Bitcoin Breaks Key Support, Analyst Signals Previous Lows

Bitcoin price action has fallen into bearish territory on the back a drop below the previous important low who had been supporting this meeting for months. At the time of writing, Bitcoin is trading at $78,560 after falling as low as $77,082 in the past 24 hours, a move that crypto analyst XForceGlobal says is highly representative. change in technology structure.

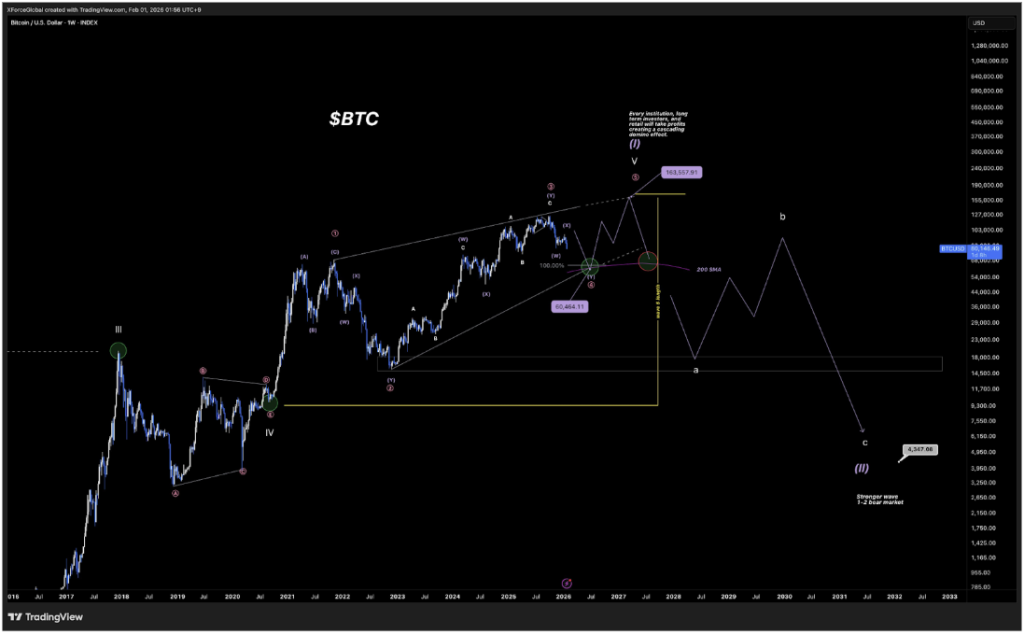

According to his detailed analysis of the Elliott Wave shared on X, price action has now formed a bullish framework that many traders were counting on, and lower levels are more likely in the coming weeks and months.

Related Reading

Breakdown Below Previous Low Changes Counting Main Wave

According to XForceGlobal, Bitcoin was working complex lateral structure, especially the WXY combination that would have been expected to be resolved by diffusion rather than direct separation.

The bulls were able to complete three of the five required parts of this triangle-like structure, but the failure to protect the lower front was the signal that led to a change in the structure. This previous decline points to a low of $82,000 in November 2025. Bitcoin bulls failed to defend this low when price action breaks below $80,000 in the last 24 hours.

When that level is exceeded, the main wave count could not be saved. According to Elliott Wave statistics, that lower low means that price action from the top all the time should now be considered isolated and corrective, not part of a healthy continuation. This rescheduling gives the current downtrend more room to develop from the perspective of the Fibonacci extension and changes how low and high it is. the target should be evaluated.

Bitcoin price chart. Source: @XForceGlobal On X

Two Bearish conditions point in the same direction

The resulting analysis shows two main scenarios for how Bitcoin price action could continue from here, both converging on similar lows. The first is a flat correction, where Bitcoin is currently opening a C wave. Although XForceGlobal describes this as a less attractive option, it will continue means the full width of the distribution that invalidates the bullish formation and drags the price of Bitcoin down as low as $60,000.

The second scenario is a diagonal that maintains a large ending that is formed as WXY goes downward. This scenario uses the October 2025 high above $126,000 as a cut-off point to develop a wave split for the current price action. Interestingly, the price projection from this scenario is also in line with the target in the same area of $60,000. Despite the different technical approaches, both explanations point to a relatively low risk in the medium term.

Related Reading

Now that the main structure is now at stake, XForceGlobal says it makes sense to accept a short-term bearish bias while rescheduling the next wave count. The idea is that Bitcoin continues its decline to at least $60,000 before returning to the stage refunds in excess of $100,000.

Featured image from Pixabay, chart from TradingView