Crypto Not Broken, US Liquidity Squeeze, Says Raoul Pal

Raoul Pal backs away from the idea that the current decline in crypto reflects a broken market cycle, arguing instead that bitcoin’s risk and high beta have been hit by the temporary US air fund tied to the Treasury’s monetary management and government shutdown measures.

In a weekend post on X framed as a debunking of “false narratives,” the founder of Global Macro Investor said the prevailing narrative — “that BTC and crypto are broken. The cycle is over” — has become a “seductive narrative trap,” especially as “prices [are] to drink every day.” But Pal said a separate question from a GMI hedge fund client about battered SaaS shares made him reexamine the data and rethink the driver.

“What I found destroyed both the BTC narrative and the SaaS narrative,” Pal wrote. “HOW are SaaS and BTC the same chart. Huh? That means there’s something else at play that we all missed…”

Crypto Slide Due to US Liquidity Drin?

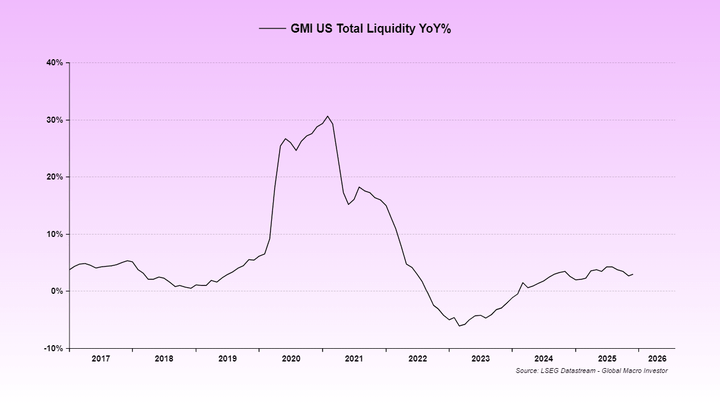

Pal’s answer is liquidity. He argues that the US currency is being “held back” by two episodes of shutdowns and “problems with the US pipeline,” adding that the Fed’s reverse repo facility was “really phased out in 2024.”

Related Reading

That, he said, left the Treasury General Account (TGA) rebuilt in July and August without the type of offset that usually softens the impact, turning into a drain. In his discussion, the same lack of liquidity helps explain why the major activity gauges look weak, writing that “the lack of liquidity is the reason why the ISM is so low.”

Although Pal said that he usually tracks the total amount of money around the world because of its long association with bitcoin and US technology, he argued that the US rate is the one that dominates this phase of the cycle because the US remains the main liquidity provider of the system. That’s important, he said, because the assets most exposed to the withdrawal of liquidity are long-term, volatile exposures—which is exactly where bitcoin and SaaS sit in most portfolios.

“Both of these are long-term assets that exist and both were devalued because money was temporarily withdrawn,” Pal wrote, attributing their decline to the same momentum rather than a project-specific failure or a broken crypto “cycle.”

He also pointed to the gold rally as an additional barrier to lateral flow. “The gold rally basically absorbed all the small payments in the system that would have gone into BTC and SaaS,” Pal said. “There was not enough money to finance all these goods, so the worst was affected.”

Pal described the latest shutdown as another windfall, saying the Finance Ministry was “fenced” by not pulling down the TGA after earlier shutdowns and instead “adding more to it,” deepening the ditch. He said that is “the current windbag” after “brutal price action” across risks.

But he also argued that the pressure is close to being clear. “However, indications are that this shutdown will be resolved this week and that is the LAST barrier to funding,” Pal wrote, adding that the next phase could bring a “flood” of factors he listed including changes around the eSLR, partial TGA declines, financial restructuring and price cuts.

Related Reading

He expanded on the “false narrative” theme of Fed expectations, rejecting the idea that Kevin Warsh will handle policy like a hawk. “On the subject of price cuts, there is another false narrative that Kevin Warsh is a hawk,” wrote Pal. “It’s terrible nonsense. These were words spoken 18 years ago.”

Pal said Warsh’s mandate would be consistent with what he called the “Greenspan-era playbook”—to cut rates, let the economy grow, and rely on manufacturing gains to prevent core inflation—while avoiding balance sheet moves that could conflict with regulatory limits and freeze lending.

Pal issued a mea culpa, admitting that GMI “didn’t see that the US currency is the current driving factor,” after years of emphasizing global initiatives. “There is no termination,” he wrote. “Just that the confluence of events Reverse Repo consumed > TGA rebuild > Shutdown > Gold rally > Shutdown was not predicted by us, or in any event we missed the impact.”

His theme was less about down-to-earth and more about time-per-cycle. “Usually in these crowded exchanges, time is more important than price,” he wrote, urging “PATIENCE!” and reiterating that he remains “BIG” in 2026 if his policy and fiscal playbook comes to pass.

At press time, BTC traded at $77,510.

The featured image was created with DALL.E, a chart from TradingView.com