Sentiment Flags XRP and Ethereum as Overlooked After Recovery

Understandably, you must have a “strong desire” to buy Ethereum, XRP, or any of the top 10 altcoins. The past few weeks have been brutal for promising tokens. And this is expected to continue as long as Bitcoin struggles for momentum.

To put the numbers in, Ethereum is down from its December 2025 highs of around $3,500. Meanwhile, like Solana, Cardano, and other best cryptos to buy, XRP crypto, despite the XRP Army calling for a moonshot, slide below $2 and will still reverse losses.

However, given this state of affairs in the crypto market, the on-chain data points to a different story. Yesterday, Santiment, an on-chain intelligence platform, said that XRP and Ethereum are sitting in an “undervalued” position based on market value to value (MVRV).

The lower the coin’s 30-day MVRV, the less risk there is in opening or adding to your position.

A coin with a negative percentage means that the average traders you are competing with have low capital, and there is an opportunity to enter while the profit is below normal… pic.twitter.com/YH8y4IzkWc

– Santiment (@santimentfeed) January 26, 2026

DISCOVER: The best Meme Coin ICOs to invest in 2026

XRP Crypto and Ethereum Holders in “Pain”

For starters, the MVRV ratio measures the “life” of the property in question. This time, it’s all about XRP and ETH crypto prices. What it does is simple: It compares the current market price, that is, what you are currently selling, with the average price that everyone is paying to get their coins.

If the ratio is high, then the owners are profitable, and the opposite is true. In general, analysts use this metric to determine if the market is overheated (overpriced) or if everyone is in “big pain” (undervalued).

Santiment’s 30-day MVRV only looks at people who made a purchase in the last month. If that number is negative, it means that recent buyers have lower incomes on average. Santiment considers this area “less important” because traders feel pressured and few people are in a rush to take profits.

Given this discovery, it seems that ETH and XRP crypto prices are currently trading below the average entry price, and holders are under pressure and in the red. When Santiment shared their findings, Ethereum’s 20-day MVRV stood at about -8%, while the XRP crypto was at -6%.

Interestingly, the same metric for Bitcoin was slightly better. This shows that despite all eyes tracking Bitcoin, buyers who have picked up digital gold over the past 30 days are close to or above break even. Meanwhile, those who bought ETH or XRP crypto at the time feel the pain and may sell and hold, piling more pressure on the price.

FIND: 9+ Best Memecoin to buy in 2026

No Help for XRP USD and Ethereum Crypto?

The good news is that Bitcoin’s 30-day MVRV is positive. If it was in a bad spot, any sale would risk dragging the rest of the market down with it. If this happens, as the recent price action shows, not only will ETH USD and XRP drop the crypto, but the impact will spread, affect sentiment, and lead to spending on all XRP and Ethereum ETFs.

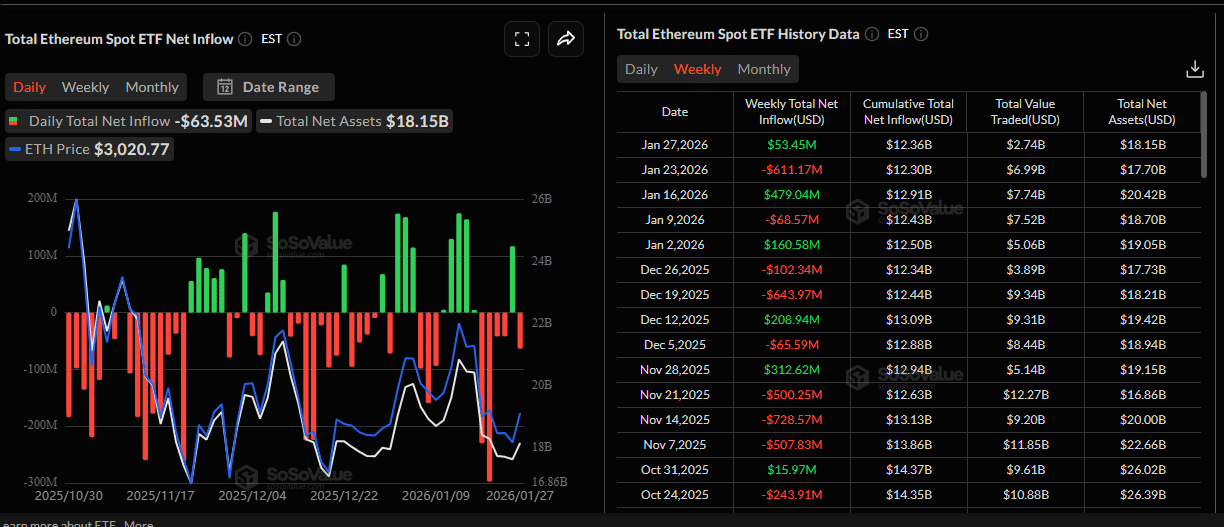

Ethereum crypto prices have fallen over the past few weeks following a massive ETF outflow. Trackers show that more than $611M of shares of the spot Ethereum ETF have been traded, which has a negative weight on the price.

