£15,000 annual income: how big an ISA do you need?

Image source: Getty Images

Combined with the State Pension, £15,000 of passive income – or around £1,250 a month – can make a real difference to retirement. But being in a position to withdraw that amount every year for the rest of his life is a different challenge.

Clicking numbers

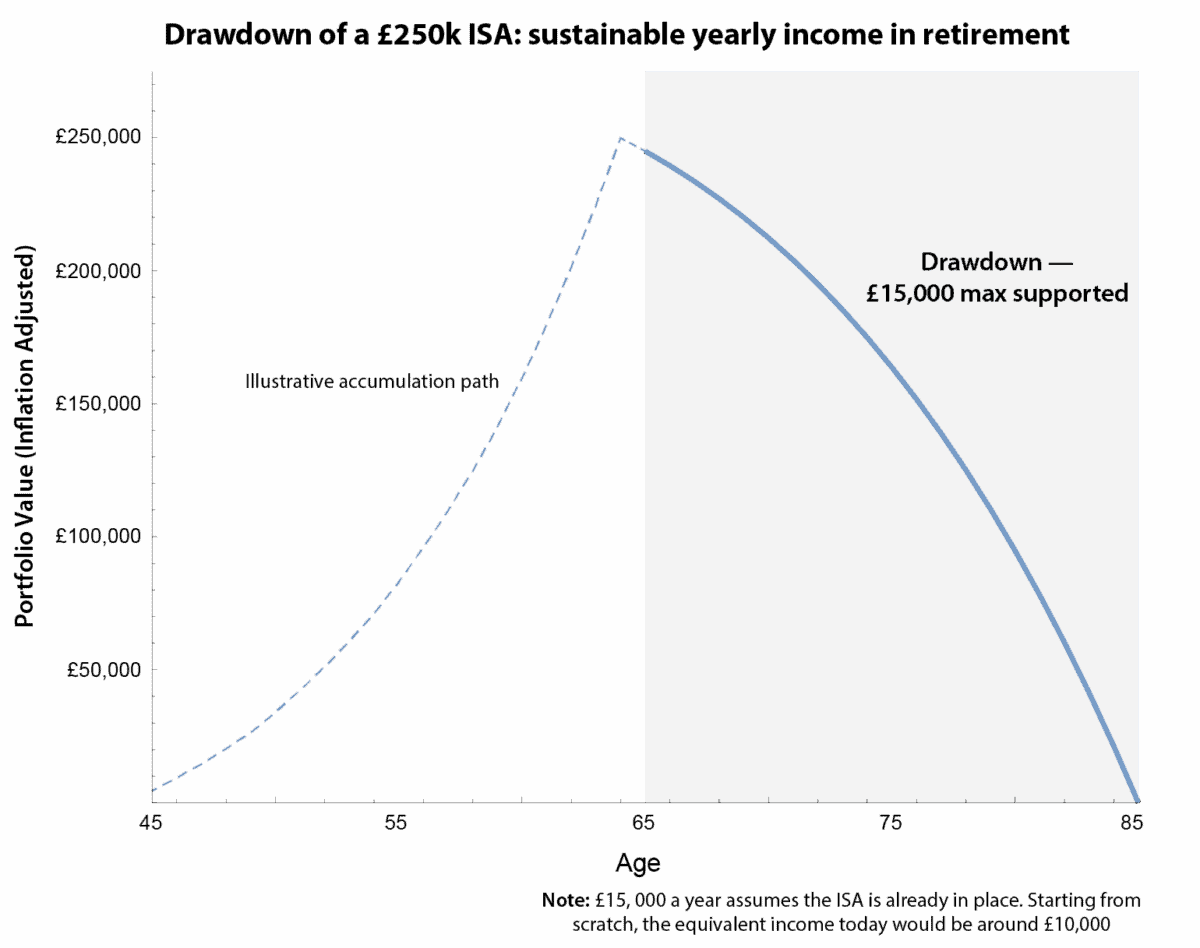

My calculations show that a £250,000 ISA today is the minimum portfolio required to maintain this level of income. This assumes that the portfolio grows by 4% in retirement and inflation stays at 2%. That’s money you can count on to cover expenses, travel, or simply enjoy your retirement with confidence.

For those starting out, the income you can safely withdraw today is close to £10,000 a year in today’s terms. The reason is simple: it’s all about when the capital is available. More money up front means faster income; building it gradually over 20 years means you also need to account for inflation along the way.

The chart shows this clearly. It shows one sustainable withdrawal line for a £250,000 ISA balance. The important thing is that this line does not change whether the pot already exists or is still being built. What changes is how that income translates into today’s spending power.

A chart created by the author

Sustainable withdrawal

The chart also tells an important story: there is no room for overconfidence. Withdraw too much, or think that the portfolio will grow faster than it actually is, and the money may run out faster than expected.

That’s an important lesson: the line provides the basis for planning. From there, you can adjust withdrawals to suit different stages of retirement, deal with market ups and downs, or leave a small cushion for long-term or estate goals.

With careful planning, an ISA provides flexible, reliable income, allowing you to enjoy retirement on your own terms without complicated calculations or risky guesswork.

A high income stock

If you’re thinking about generating income from your ISA, Legal & General (LSE: LGEN) is worth a look. The sustainability of its 8.2% yield remains impressive, but I think many investors are missing a much larger point.

What makes insurance stand out is the predictability of cash flow. The business takes on pension liabilities and long-term funds, invests them conservatively, and gradually returns the money to shareholders through dividends. That means that income is supported by fundamental income generation rather than short-term market measures.

For investors building a £250,000 ISA, reinvested dividends increase compounded returns. For those who have little left, those same shares reduce the need to sell shares, effectively withdrawing from volatile markets. In other words, insurance benefits can supplement the sustainable withdrawals you plan on your ISA.

There are risks. If high levels of inflation become the norm, that could put significant pressure on the value of its £86bn bond portfolio, thereby threatening future dividend payments.

Bottom line

Legal & General’s share price has struggled over the past few years. But despite this it continues to reward investors with superior returns on sales. With an adjusted price-to-earnings (P/E) ratio of just 13, I’m very comfortable holding it in my Stocks and Dividends ISA. Indeed, I have recently added to my holdings.