FPI Q4 2025 Profit Growth: Farm Growth Picks Up

Farmland Partners Inc. (NYSE: FPI). FPI Q4 2025 earnings beat guidance. The company increased its dividend by 50%. Record AFFO performance and drive results. Indeed, farm demand remains strong and continues to support estimates.

Market Status and Fundamentals

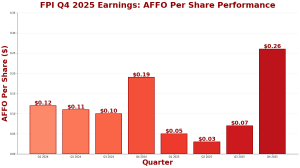

Therefore, farm demand remained strong in Q4 2025. The REIT reported AFFO of $11.4 million. Notably, per share AFFO reached $0.26. In addition, revenue reached $21.8 million. The market capitalization stands at $424.8 million. Total debt was $160.8 million. At that time, the company managed about 90,000 hectares of farmland.

FPI Q4 2025 Results: Financial Results

Most recently, operating income for Q4 2025 reached $20.7 million. This compares to $21.5 million in Q4 2024. Rental income reached $20.5 million. Net Operating Income (NOI) increased to $17.5 million. Therefore, adjusted earnings from operations increased by 22% year over year. Indeed, full year 2025 AFFO was $17.9 million, up 27% from 2024. Also, revenue for the full year totaled $32.2 million.

Full Year of Operation 2025

Annual operating income reached $52.2 million compared to $58.2 million in 2024. Total AFFO reached $17.9 million with full-year guidance. Therefore, AFFO per share was $0.39 for the year. In addition, the company completed strategic processes. The property sale netted $34.9 million. Meanwhile, FPI increased its dividend by 50%.

FPI Q4 2025 quarterly revenue shows steady performance in 2025.

Crop and Land Management Portfolio

Overall, the FPI portfolio is divided by type of crops. About 60% of the farmland is planted with first crops. These include corn, soybeans, wheat, rice and cotton. Meanwhile, 40% grow specialty crops. Specialty crops include oranges, avocados, and tree nuts. Thus, this diversity reduces risk. In fact, it provides exposure to global food demand trends.

FPI Q4 2025 Benefits: Business Drivers

IE-commerce has driven farmland prices up. Therefore, North America’s high-quality farming area remains limited. Supply limits are based on rental income. Also, the diversification of strategic properties improved the quality of the portfolio. The loan portfolio expanded by $25 million in acquisitions. Also, variable rental payments have increased due to higher crop yields. Meanwhile, the company has maintained operational discipline. After that, the management increased the confidence of the dividend.

Dividend Increase and Strategic Outlook

Management increased quarterly dividends by 50%. paid a dividend of $0.09 per share. This shows confidence in making money. Therefore, the company beat AFFO guidance by $0.05 per share. Importantly, managers continue to find quality farmland. FPI provides investors with exposure to agricultural properties. In addition, the REIT benefits from structural demographics and asset trends.

Key Takeaways

- Q4 AFFO of $11.4 million, or $0.26 per share

- Full-year AFFO increased 27% to $17.9 million

- it paid dividends of 50% to $0.09 per quarter

- Construction generated a profit of $34.9 million

For details, see FPI Q4 2025 income statement. Also visit Yahoo Finance or NAREIT.

Click Here to visit the AlphaStreet website.