Home Sales Up 8.5%

Marcus & Millichap (NYSE: MMI) MMI Q4 2025 Profit beat expectations as the real estate investment services company reported revenue growth. The company posted fourth quarter results of $244.0 million, up 8.5% year over year. Also, revenue increased by 57.0% compared to the previous period. So the profit was much better.

MMI Q4 2025 Earnings: Company Overview

Marcus & Millichap, Inc. applies to the sale of real estate. The company also provides financing and advisory services. Based in Calabasas, California, MMI operates in three divisions. Brokerage commissions form a major source of income. Financial income adds to stable income. Management fees provide additional income.

Marcus & Millichap Q4 2025 Earnings: Financial Performance

Total revenue reached $244.0 million in Q4 2025. This increased by 1.6% from $240.1 million last year. However, the year-on-year results show a growth of 8.5%. Real estate brokerage income reached $205.3 million. This was an improvement of 1.2% compared to Q4 2024. The profit therefore reflects a higher transaction volume. Also, the average commission rate has been extended. Financial income rose to $31.2 million.

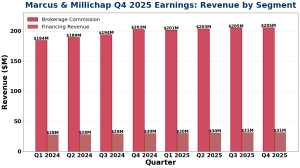

Quarterly Revenue Performance

Marcus & Millichap Q4 2025 quarterly earnings chart showing eight quarters of data from Q1 2024 to Q4 2025

MMI Q4 2025 Results: Key Business Drivers

Brokerage revenue expanded as transaction volume jumped 9.2% year over year. The average commission rate increased by 9 basis points. Many good things have made a profit. Indeed, sales volume decreased by 4.0%. However, higher purchase prices offset the decline. Managers have expanded the agent base. In addition, market presence has improved in all regions. Market demand indicators point to positive trends. So the company took more market share. For detailed financial information, see the Marcus & Millichap Q4 2025 earnings press release.

Income by segment analysis

MMI Q4 2025 Revenue by segment showing dealer commission and revenue across eight segments

MMI Q4 2025 Earnings: Profit Increase

Total revenue increased by 57.0% to reach record levels in Q4 2025 compared to Q4 2024. This represents a significant profit gain. Operating margins increased on a higher revenue basis. Management controlled costs throughout the period. Also, the balance sheet remained strong. Liquidity is getting better every year. Thus profit performance reflects improved efficiency.

Marcus & Millichap Q4 2025 Earnings: Market Outlook

Management sees continued growth ahead in real estate services. The business model offers various advantages. Also, the extended agent network supports future expansion. Industry volatility is always good for investment professionals. So MMI is well positioned to grow. The company focuses on good trends. Investors can track performance on Yahoo Finance (MMI) or visit MMI’s investor relations page.

MMI Q4 2025 earnings: Summary

Marcus & Millichap Q4 2025 earnings showed impressive results. Revenue grew 8.5% year over year. Transaction volume increased by 9.2% during that period. So the revenue increased by 57.0% year on year. A diversified business model supports sustainability. Management discipline improved margins. Also, investor sentiment appears to be positive. Also, the vision for 2026 is still under construction. In fact, the company is gaining market share.

Click Here to visit the AlphaStreet website.