Earnings preview: Will Boeing (BA) Q4 FY25 results benefit from recovery efforts?

The Boeing Company (NYSE: BA ) has entered a critical phase in its turnaround efforts, following a long period of financial and safety-related operational stress. The market will be closely watching the airline maker’s upcoming earnings report, looking for updates on its recovery strategy.

Finding Altitude?

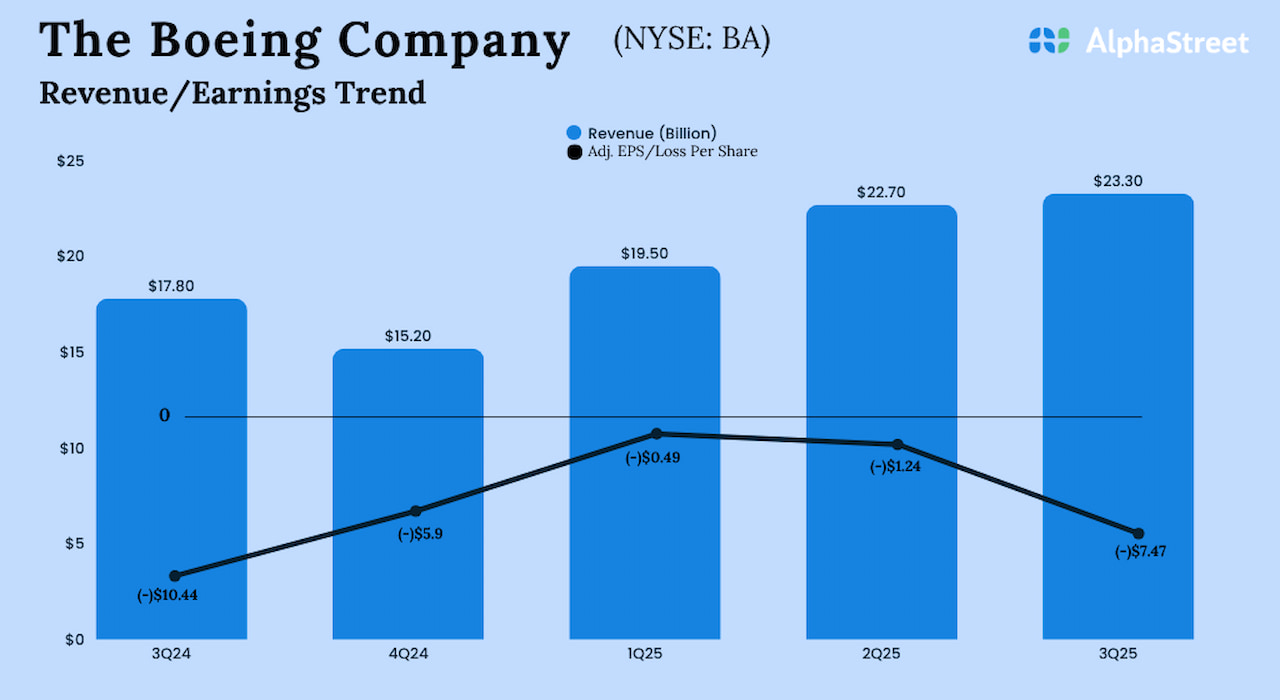

Boeing plans to publish its results for the fourth quarter of 2025 on Tuesday, January 27, at 7:30 am ET. The company is estimated to have lost $0.44 per share in the December quarter, marking a significant improvement from last year’s quarter when it recorded a loss of $5.9 per share. The positive outlook shows an estimated 48.8% increase in fourth quarter revenue to $22.67 billion. In the third quarter, the bottom line missed expectations.

Boeing shares have risen nearly 45% over the past twelve months, outperforming the broader market. Even after this rally, the company’s valuation remains unscathed, reflecting the progress that has been made and the work that remains in its transformation. There is hope for additional benefits this year, based on improved performance and greater stability in all key systems. As such, BA remains a stock to watch for those looking for a long-term investment.

Losses are Reduced

In the third quarter, Boeing reported a loss of $7.47 per share, adjusted for special items, compared to a loss of $10.44 per share in the year-ago quarter. On a reported basis, net loss was $5.34 billion or $7.14 per share in Q3, compared to a loss of $6.17 billion or $9.97 per share in the third quarter of 2024. Revenue rose 30% year over year to $23.27 billion in the September quarter, beating estimates. Revenue grew by double digits in all three operating segments.

From Boeing’s Q3 2025 Earnings Call:

“Backed by great stability, we successfully increased production of 737 aircraft to 38 per month as planned. We then focused on things like improved quality, training, and workplace trainers to help stabilize at that level and demonstrate that all our key performance indicators are healthy. Once we are satisfied with the continued health and stability of our production system, we will introduce production of 2 aircraft to the FAA2. per month We continue to be guided by our safety and quality program, and we will monitor our performance against and these six KPIs as we move to higher levels.”

On Track

Boeing recently increased the production rate of 737 aircraft to 42 per month, from a stable level of 38, with plans for further increases in the coming months. The defense sector experienced strong growth last year, supported by major contract wins and multi-year agreements, which pushed the backlog to the highest levels.. Although the certification and first delivery of the new 777X has been delayed, the program is expected to provide a significant boost to the business, as the wide-body aircraft is designed to be more fuel efficient and provide a clear competitive edge.

While Boeing’s 52-week moving average stands at $201.65, the stock continues to trade above that level, nearing its high for the year. On Tuesday, shares opened lower at $244.40.