Crypto Market News Today, January 19: Why Is Crypto Down Today? BTC USD Drops to $92,000 Level, ETH Below $3,200

Why is crypto down today? BTC USD drifted to the $92,000 area, and ETH USD hit hard, now below $3,200. The mood and mood changed quickly as debt settlement broke this year’s record, screens turned red, and we were caught off guard. About $800 million in leveraged long bets disappeared as pressure mounted.

(source – Coinglass)

Why crypto is down today also connects to where the money has moved. Although BTC USD and ETH USD are trending lower, the main currency is still circulating in the metals. Gold and silver rose to record highs, with gold hitting $4,660 an ounce, pulling money out of other commodities as World War III rages on. Today, the crypto market has lost more than 100 billion dollars, while the total market capitalization has risen to $3.217 trillion, or a significant decrease of 2.8% in 24 hours.

(source – CoinGecko)

Really, Why Is Crypto Down Today?

So what is it? Why is crypto down today? Politics and price risk may play a big role. Donald Trump’s announcement of a 10% tariff on eight European countries tied to Greenland reignited fears of a trade war. The market has a potential EU retaliation value of up to $100 billion. The fear alone was enough to depress BTC USD and ETH USD, especially with profits already lifted in all futures markets.

BREAKING: French President Macron wants the EU to use its “most powerful weapon” against the US after President Trump’s threat over Greenland.

Macron now wants the EU’s “anti-enforcement tool” to be used.

If used against the US, it will… pic.twitter.com/E47Bpe03lK

— The Kobeissi Letter (@KobeissiLetter) January 18, 2026

Stocks also weakened near crypto, although the drops were not comparable. The S&P 500 was down about 1% with European stocks following a free fall. BTC and ETH have followed the same direction against the USD, with less currency and aggressive derivatives. The selling pressure continues to increase as the loss decreases, which reminds us of October 10 of last year’s hunt, when prices also caused the elimination of the lot, much greater than today.

Geopolitical factors help price action, too. China’s limit on chip exports is uncertainty around the world, which is depressing spending on defense equipment. On-chain data from Sentiment shows an increase in negative sentiment, with whale wallets reducing crypto exposure. Those above are holiday situations surrounding Martin Luther King Jr. Day became more and more unstable and brought panic.

#CONTINUED China blocks Nvidia H200 AI chips US government cleared for export – The Guardian pic.twitter.com/ZPoJK0jFK8

