FB Financial Corporation Delivers Strong Q4 2025 Profits With Margin Expansion

FB Financial Corporation (NYSE: FBK ) reported strong results for the fourth quarter of 2025, reflecting improved profitability, balance sheet growth, and continued progress in business diversification. The results were supported by margin expansion, systematic cost control, and stable credit performance.

Fourth Quarter Performance

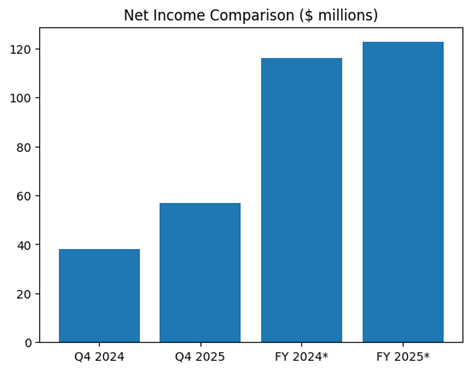

Net income for Q4 2025 was $57.0 million, or $1.07 per diluted share. This compares to $37.9 million, or $0.81 per share, in Q4 2024. Year-over-year, revenue increased 50%. Net income rose to $178.6 million from $130.4 million last year. This represented an increase of about 37%. Interest income is the main driver, reflecting both loan growth and improved financing costs.

Gross interest margin expanded to 3.98% in Q4 2025 from 3.50% in Q4 2024. Lower deposit costs following Federal Reserve rate cuts supported the improvement. Non-interest income also increased year-over-year, led by strong income from mortgage banking and service funds. Performance efficiency remained strong despite high performance-based compensation.

Full Year Highlights

For the full year 2025, FB Financial reported net income of $122.6 million, compared to $116.0 million in 2024. This represents a year-on-year increase of approximately 6%. On an adjusted basis, earnings growth was strong, reflecting lower integration-related costs and improved core profit. While reported full-year revenue was not disclosed in aggregate terms, annualized performance based on fourth-quarter performance suggests a significantly higher revenue base in 2025 compared to 2024.

Average return on assets improved to 1.40% in Q4 2025 from 1.14% last year. Return on equity ratio has also strengthened, supported by earnings growth and effective capital management. The company repurchased approximately 3% of outstanding shares during the quarter, improving per-share metrics.

Balance Sheet and Funding

Loans held for investment reached $12.38 billion by the end of 2025, up 29% from last year. Growth was driven by commercial real estate, commercial and industrial, and residential mortgages. Deposits reached $13.91 billion, a 24% year-over-year increase. Management continued to prioritize core deposit growth while reducing reliance on high-cost, non-core funds.

Credit quality remained stable. Fees were minimal at 0.05% of the average loan, below the previous year’s levels. Underperforming assets were placed higher but remained under control. The loan loss allowance stands at 1.50% of the loan, indicating a strong credit situation.

Business Development and Diversity

FB Financial has continued to diversify its income streams beyond regular income. Mortgage banking remained a significant contributor to non-profit income. The company also benefited from expanded wealth management, insurance, and wealth management services. The combination of previous acquisitions and ongoing branch development supports operational scale and market expansion throughout Tennessee, Kentucky, Alabama, and Georgia.

Management has emphasized disciplined capital deployment, organic growth, and selective acquisitions as part of its long-term strategy. The focus is on building a strong financial base, expanding revenue-based businesses, and maintaining strong risk management.

Overall, FB Financial exited 2025 with improved margins, stronger credit quality, and a more differentiated earnings profile. These factors position the company for stable performance in 2026, regardless of the change in the interest rate situation.