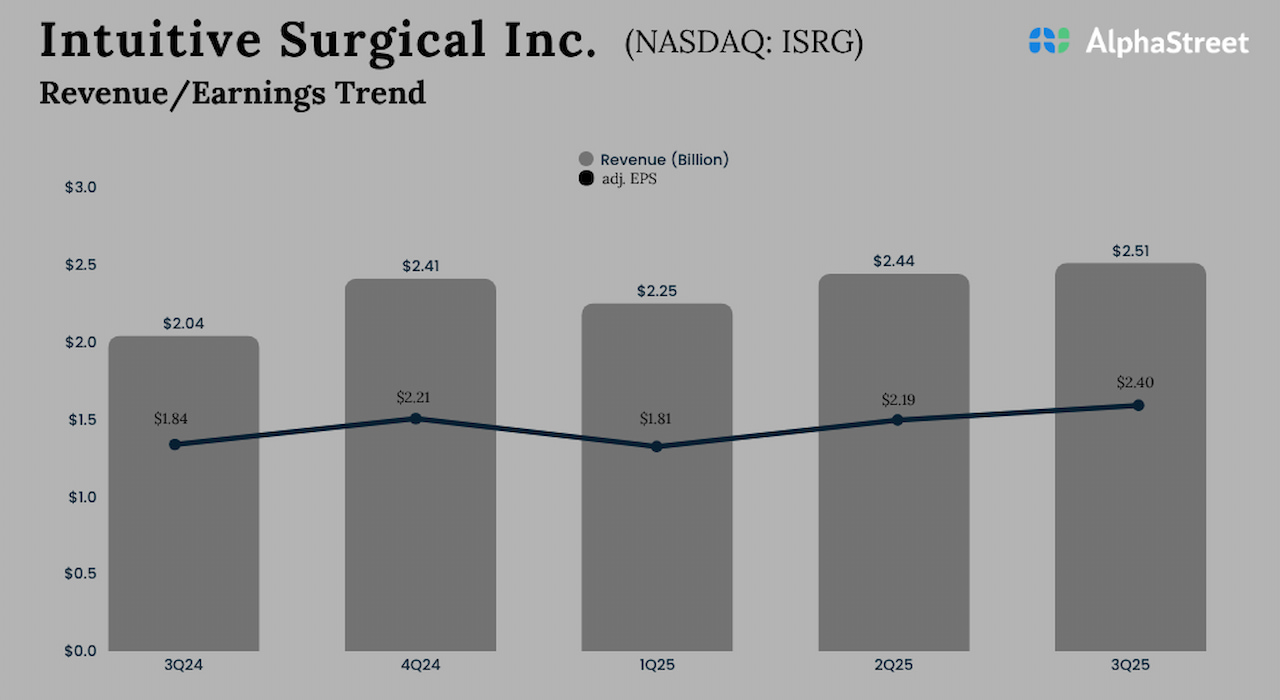

The Sunnyvale, California-based medical device maker will publish its Q4 numbers on Thursday, January 22, at 4:05 pm ET. On average, Wall Street analysts expect adjusted earnings of $2.26 per share for the quarter, compared to $2.21 per share in Q4 2024. The positive forecast shows an estimated 13.8% increase in revenue for the December quarter to $2.75 billion. Intuitive Surgical has a strong track record of outperforming estimates – quarterly revenue and profits have consistently beaten estimates for nearly three years.

In a first report published this week, the company reported 18% year-over-year growth in global procedures and a 17% increase in Da Vinci procedures in the fourth quarter. First-quarter revenue was $2.87 billion, up 19% from the year-ago quarter.

Shares of Intuitive Surgical started 2026 on a high note, though the momentum fizzled later, with the pullback continuing this week. However, the stock’s recent close was above its 52-week moving average of $522.66. At one point, the stock traded near its all-time high nearly a year ago, and ISRG has gained about 6% in the past six months.

Double Digit Profit

In the September quarter, adjusted earnings rose to $2.40 per share from $1.84 per share in Q3 2024, beating expectations. On a reported basis, net income was $704 million or $1.95 per share in the third quarter, compared to $565 million or $1.56 per share a year ago. The milestone benefited from a 23% jump in third-quarter revenue to $2.51 billion, which beat analysts’ consensus estimates. Globally da Vinci procedures have grown by around 19% year on year.

“The need for the development of da Vinci V has motivated a strong in-house placement. We believe that the development is an effective way for customers to increase their capabilities and capabilities. These capabilities include sensing power, autonomy of surgeons, telepresence, and various other digital tools that may lead to an improved understanding of what major surgery is like and more adoption of robotic-assisted surgery, providing our surgical programs with time. a comprehensive portfolio, which will help expand access to specific areas and areas of care,” said the company’s president, David Rosa, on the Q3 FY25 earnings call.

The market

For a long time, Intuitive Surgical has enjoyed a first-mover advantage, as its da Vinci system was the first robot-assisted surgical platform to receive FDA approval for routine laparoscopic surgery. Over the years, the company has maintained its market share through a diversified business model and continuous product development. However, the medical device market is seeing increasing competition – recently, Medtronic launched its robotic-assisted surgery system Hugo in the US after receiving FDA approval for urologic procedures.

The stock experienced volatility in early trading on Thursday, after a small open. Meanwhile, the positive outlook from analysts indicates that the stock may regain momentum ahead of the upcoming earnings.