XRP Price Drops Below $2 as Liquidations Hit Overexposed Traders

XRP fell below $2 during early Monday morning trading across Europe after a wave of forced cash sales hit bullish traders, wiping out more than $40M in the past 24 hours. The price of XRP is now sitting at $1.97, but it has a fight on its hands to regain the important level of $2.

The token slipped to around $1.95 before experiencing a sluggish bounce, leaving many traders underwater. This move fits the general pattern of 2025 where strength, not bad news, drives XRP sharp.

A break below $2 is important because it triggers automatic transactions in derivatives trading. When those come in, prices drop quickly. For everyday owners, this explains why the charts sometimes look violent even when nothing “fundamental” changes.

In retrospect, XRP has spent the past year stuck in bullish whipsaws as futures trading continues to grow. Institutional access to products such as CME futures fueled these moves.

(SOURCE: CoinGlass)

What Caused XRP’s Sudden Drop Below $2?

This was not a shock sold by long-term owners. It was a liquid cascade. This is where traders borrow money to bet on high prices, then are forced to sell when prices drop significantly.

Think of the benefit as buying a house with a down payment. Small price movements wipe out your equity. When XRP broke the $2.05 support, exchanges automatically closed positions to pay off the loans, sending the price down even further.

XRP Open Interest (OI) fell by -63% during historical volatility in October 2025, which I covered at that time. Monday’s departure followed a similar script. Too many sellers were long, causing liquidation as positions were liquidated one after the other until the price dropped, resetting the OI.

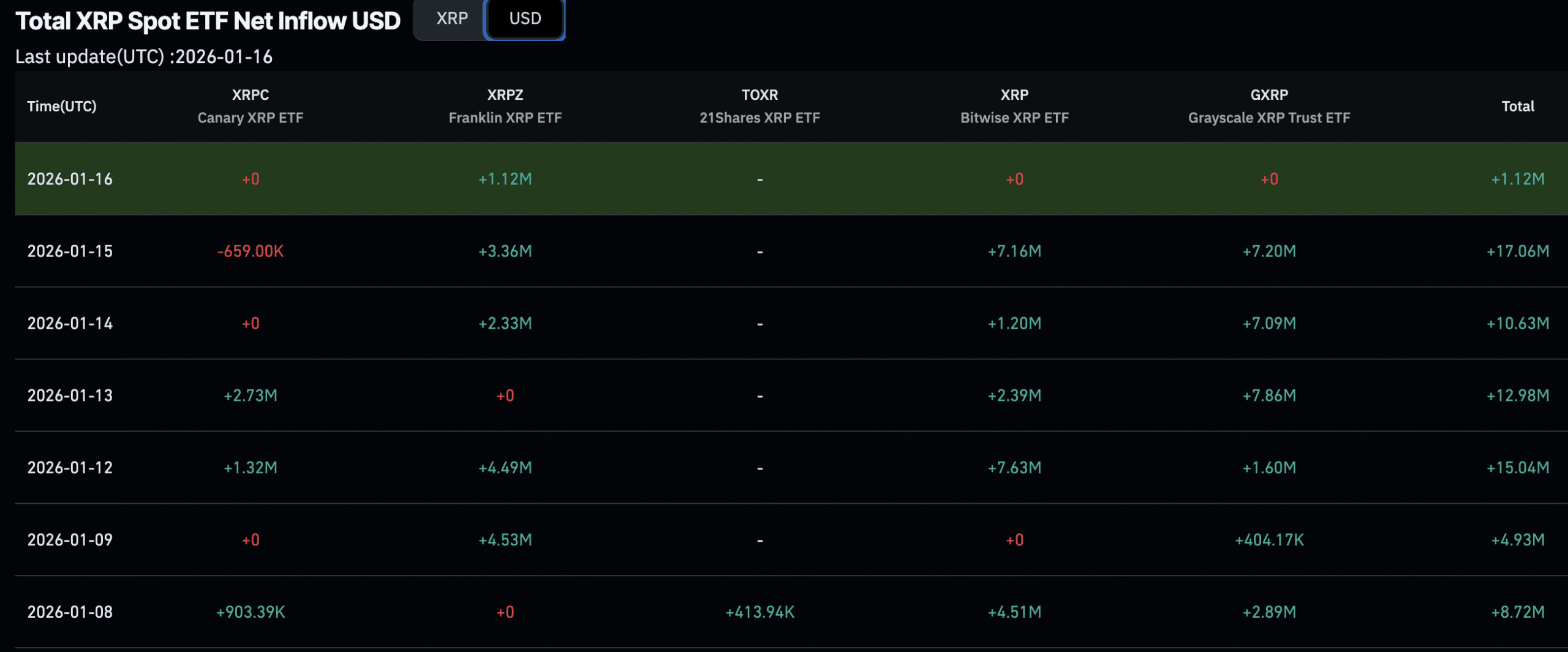

The ongoing XRP price action was unaffected by existing ETFs as Ripple closed Friday in the green, marking its seventh consecutive day of positive entry.

Per CoinGlass, more than $1.18Bn has gone into XRP virtual ETFs since they launched in November 2025, and this level of institutional demand could help stem the bleeding on the chart.

(SOURCE: CoinGlass)

CHECK: Top 20 Cryptos to buy in January 2026

XRP attracts heavy derivatives trading. Futures allow traders to bet on borrowed money, maximizing profits and losses. That’s exciting. It is also dangerous.

Per TradingView, late last year, CME-listed XRP futures reached nearly $3Bn in open positions. More leverage means more forced selling when levels are broken.

This is why the price of XRP can drop 5–7% in minutes while the headlines are silent. Excessively long positions and market structure are damaging, not bad news for Ripple.

If this sounds familiar, it is. We saw a similar reset during the XRP shutdown earlier this cycle and, worse, in October 2025, when over $19Bn was wiped from the market in less than 24 hours.

What Are the Important Support and Resistance Levels Now for XRP USD

It’s high time to tell the truth $XRP it is very good.🐂 pic.twitter.com/9Wukl25OI8

– QuantumFox (@QantaFox) January 18, 2026

Traders should now keep an eye on $1.92 as nearby support. This is where consumers step in after being hit. Lose it, and another stop wave can begin, all the way down to around $1.80.

On the other hand, if the $2 resistance is restored and $2.05 may be reversed, this will create a new support level. The price must close the day above $2.05 to show real strength. Until then, the bounces look temporary and unsustainable.

The scroll tells a story. Trading rose during the downturn, then dried up. That shows forced activity, followed by traders waiting for guidance. This decline does not mean that XRP is broken. It means that power is always a threat. If you hold an XRP position, you have avoided the worst damage.

If you trade futures, this is your warning. A high rate turns small movements into account closing events. Dissolving cascades are self-defeating when they begin.

A simple rule. If you feel stressed by looking at the chart, your position is too big. Currently, XRP is sitting in reset mode. Stability must come first, and patience trumps predictability when power comes from outside.

GET:

Follow 99Bitcoins on X For the latest market updates and subscribe to YouTube For Daily Expert Market Analysis.

Why you can trust 99Bitcoins

Founded in 2013, 99Bitcoin team members have been crypto experts since the early days of Bitcoin.

90+ hours

Weekly survey

100k+

Monthly students

50+

Professional contributors

2000+

Crypto projects reviewed

Follow 99Bitcoins in your Google news feed

Get the latest updates, trends, and information delivered right to your fingertips. Register now!

Register now