Big Panic as UAE Firm Buys Private $500M Stake in Trump Crypto Firm

A UAE-backed investment vehicle has reportedly bought a 49% stake in Trump-linked crypto scheme World Liberty Financial for $500M just before Trump returns to the White House in January 2025.

A year on from this investment, we look at what impact it has had on World Liberty Financial and the wider crypto ecosystem linked to Trump.

The UAE royal family privately bought a 49% stake in Trump’s World Liberty Financial for $500m. pic.twitter.com/xi8ByzJcyf

— db (@tier10k) February 1, 2026

It also comes at a time when global funds are diving deeper into DeFi and the broader crypto space, betting that continued friendly US policy will unlock more growth.

The crypto market took a hit this weekend, and more than $300Bn was wiped off the total market capitalization of Bitcoin .cwp-coin-chart svg { stroke-width: 0.65 !important; } .cwp-coin-widget-container .cwp-graph-container.positive svg path:nth-of-type(2) { stroke: #008868 !important; } .cwp-coin-widget-container .cwp-coin-trend.positive { color: #008868 !positive; background-color: transparent !important; } .cwp-coin-widget-holder .cwp-coin-popup-holder .cwp-coin-trend.positive { border: 1px solid #008868; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.positive::before { border-bottom: 4px solid #008868 !important; } .cwp-coin-widget-container .cwp-coin-price-holder .cwp-coin-trend-holder .cwp-trend { background-color: transparent !important; } .cwp-coin-widget-container .cwp-graph-container.negative svg method:nth-of-type(2) { stroke: #A90C0C !important; } .cwp-coin-widget-holder .cwp-coin-popup-holder .cwp-coin-trend.negative { border: 1px solid #A90C0C; border-radius: 3px; } .cwp-coin-widget-container .cwp-coin-trend.negative { color: #A90C0C !important; background-color: transparent !important; } .cwp-coin-widget-container .cwp-coin-trend.negative::before { border-top: 4px solid #A90C0C !important; } the price dropped below $80,000 and is currently trading at $78,250.