(Source: SosoValue)

Apart from ETFs, even the upcoming development of Glamsterdam in H1 2026 will attract institutional investment in Ethereum. By the end of the year, the developers will re-use the Hegota development. Both of these updates will make the network simpler, more efficient, and more reliable, with the ability of institutions to operate nodes safely.

While ETH USD posted losses, the sell-off in XRP crypto has been sharp. Specifically, the drop below $3 and later $2 was due to big emotions. Threats of additional tariffs in eight European countries, combined with weak Bitcoin, hastened the divestment.

However, there is confidence that XRP crypto can turn the corner. With the legal battle fully resolved, the “control risk” that plagued XRP for years is over. This transparency has reopened the doors of US banks and regulated funds to use XRP in cross-border settlements without legal fear.

Integration of RLUSD to XRP Ledger is a much needed “bridge” for TradFi. While RLUSD offers stability, XRP remains the “gas” and service token that powers these high-speed transactions.

Ripple’s Brad Garlinghouse answers how major retailers can bring institutions to DeFi.$XRP $RLUSD pic.twitter.com/SicNaiywl3

— ALLINCRYPTO (@RealAllinCrypto) January 28, 2026

When RLUSD receives inter-facility adoptions, additional gas is required to secure the transaction. To date, RLUSD is among the largest stablecoins, commanding a market cap of $1.4Bn.

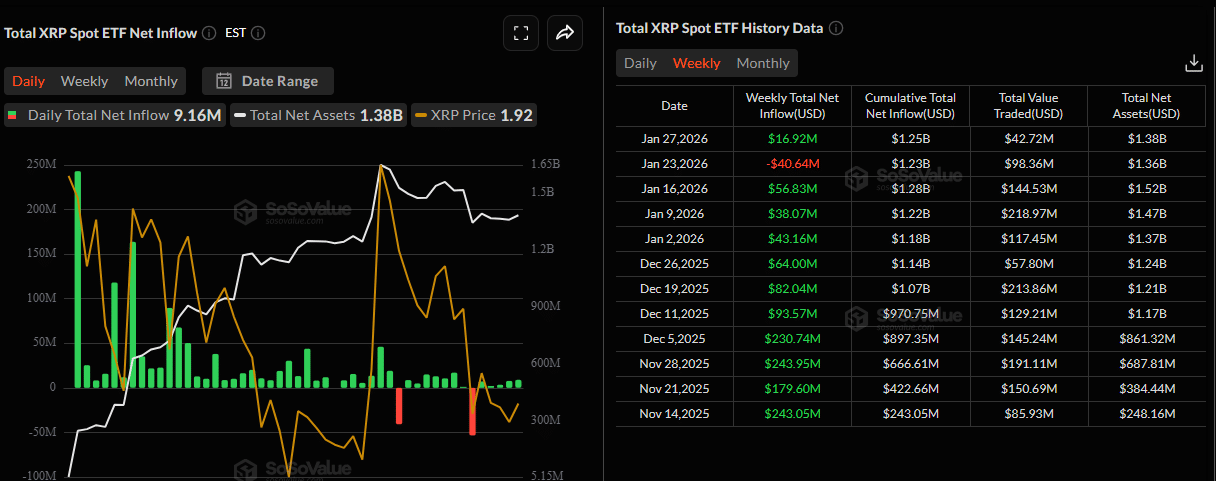

Institutions are also flocking to XRP. The data shows a strong inflow to see XRP ETFs from November 2025 until last week, indicating that the big boys may be “hoarding” XRP as a structural asset.

(Source: SosoValue)

GET:

- 16+ New Upcoming Binance Lists in 2026

- 99Bitcoins’ Q4 2025 State of Crypto Market Report

Follow 99Bitcoins on X For the latest market updates and subscribe to YouTube For Daily Expert Market Analysis.

The post Sentiment Flags XRP and Ethereum as Insignificant on the Back of a Pullback appeared first on 99Bitcoins.