– War Intel (@warintel4u) January 18, 2026

DISCOVER: 10+ Next Crypto to 100X By 2026

Where BTC USD and ETH USD Go From Here

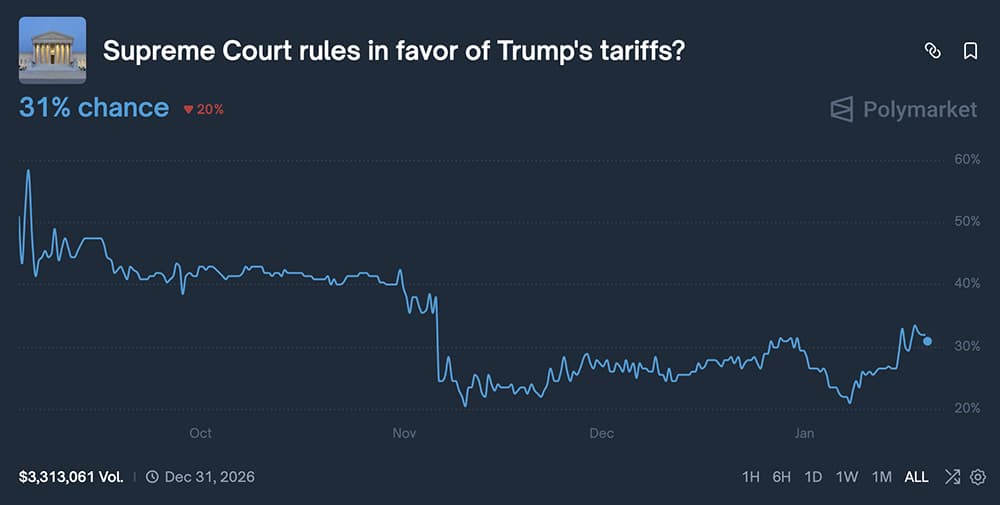

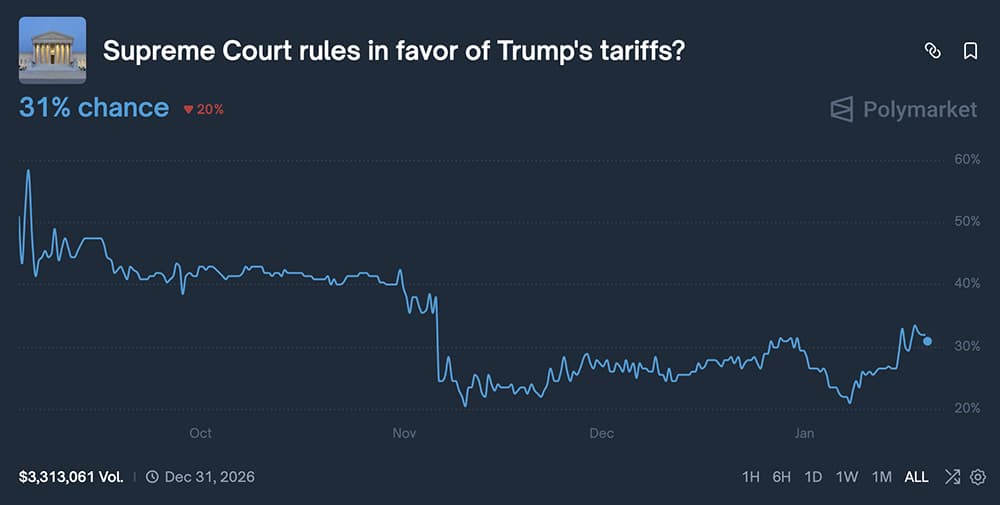

What are our expectations in the short term? Polymarket now has a 70% chance that the US Supreme Court will rule that Trump’s tariffs are illegal. This result will likely bring immediate relief to all risk assets, including ETH and especially BTC against the USD. A decision otherwise keeps the stress alive and delays any meaningful recovery.

(source – Polymarket)

From a chart perspective, BTC USD is sitting on a line that we should respect. A clean break below $92,000 opens up the mid-$80,000s, while stability above that area keeps the late January target of $98,000 in play. ETH USD continues to show relative strength, with $3,500 to $3,7000 levels expected, although it requires consistent ETF inflows.

Why is crypto down? Policy topics, liquidity gaps, and leveraged positions, especially leveraged positions. Maybe watch the market, gamble on the prediction market, cause leverages to kill the vibes.

GET:

Follow 99Bitcoins on X For the latest market updates and subscribe to YouTube For Daily Expert Market Analysis.

Steak ‘n Shake Buys $10M in Bitcoin After Testing Lightning Payments

Will 2026 be the year of the “Bitcoin Standard”? It seems so. Institutional acquisitions began when Michael Saylor and MicroStrategy began adding Bitcoin to its balance sheet. After four years of volatility, the US tech company is now the largest owner of BTC among public companies. MicroStrategy owns more Bitcoin than the US, at least from public data, and even China.

Given the gains MicroStrategy stock received after Saylor opted for Bitcoin, many public companies have lined up, looking to copy his strategy. Whether they will succeed or not depends a lot on how BTC and the following crypto 100X companies do. At the moment, however, the price of Bitcoin is strong, and increasingly, if the political fires subside, the bulls want to close firmly above $ 100,000.

Among the firms that accept Bitcoin is Steak ‘n Shake. On January 17th, they just bought $10M worth of Bitcoin with their company treasury, months after Lightning Network payments were rolled out to all US stores.

Read the full story here.

Saylor’s Tips on Fresh Bitcoin Buy As US Taxes Spook the Market

Michael Saylor has reportedly revealed that the Strategy could buy more Bitcoin, just days after spending $1.25Bn on a new batch of BTC. The entire crypto market fell overnight, down -2.8% to $3.2 trillion, Bitcoin down -2.5%, to $92,500 as the news spread, holding rather than selling. This comes as institutions, from ETFs to public companies, continue to pile on Bitcoin in early 2026.

Crypto has taken off in the past 24 hours amid growing tensions between the US and Europe over Greenland. President Trump has imposed heavy tariffs on any European nation that stands in the way of the United States’ Greenland.

In a post on his Twitter account, Trump listed the UK, the Netherlands, Finland, Norway, Denmark, France, and Germany as countries that will be hit with a 10% tariff starting February 1, 2026, rising to 25% on June 1, 2026.

Read our full coverage here.

Binance Reopens Australia’s Fastest Bank Transfers After 2 Years

Binance Australia has also opened direct bank transfers for Australian users, allowing verified customers to deposit and withdraw Australian dollars (AUD) via PayID and standard bank transfers after more than two years without these services. This change restores real-time fund movement between local bank accounts and the Binance platform, removing the biggest hurdle Australian traders have faced since mid-2023.

PayID is the most widely used domestic payment method in Australia that allows users to send money using a phone number, email address, or ABN instead of lengthy bank account details.

Now, Australian customers can move money in and out of Binance faster and at a lower cost than ever before.

Read the full story here.

Bitcoin BTC USD Price Slides Below $92K as Tax Fears Spook Global Markets

Under Donald Trump, you can’t name a president without a tax. Tariffs have become a defining feature of President Trump, and the global economy is often reacting cautiously. Not only do commodity prices fall, but risk factors tend to be more affected.

By 2025, Bitcoin and other best cryptos to buy would fly to record highs if not for taxes. A number of tariff threats from China and European countries, some of which are aligned with the US, have halted growth. And in 2026, we’re back again to fund managers who might “manage the risks” associated with taxes.

President Trump announces tariffs on 8 European countries in an effort to reach an agreement on Greenland. pic.twitter.com/Bzr8uIZjqF

– America (@america) January 17, 2026

On January 17, Trump proposed new tariffs for eight European countries, including the UK, Germany and Germany. As expected, risk assets, especially the next cryptos to explode, deferred gains, are sliding. Ethereum fell to $3,200 while Bitcoin crashed below $95,000 towards $92,000.

Read the full story here.

Why you can trust 99Bitcoins

Founded in 2013, 99Bitcoin team members have been crypto experts since the early days of Bitcoin.

90+ hours

Weekly survey

100k+

Monthly students

50+

Professional contributors

2000+

Crypto projects reviewed

Follow 99Bitcoins in your Google news feed

Get the latest updates, trends, and information delivered right to your fingertips. Register now!

Register now