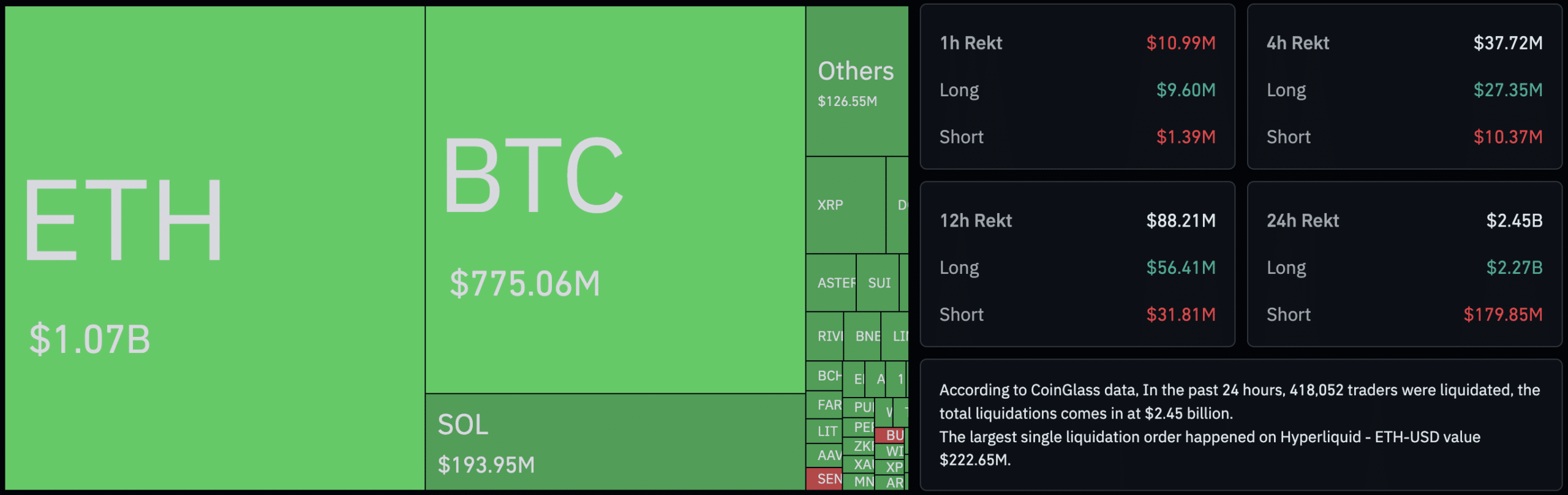

(SOURCE: CoinGlass)

What Is the Significance of Abu Dhabi’s $500M Investment in Trump-Backed World Liberty Financial?

The Wall Street Journal reports that Aryam Investment 1, an Abu Dhabi-based vehicle backed by Sheikh Tahnoon bin Zayed Al Nahyan, agreed to buy a 49% stake in the company just days before Donald began his second term as US President.

Part of the money came before. About $187M flowed to companies controlled by the Trump family, with more money to groups affiliated with the project’s founders. Donald’s son, Eric Trump, is said to have signed the agreement.

The agreement with World Liberty Financial, which has not been reported before, was signed by Eric Trump, the president’s son. At least $31M was expected to go to organizations connected to the family of Steve Witkoff, the founder of World Liberty, who in recent weeks was named as the US ambassador to the Middle East, the WSJ said.

Sheikh Tahnoon’s involvement is significant as the Abu Dhabi monarchy has reportedly been pressuring the US for access to tightly controlled artificial intelligence chips. Tahnoon is the brother of the president of the United Arab Emirates, the government’s national security adviser, and the leader of the oil-rich country’s largest wealth fund.

He oversees an empire worth more than $1.3 billion, funded by his personal wealth and state money, that includes everything from fish farms to AI for surveillance, making him one of the world’s most powerful single investors.

The deal marked something unprecedented in American politics: a foreign government official taking a majority stake in a company linked to an incoming US President.

So… a bribe?

Trump got $500 million and the UAE got “tightly guarded” AI chips. How is this not bribery, really? pic.twitter.com/ZS9Pt9Ippn

— The Tennessee Holler (@TheTNHoller) February 1, 2026

GET: 12+ Hottest Crypto Presales You Can Buy Right Now

Why UAE Capital Is Important Here?

This is not retail speculation. This is government-linked money entering crypto on a massive scale. For everyday investors, that shows confidence that crypto will stay close to mainstream currencies under Trump.

It also fits the main pattern. The UAE is heavily focused on digital assets, from exchanges to stablecoins. A recent move The UAE’s crypto expansion shows that the country wants to influence where finance and technology meet.

A few weeks before the deal came out, another company led by Tahnoon used World Liberty’s USD1 stablecoin to settle a $2Bn investment in Binance. That connects Trump Crypto, the world’s leading crypto exchange, with private capital through a single agreement.

