Crypto Market News Today, January 20: Federal Reserve Injects $8.3 Billion Liquidity as Gold Records Another ATH | Bitcoin USD Next?

Something subtle but important is happening at the bottom of the market. The latest injection of Federal Reserve liquidity, up to $8.306 trillion and set for tomorrow, comes at a time when investors are already nervous, defensive, and looking for a hint or two in the market.

Anxiety can be seen in price action. Gold’s new ATH of $4,717 per ounce is proof, while Bitcoin USD falls to the $95,000 support area. However, when the Federal Reserve injects liquidity, and Gold maintains its ATH behavior, Bitcoin USD prepares to rise.

The Federal Reserve, Liquidity, and Pressure

The New York Fed focused this performance on Treasury bills maturing between February and May, a narrow window of its own. By injecting liquidity directly into banks, the Federal Reserve is making sure that reserves remain adequate without reopening the political battle surrounding QE. It is a perfect example of expensive housekeeping.

In total, the Federal Reserve’s monthly injections of liquidity now total $55.4 billion. This spending doesn’t sound encouraging, but now we know what excess savings can do. They leak, slowly at first, then all at once as liquidity hell breaks loose.

🇺🇸BREAKING: The Fed will inject $55.3 BILLION into the markets over the next 3 weeks. From TUESDAY.

That is not QE. That is not a reduction in quality. That is DIRECT LIQUIDITY.

$55.3B flows into risk assets in 21 days.

And still wondering if it’s “too late” to buy crypto?

Position.… pic.twitter.com/gg1l5ODHOe

— Gordon 🐂 (@GordonGekko) January 18, 2026

When it does, Bitcoin USD often enters the picture. Reduced financial pressure lowers borrowing costs and encourages risk-taking. Even conservative funds begin to redistribute when money feels plentiful. Federal Reserve liquidity has a way of forcing money to flow; it’s always the same known mechanism.

DISCOVER: 10+ Next Crypto to 100X By 2026

Gold ATH Rings Alarm Clocks

The push for another Gold ATH is likely driven by central banks, inflation, and geopolitical pressures. This year, 755 tons of official gold (the amount of gold expected to be purchased by major banks around the world in 2026, predicted by JP Morgan) will be symbolic and strategic.

(source – TradingView)

But, once again, as gold blows up ATH after ATH, the narrative converges with Bitcoin and its strength against the USD. Gold is still attracting the first wave of fear-driven capital, and Bitcoin, historically, is catching the second wave, especially when investors start thinking about mobility, risk of holding, and portability.

Humans have such a short memory!

If you are afraid $GOLD climbing, you don’t understand what this is really like.

The higher gold goes, the stronger the Bitcoin output will eventually become.Gold trading is always boring. When that happens, the cycle starts again… pic.twitter.com/dDX3ad4kry

— ₿εKα (@beka_web3) January 20, 2026

Gold’s ATH often reflects a lack of confidence in systems and currencies and does not stop at bullion vaults. Federal Reserve liquidity only sharpens the gap by reminding markets how fast balance sheets can grow again.

Will Bitcoin be next?

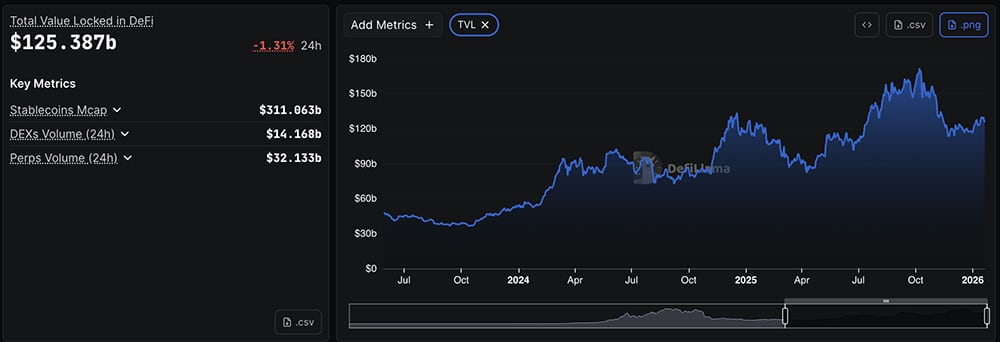

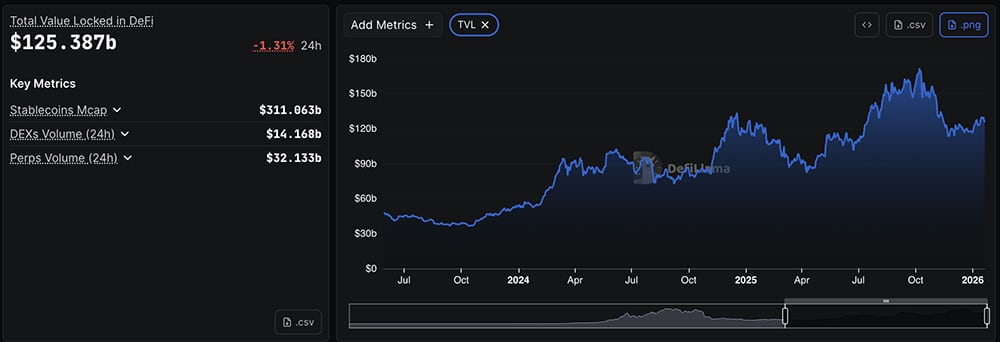

The latest on-chain data doesn’t look good, and that’s the point. The shutdown is muted, but the locked value of DeFi is increasing. Bitcoin USD dominance is still sitting close to 60%, on solid ground. These situations came before aggressive measures. We know that when the Federal Reserve injects liquidity, volatility remains depressed, and the pressure is cumulative.

(source – Defilama)

The weakness of the dollar over the past year also adds another layer. With the greenback in double digits, Bitcoin USD is absorbing some of that valve release pressure. ETFs make the process cleaner, faster, and less speculative than previous cycles. The center campaign is here in this cycle.

Gold’s 2025-2026 run is already one of its strongest in decades, the strongest since the 1970s. But Bitcoin USD doesn’t need to overtake gold any time soon. It takes time, money, and reason. Currently, the Federal Reserve provides two of those three, money and reason. Gold had a lot of time, something BTC will have for decades.

Will Bitcoin bounce against the USD? Is the cycle over? Gold may be at ATH, and so is silver, but Bitcoin is collapsing.

GET:

Follow 99Bitcoins on X For the latest market updates and subscribe to YouTube For Daily Expert Market Analysis.

There are no live updates available at this time. Please check back soon!

Why you can trust 99Bitcoins

Founded in 2013, 99Bitcoin team members have been crypto experts since the early days of Bitcoin.

90+ hours

Weekly survey

100k+

Monthly students

50+

Professional contributors

2000+

Crypto projects reviewed

Follow 99Bitcoins in your Google news feed

Get the latest updates, trends, and information delivered right to your fingertips. Register now!

Register now