JD Sports’ share price fell after the retailer was downgraded. But I always have hope

Image source: Getty Images

During lunch today (6 January), the JD Sports Fashion (LSE:JD.) share price is almost 7% lower after Bank of America reduce the stock. In November, Shore Capital also downgraded the retailer’s shares. It said the group’s third quarter (13 weeks to 1 November 2025) trading update “underscored the depth of the current trade storms“.

Admittedly, the retailer’s latest press release wasn’t very positive. The group said pre-tax profits would be at the lower end of consensus estimates (£853m-£888m). Also, worryingly, compared to last year, like-for-like (LFL) sales decreased by 1.7%, with Asia-Pacific being the only growing region.

Shore Capital was concerned that the group was unable to pass on rising labor and operating costs to clients due to the decline in the top line.

However, despite this doom and gloom, I remain optimistic about JD Sports’ prospects. Here is the reason.

Cheap as chips

At the moment, I think the group’s shares are attractively priced. In fact, they look like a bargain.

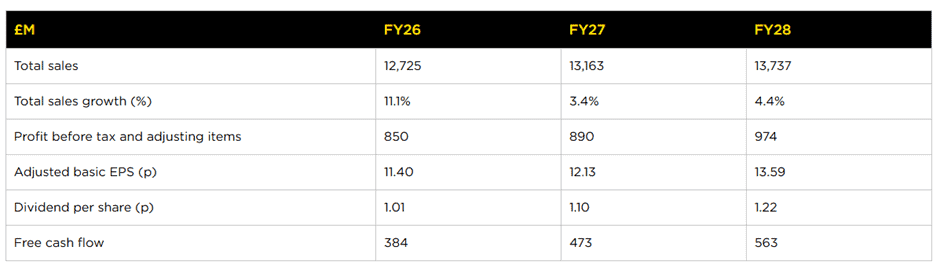

Analysts expect adjusted underlying earnings per share of 11.4p for its current financial year ending February 2026 (FY26). This means the stock is trading at just 7.3 times expected earnings. Looking ahead to FY28, the multiple drops to 6.1. This is incredibly cheap for any business, especially an existing one FTSE 100.

And with little borrowing on its balance sheet – it reported total debt (excluding leases) of £125m at 2 August 2025 – it remains impressively profitable. This is important because it gives you headroom to spend more on renovating existing stores or buying more. Alternatively, it can return some money to shareholders.

Focusing overseas

Following a major acquisition in 2024, North America is now the group’s largest market. I think this is important because, unlike Europe, the US economy seems to be growing fast at the moment.

I’m sure this summer’s FIFA World Cup in the region will also help boost sales. But it’s also a reminder of how the club’s share price has struggled in recent years. Since the last tournament in Qatar in December 2022, it has decreased by almost 30%.

Important, though Nikestruggling US sportswear giant, believed to comprise the group’s retail arm, JD Sports is brand-agnostic. The British retailer has a reputation for responding quickly to changing consumer trends. A look at its website shows 108 different brands/manufacturers listed.

Final thoughts

I agree that JD Sports seems to be out of favor at the moment. The group’s revenue is growing because it is expanding organically and through acquisitions, not by increasing LFL sales. To restore the confidence of investors, I think it will have to solve this concern.

But the problems facing the club appear to be wider than the sector rather than anything specific to JD Sports. Indeed, the company itself maintains a strong brand and strong balance sheet. I suspect that the current downturn in the once historically strong sports/sports market is a short-term phenomenon.

Shareholders probably have January 21 marked on their calendars. This is when the company is due to give its next trading update, which will include key sales for the Christmas period. Yes, it can herald very bad news. However, for the reasons stated above, I think JD Sports is a stock worth considering.