Why a £250K ISA won’t replace your salary – but can still transform your retirement

Image source: Getty Images

A £250,000 ISA sounds like a huge financial milestone. But when it comes to changing wages, the reality is more sobering than it first appears.

That’s because retirement outcomes are not determined by how the portfolio is constructed. It is determined how much income it can continue to provide once withdrawals begin.

Continuous income

If the donations stop, the math becomes significantly easier. The portfolio either supports a certain level of inflation-adjusted income, or it doesn’t – no matter how long it took to get there.

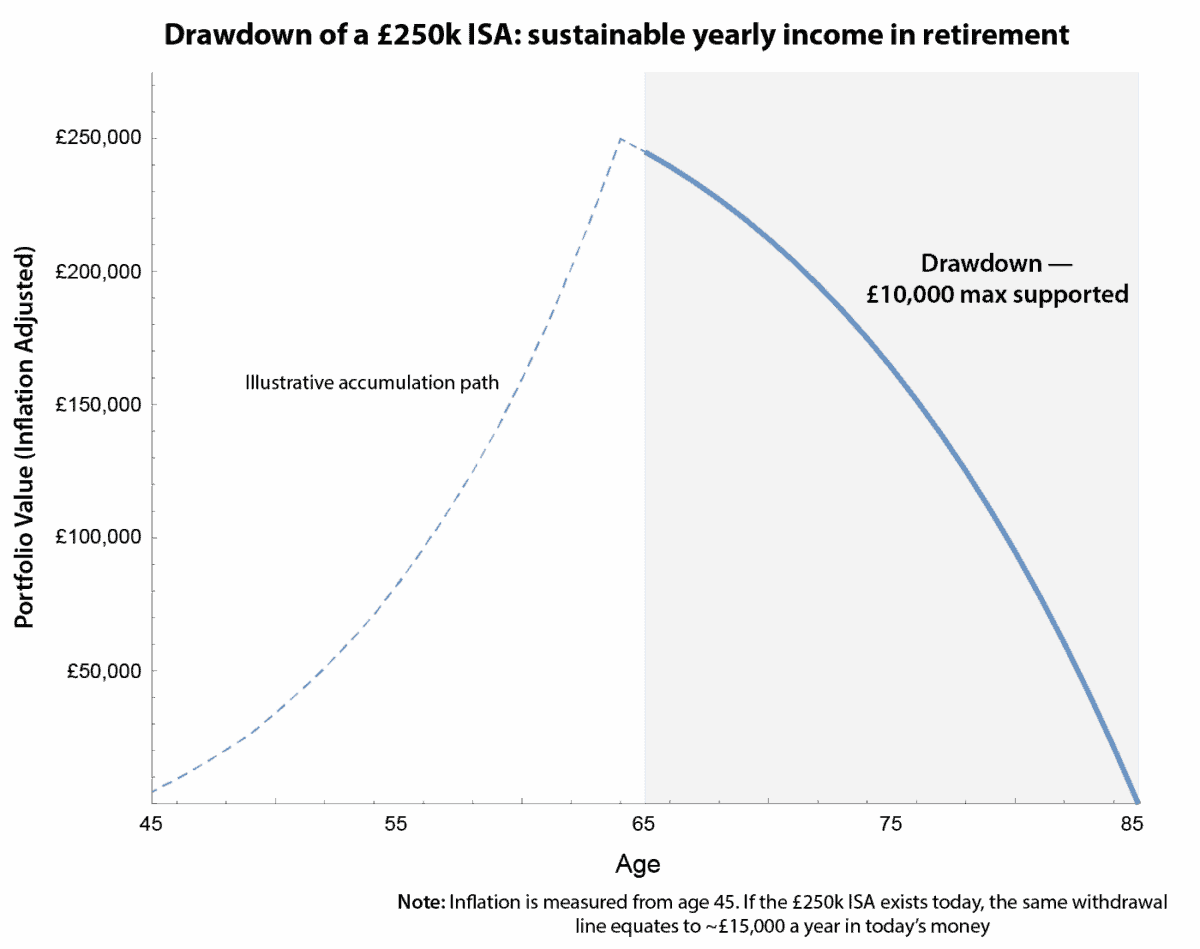

The chart below focuses only on this downsizing category. It assumes a conservative long-term return of 4% per year and 2% inflation, and reduces the portfolio to zero by age 85. This effectively stress-tests a sustainable high income over a 20-year retirement.

A chart created by the author

Under these assumptions, a £250,000 ISA would generate around £10,000 a year, or around £833 a month, in real terms. That may include essentials or supplement other income, but it falls far short of taking a regular salary.

Allowing for market volatility or life expectancy reduces sustainable income to around £750 a month, while leaving a residual balance of around £57,000.

Time for inflation

Where investors often get confused is inflation. If you already hold the full £250,000 today, the initial capital is in place quickly, supporting an income of close to £15,000 a year, or around £1,250 a month in today’s money.

Most importantly, this is not a separate withdrawal strategy. The sustainable income line in real terms has not changed – having capital today simply increases the income equivalent of today’s income. Previous accruals improve volatility, but do not change the underlying depreciation calculations.

The message is clear: a £250,000 ISA is a solid foundation, but it’s not life-changing in itself. Its real value is in providing flexibility by supplementing pensions and spending, rather than fully replacing income.

A different approach to Legal & General

When investors talk about income stocks, the focus is usually on yield. But with Legal & General (LSE: LGEN), the more interesting question is why that income – and why it keeps coming up year after year.

At its core, it is a money recycling business. It is necessary for old debts from pensions and annuities, to invest in them in an economical way, and gradually release the money over time. That money is then returned to shareholders through stock dividends and buybacks.

This is important whether you are setting up an ISA or are already earning money from it. During the accumulation period, reinvested shares do the hard work in silence. If you pay less, those same fees can reduce how much you need to sell – making for a smoother ride through volatile markets.

What makes stocks stand out today is predictability. The administration has committed to 2% budget growth, supported by long-term pension contracts rather than short-term market optimism. It’s not fun, but it’s intentional – and that’s usually what income investors need.

Of course, it comes with risks. Sharp moves in bond maturities, regulatory changes, or weak capital production can pressure dividends, while high yields leave little room for negative performance moves.

Bottom line

Legal & General is not about maximizing returns. It is designed to generate and return income gradually over time, making stocks relevant at many stages of the investor’s journey. That long-term investment is why I own stocks.