XRP Is Doing Something It Has Never Done Since 2021: Why It Matters

XRP is flashing a rare relative strength signal against ETH, according to crypto analyst Matt Hughes (“The Great Mattsby”), who points to the two-week Ichimoku cloud that he says has not held as support since 2021. Since XRP has been re-boxed within the range of the USD defined in low periods, Hughes calls one level as a segment, Hughes refers to the next level, repositioning one level the market has room to operate; fail, and the resulting narrative remains premature.

XRP Poised To Overtake ETH?

Hughes’ main claim is based on the XRP/ETH pairing on the 2-week chart. In his reading, there is a major change of state: “If you look at the 2-week Ichimoku cloud, you can see that XRP is doing something it hasn’t done since 2021: it is turning the 2-week cloud to support. The cloud has been the biggest resistance in most of the history of the chart so far (with a significant explosion only in the 2021 weeks, but only in the 2021 weeks).

On the Hughes chart, XRP/ETH is pushing into the upper side of the 2-week Ichimoku cloud, with the latest candle marked around 0.00062. His best reading is that a clean flip, where the price holds above the cloud and is treated as a low in pullbacks, can be a regime change for the pair.

Roadmap for XRP to $9

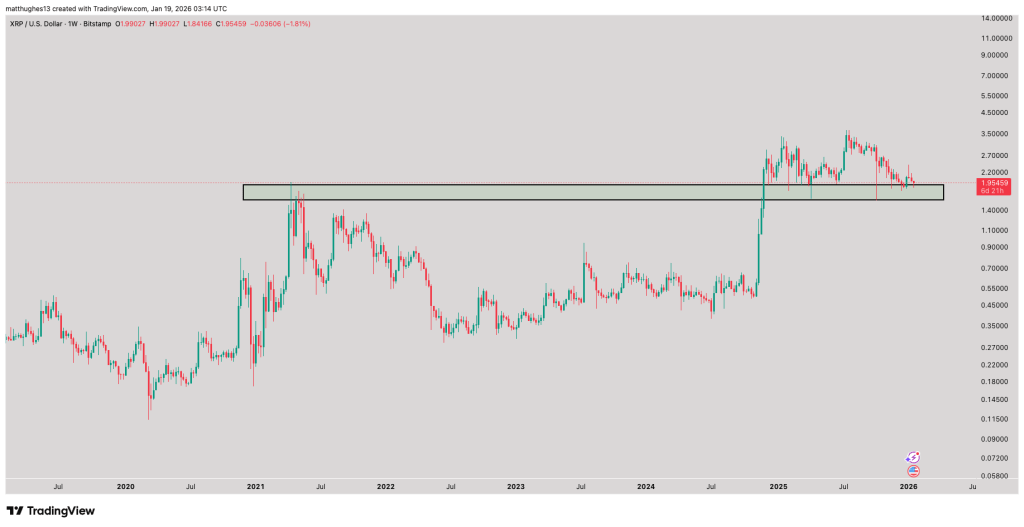

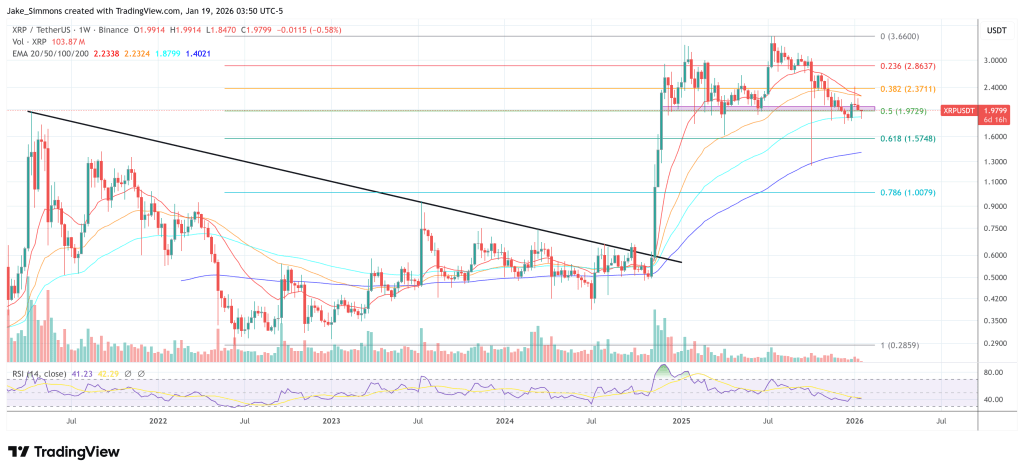

Hughes’ short-term work shifts from relative performance to mechanics in USD terms. On the daily chart of XRP/USD, the price is still behaving like a market that has not yet resolved its larger consolidation, moving between stacked horizontal levels while respecting descending supporter lines that visually reinforce why observation efforts have repeatedly stalled.

Related Reading

Hughes boils that structure down to one potential limit: “The price is on the upswing, and this Gann follower shows exactly why the price is stuck in its current range. If XRP can close candles above $2.30, the upswing can continue.” Furthermore, the next targets for the daily time frame are $2.59 and $2.95.

The weekly chart of XRP/USD adds the next level when that acceptance comes. Two extension levels (drawn from the 2014 low to the 2017 high) are clearly marked: 2.272 at $3.09882 and 2.618 at $9.00194, Hughes’ charted pattern first treading the $3 low before extending higher if momentum persists.

Related Reading

Therefore, Hughes’s Bullish scenario is a two-part sequence: first, clear the USD range trigger (sustained close above $2.30), and then turn the last major area before the 2025 peak into support. To paraphrase X: “XRP has been going sideways for 1+ year while many other alts are bleeding. Not IF it hits $9—it’s WHEN. Key takeaway: $3.09 becomes support and then it’s time to go.”

The failover scenario is simple and very fast. If XRP cannot secure a close above $2.30, the fan structure and range remain the same: the circles are just circles on the same roof, and the market risk returns to $1.78.

However, a dip in this price will not change anything regarding the long-term bullish chart of XRP. Pointing to the gap between chart structure and crowd sentiment, Hughes wrote:

“A real baby in diapers and a 120-year-old grandfather who has forgotten his own name can look at this chart and say, ‘Yeah, the old breakout above the 2021 high, now it’s turning into strong support.’ At that moment, every bear in X, his mailman, his mail dog, and the one guy who thought it was 2022 were outside shouting ‘BEARISH! DOOM! SELL YOUR CHILDREN!’ like it’s still a special bear market. Bro, even my grandma’s bingo partner is old now. Wake up and smell the fat of the bull.”

At press time, XRP traded at $1.9799.

The featured image was created with DALL.E, a chart from TradingView.com