Trump Crypto Projects Are Currently In The News For All The Wrong Reasons

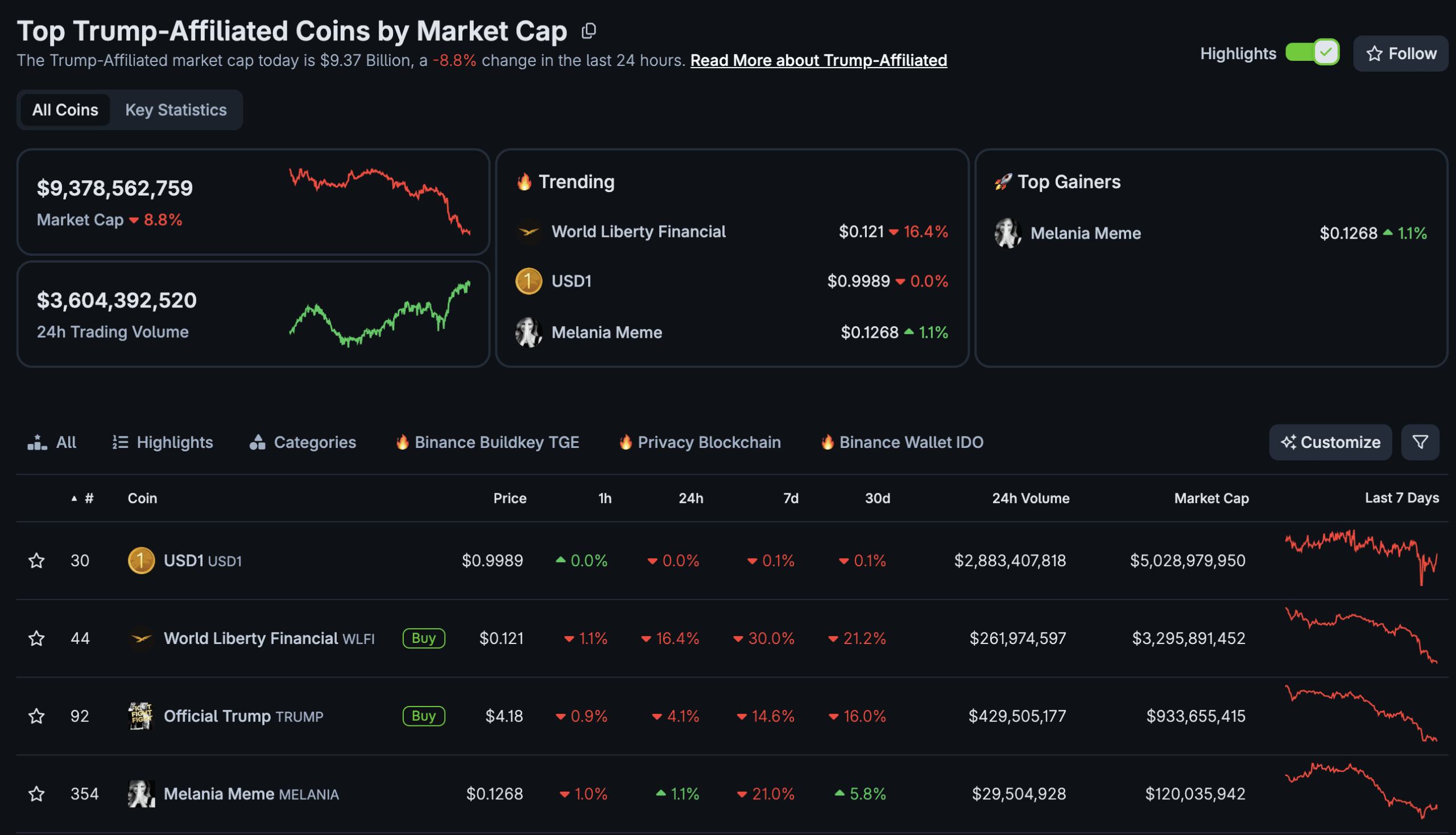

(SOURCE: CoinGecko)

This story, reported by the Wall Street Journal, comes at a time of great volatility in the crypto market, especially in projects related to the President.

The Official Trump memecoin is down more than -94% from its all-time high and is currently trading at just $4.15, after briefly trading above $40 in January 2025.

Then there is the President’s wife, Melania, and her official memecoin. MELANIA is down -99% since January 2025 high above $7 and is trading today at only $0.12.

Finally, the native token of Trump’s DeFi platform, World Liberty Financial, is down 63% from its peak in September 2025. WLFI is trading at $0.125, down -17% on the day, and its market cap is down to $3.2Bn from $6.6Bn six months ago.

CHECK:

- 16+ New Upcoming Binance Lists in 2026

- 99Bitcoins’ Q4 2025 State of Crypto Market Report

Follow 99Bitcoins on X For the latest market updates and subscribe to YouTube For Daily Expert Market Analysis.

The post Big Shock As UAE Firm Buys Secret $500M Stake In Trump Crypto Firm appeared first on 99Bitcoins.