BitMine Buys More ETH While Sitting on $6B Paper Loss

BitMine Immersion Technologies added more ethereum last week, although its existing stash sits deep in the red. ETH fell to around $2,280 (-2.5%), well below the company’s average entry price. The move comes as crypto markets falter, with investors chasing cash and gold.

On paper, BitMine has lost more than $6 billion in its ETH holdings. That sounds reckless. Even if it feels like a long sentence. The difference is worth your money.

ALSO READ: BitMine, $BMNRETH’s unrealized loss rises to $6.6 billion, now on track to become the 5th largest loss on record in history.

The unrealized loss is now ~66% of Archegos size in 2021, the largest loss ever recorded. pic.twitter.com/JLHqMDLL1M

— The Kobeissi Letter (@KobeissiLetter) February 2, 2026

DISCOVER: The Best New Cryptocurrencies to Invest in 2026

Why Bitmine Can Buy ETH While Losing Billions?

BitMine uses Ethereum’s treasury strategy. Think of it as a company that chooses to hold gold bars instead of dollars. In this case, the “gold” is ETH.

Last week, BitMine captured 41,788 ETH, pushing its total value over 4.2 million tokens. The company started buying in June when ETH was trading near $2,480. Today’s price is sitting at the bottom, which means that all new prices are lower in cost.

This shows what Michael Saylor did with Bitcoin years ago. Buy in a time of pain. Hold on to the sound. Bet that the asset is valuable for a long time.

Ethereum Price Drops, But Usage Tells a Different Story

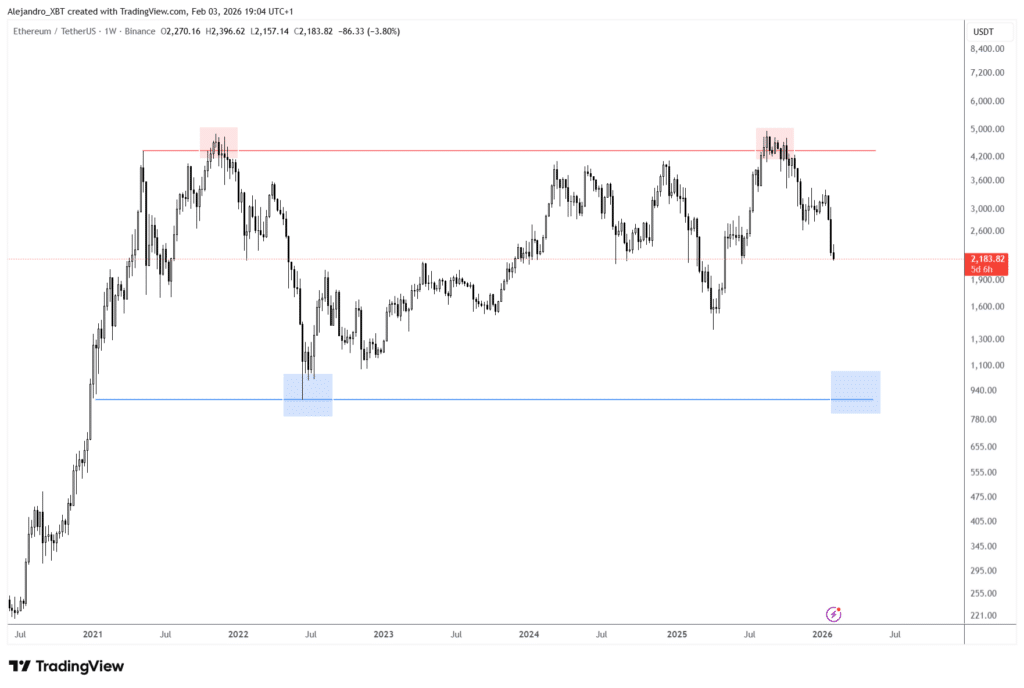

ETH is down more than 18% in the last week. That sounds like a risk. Price drops are painful. Immediately.

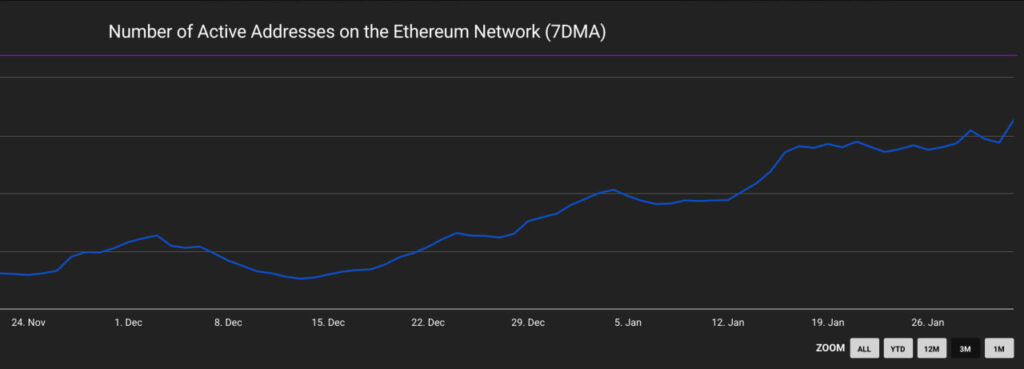

But Tom Lee points out something that many people miss. On-chain activity continues to increase. That means more transactions and active wallets. Think of it as a highway. Even as toll rates drop, traffic continues to grow.

(Source: Number of Active Addresses on the Ethereum Network / The Block)

In the last crypto winter, the use dried up. This time, it didn’t happen. That’s why BitMine classifies a dip as a reset, not a rollover.

We covered the decline in the price of Ethereum earlier this month, and the same tension remains. A weak price. Strong usage.

FIND OUT: Top 20 Cryptos to Buy in 2026

What does this mean for everyday investors looking at ETH

BitMine’s bet sends a signal. Some institutions still see ETH as basic financial conduits, not meme trading. Smart contracts, stablecoins, and DeFi applications are still working on it.

That doesn’t mean the price will go up again tomorrow. Bitcoin recently dropped below $74,000, dragging the market with it. The rules of conduct are currently in jeopardy.

(Source: ETHUSD / TradingView)

If you are new, here is the translation. Buying big players doesn’t cancel volatility. It only shows the time horizon. BitMine can wait years. Can you?

FIND: Top Solana Meme coins to buy in 2026

Follow 99Bitcoins on X for Latest Market Updates and Subscribe to YouTube for Daily Expert Market Analysis

The post BitMine Buys More ETH While Sitting on $6B Paper Losses appeared first on 99Bitcoins.