How much money will an ISA need to match the State Pension?

Image source: Getty Images

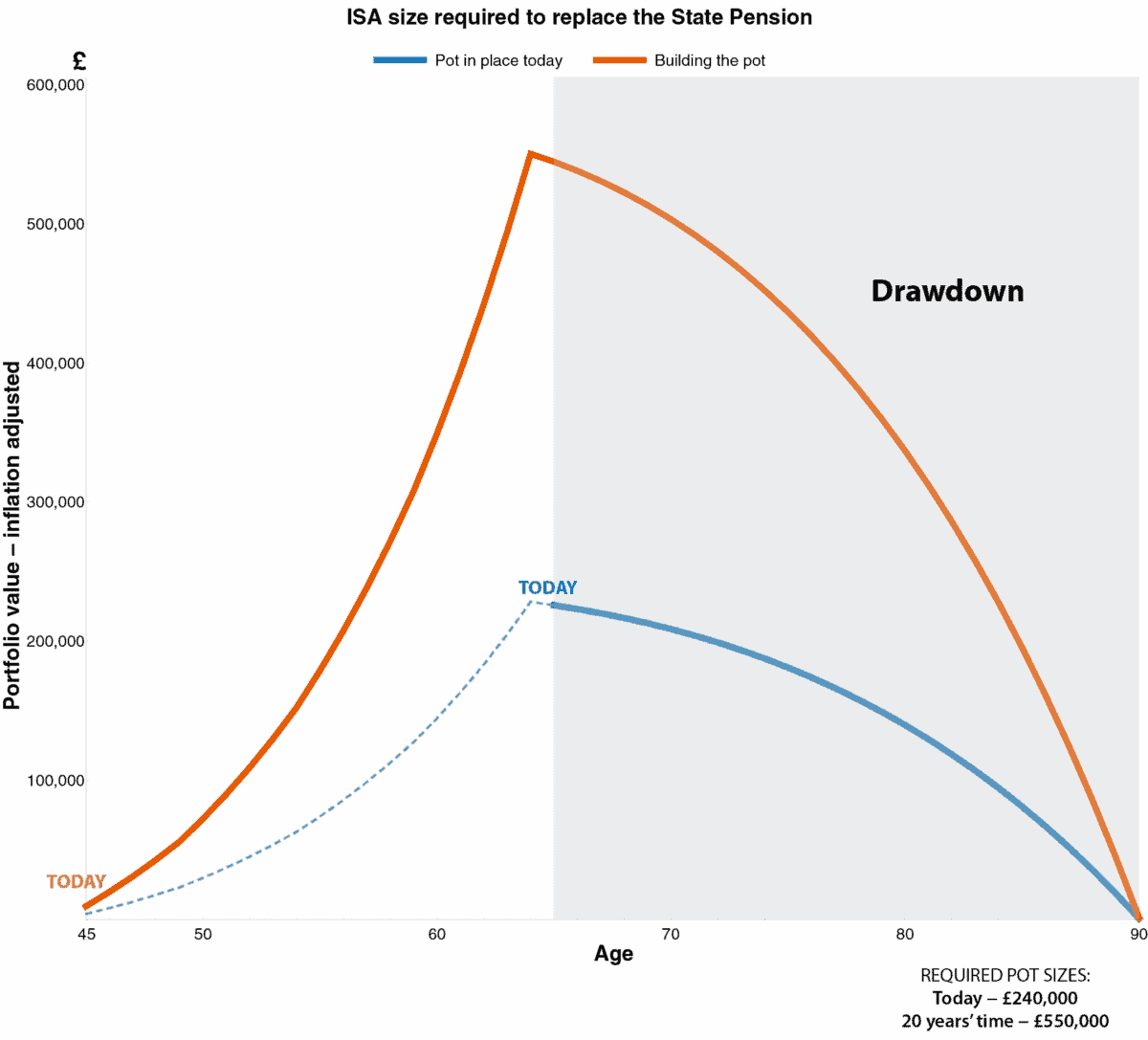

Today, the State Pension pays £11,502 a year. The obvious question is how big an ISA would it take to generate the same income independently – double the retirement income of someone who is eligible for the full State Pension.

Gravity calculations

Once the contribution phase of the ISA is over and withdrawals have begun, the challenge becomes simple in theory but difficult in practice: balancing portfolio growth with ongoing income.

The chart below shows this. The green line assumes that contributions stop today and the portfolio is already there. That portfolio supports state pension-matched withdrawals every year until age 90.

I assume the State Pension grows at 4.5% per annum, inflation moves at 2%, and the remaining portfolio delivers an annual return of 4%. During a recession, protecting capital is more important than chasing high growth. Under this assumption, the required portfolio is £240,000.

A chart created by the author

Future contributions

The picture changes when you are in the accumulation phase. To illustrate, let’s assume that the investor is 45 years old and planning ahead.

Because the State Pension is expected to increase by 4.5% a year, its annual value over 20 years will be closer to £27,000.

This is where the orange line comes in. As the chart shows, only one route supports pension-matched withdrawals to age 90. In this case, the required portfolio rises to around £550,000.

Thinking long term

Achieving a portfolio value of £550,000 over a 20-year investment period is quite a challenge. But I believe it can be achieved with a carefully selected portfolio of high growth stocks and low volatility equities.

In the earlier stage, the power shift gives investors an opportunity to gain exposure to a trend that is still growing.

One metal is at the heart of the energy revolution: copper and the mining giant Glencore (LSE: GLEN) is positioning itself to be one of the world’s largest copper producers over the next decade.

Recent merger discussions Rio Tinto highlight the strong position where the miner’s portfolio places you. While the deal is far from certain, it underscores how highly its copper asset is viewed by its larger peers.

When it reports later this month, copper output will be 850,000 tonnes. By 2035, it is aiming for its 1.6m output.

Last year, copper prices exploded by 40%. This is not only due to increased demand but also reflects a very tight supply.

Chile is the undisputed king when it comes to copper production accounting for a quarter of the world’s production. But new discoveries are becoming increasingly difficult to find and ore grades are declining over time.

That said, the recent run in the stock can be directly attributed to the merger talks. Even if an agreement is reached, a merger of this size carries significant risks. Rio Tinto is a conventional mining player, while Glencore’s roots are in trading. Marrying different corporate cultures can be costly.

Bottom line

There are many ways for investors to gain exposure to the day’s biggest themes including electrification, offshore drilling and the AI arms race. But for me the greatest value today is not in the technology itself but upstream: finding the precious minerals that turn bold aspirations into reality. This is why Glencore earns a place in my ISA portfolio and may be worth considering.