Stop Losing Money on Real Estate Deals

The brutal underwriting behind many of the subdivision agreements across the world industry blew me away.

Are you angry? Great, but for users who want to upgrade, read on.

After reviewing thousands of “possible” categories (and he bought and sold them), I think less than 5%, about less than 1%, of the land industry has a good contribution to the analysis of land subdivision. The focus here is on the sub-division, or main one that exists which can be sold as a paper lot to the developer or a builder.

This article aims to be as bare bones as possible, as I want to refer to these guidelines regularly, including my team.

A few quick explanations:

- Small episodes usually involves dividing the land into several zones (typically 3-5), with limited or no infrastructure required, and allowing for a faster approval process.

- Big episodes it involves the division of land into whole lots (variable but potentially large), often with strict infrastructure management requirements.

- Parent parcels they are the property of the first lesson before subdivision.

- Packages for children are new lots created in the parent parcel after subdivision.

RELATED: What are Parent and Child Packages?

Caveat: This is the FIRST point. These are table stakes that work ~99% of the time, anywhere in the country. But each part of the world will have its own unique characteristics, its own market, and its own set of rules. Adjust accordingly; subdivision is complex.

And if you take away just one thing from this, never forget that the market doesn’t care about your IDEA; it rewards only the TRUTH.

=====

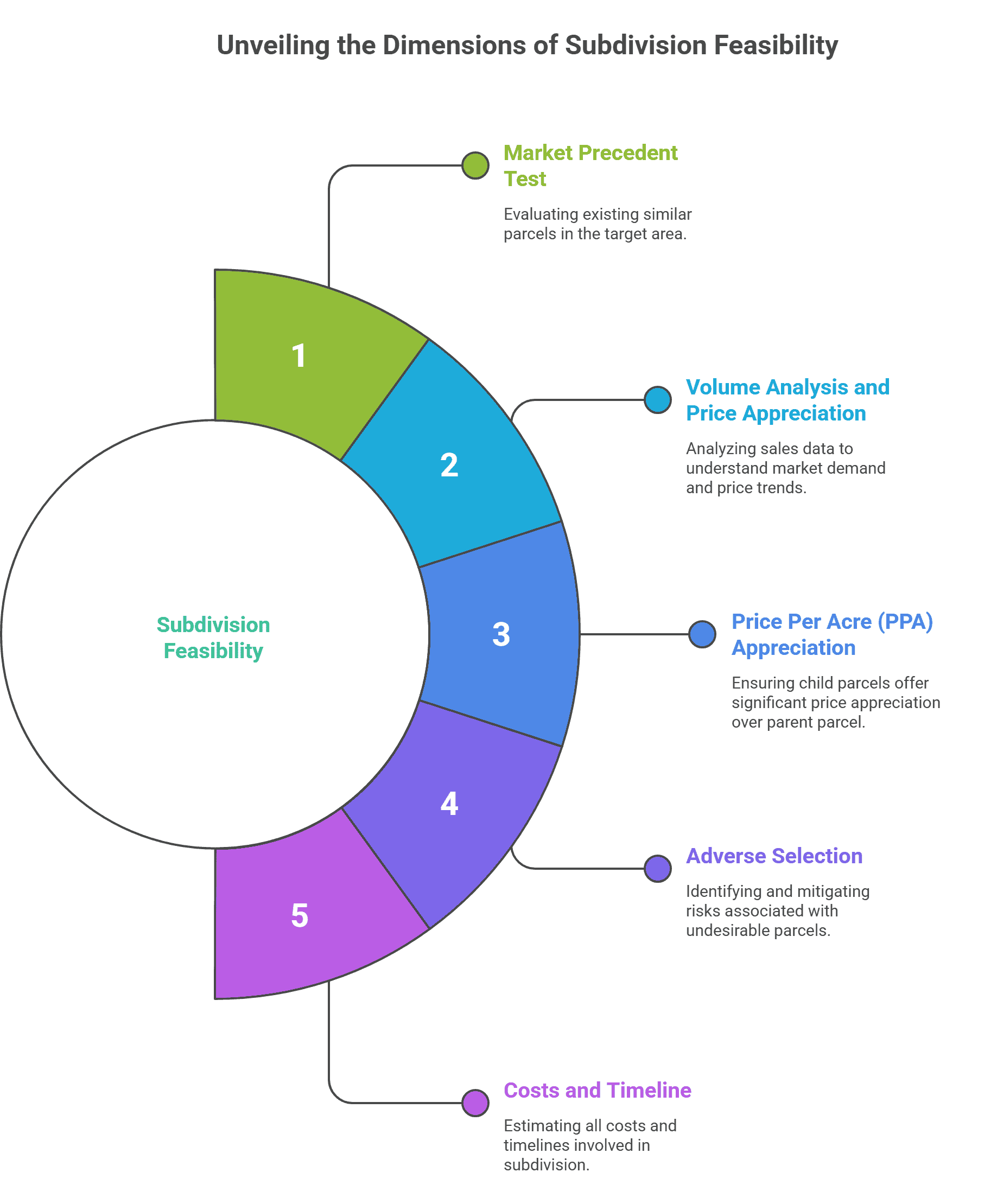

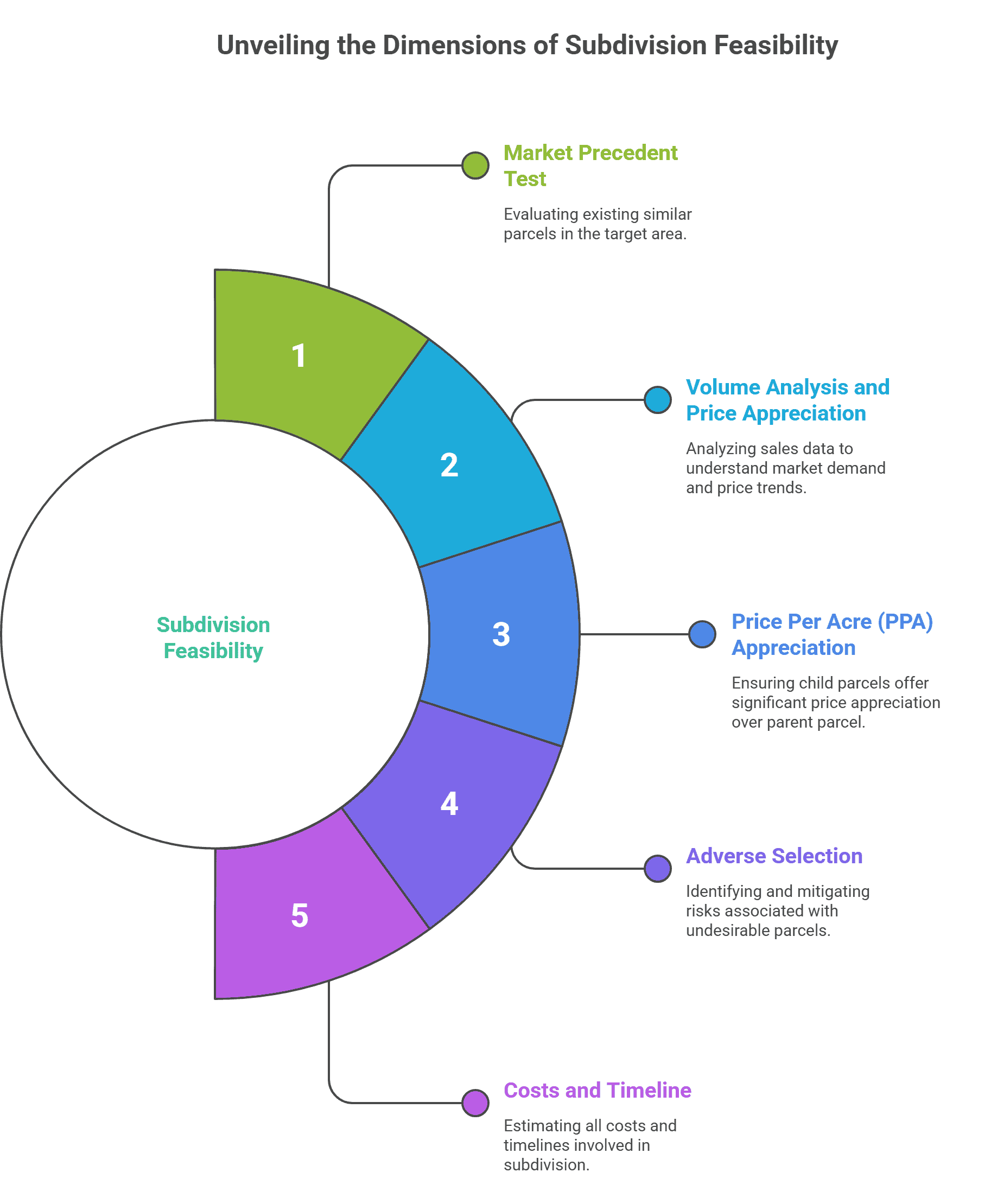

Step 1: Market precedent assessment

On the aerial map, are there already parcels of similar acreage (between ~1-2 acres) as your proposed child parcel plan within a 5-10 mile radius, with similar features, such as contour and road frontage?

- If “Yes”: That’s a good sign. The market has proven receptive to that product.

- If “No”: You are the first mover. That’s a big red flag unless you have the patient’s money and the desire to stay for a long time, which could be years.

Understanding whether comparable categories exist in a target area is the basis of effective parcel segmentation research. Without an existing market precedent, you are actually experimenting with the consumer’s desire using your money.

Step 2: Volume analysis and pricing

For Step 2, check sold, pending, and active listings within a 5-10 mile radius. The closer, the better. Some areas will justify an extended search radius.

If you create 2 child parcels of the same acreage, do at least 2x child parcels (compared to the acreage of the parent parcel) sold or pending in the last 3-6 months, maximum 12, in that area. Bonus points if a sold or pending comparison comes from another category project.

Creating 3 baby packages? You need 3 times the comparable sold or pending volume compared to the acreage of the parent parcel.

If the child parcels are spread over multiple acres, such as three 5-acre parcels and two 20-acre parcels, adjust the sales or pending comparison multiples for each acreage band.

An active market is effectively inverse. If you see a lot of active baby packages (especially if they are grouped together as part of a package project and have similar features), be very careful about introducing more inventory, unless you can narrow down the market significantly. If the accumulated days on market (DOM) is getting longer for the active listing, you need to be more careful.

Ask yourself:

- Are they all near the county or city limits? An account of where the children’s parcels are moving. If your project is too rural, your project may blow up in your face.

- Are the child parcels moving much faster (eg, 2x faster) than the parent parcel’s acreage? Although common, that can reduce the number of low or pending sales, but be very careful when deciding on this idea.

Step 3: Price-per-acre (PPA) valuation must be realistic

In step 3 of the zoning analysis process, as a rule for child parcels above 2-3 hectares, the PPA must show at least 1.5x appreciation over the price of the parent package. For child parcels below that acreage limit, the green price must be at least 1.5x the premium, as the PPA breaks down.

To be clear: If my 50 acre parent parcel trades for $10K PPA, then my single split pair of 25 acre child parcels should trade for $15K PPA minimum. Anything less and you don’t have enough premium calculation for subdivision timeline risk and cost, potential negative selection, and DOM.

The more child parcels you bring to market (especially if they are the same acreage), the higher the PPA valuation should be.

The mechanics of the deal can make a big difference here. If you’re buying the parent parcel outright, you’ll want a higher PPA value. If you are working with a merchant and your capital is small, a small margin may be acceptable. This is a completely different discussion, but it’s worth mentioning here.

Step 4: Account for wrong choices

Are all of your baby’s packages the same in terms of physical characteristics, or will one or more packages be more or less desirable than others?

If you create 3 parcels and one needs to grade the material to account for the rough contour and affected by wetlands, while others are flat and clear, you cannot estimate the value. Low parcels will drag down your combined return and can expand your overall DOM significantly. Model each child parcel separately with a strong assumption of a very weak supply.

RELATED: How to See (and Avoid) Wetlands

Remember, when you present an inside package down 25% from a feature perspective for everything sold and on the market, you should think twice before buying it.

Step 5: Know your total actual costs and timeline

In the last step, assuming you have passed the 4 hurdles above, what is the total cost of separation? Include filing fees, surveys, engineering, legal, and to bear the cost at the time of approval.

What is the approval process? Is there a hearing? Planning commission review? Environmental testing?

Most operators underestimate both the cost AND the timeline or did not conduct any research. If you are doing horizontal improvement work (eg, clearing and driveways), add at least 25% soft quoted cost buffer to be safe… and triple the quoted timeline.

A comprehensive cost analysis requires accounting for all soft and hard costs, as well as opportunity costs over extended approval periods. The difference between the estimated and actual costs often determines whether your deal produces a profit or a loss.

The Bottom Line

Often, after rigorously applying the above steps, the market the will let us know if you are better off trying to sell the parent parcel by trying to split it up.

Even if the data shows that subdivision is a good play, the market may surprise you (as it often does), where only serious buyers want complete acreage. So having a choice is a good thing, where at least you can break down the selling acreage of the parent parcel, net of all value added and closing costs.

Almost no one sends us split deals that work equally well ONE of the above steps. I realize that the above steps are not as easy as I intended. Ultimately, there is so much diversity in the country that it’s hard to boil things down to hard and fast rules. So you have to put in reps to start seeing things clearly like we do with my team.

Partitioning works… if you follow the guidelines. If not, the market will beat you down. It’s difficult.

Whether you’re thinking of working with us or exploring subdivisions yourself, use this checklist first.

If you can’t confidently answer each category with data, it’s likely that the segmentation won’t work.

=====

Need funding for a well-structured budget (or any international agreement)? Work with the world’s most data-driven finance team, with a leading performance ratio of 41%. $50K minimum purchase price, ~2x total turnover. We close 100% of the deals we commit to.

Analyze Your Property Today

Originally published on https://seriousland.capital on November 24, 2025.