Memecoin Market May Collapse, Sentiment Warns

Memecoins has just been hit, and what appears to be a trajectory may be closer to change than many traders expect.

Related Reading

Santiment said the sector is showing an old signal: the widespread talk that meme tokens are “dead” can sometimes mark a time when buyers are quietly returning.

According to Santiment, this “collective acceptance of the ‘end of the meme era’ is a classic sign of accountability,” showing that when a market sector is taken for granted, it’s often a “contradictory moment” to watch out for.

The sentiment on social media is heavily skewed toward fear, and when the crowd abandons an entire category, prices can move in a different direction for a while. Some traders who backed out early took a closer look.

Capitulation Can Signal a Turn

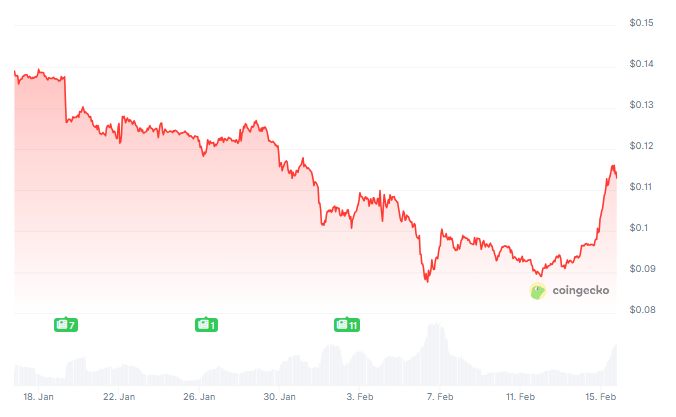

Reports note that the memecoin market’s recent slide has increased in raw numbers. Memecoin’s total market capitalization has dropped 34% to $31 billion in the past 30 days, CoinMarketCap data shows.

Bitcoin withdrawals – up to $60,000 on Feb. 3, the lowest since October 2024 – added pressure across the board and left speculative tokens more exposed.

The position was concentrated in a few names, and when the big owners left to take advantage the movement was expanded.

Losses were not limited to small projects; some of the better known meme tokens have left the world of logic.

Rotation Can’t Lift All Boats

Some market watchers argue that the old pattern — Bitcoin runs first, then money flows into Ethereum, then riskier altcoins — may not play out the same way this time around.

As institutions grow and trading strategies change, money may move selectively. That means a few tokens may rally strongly while many others lag behind.

Reports from traders and analysts say that selective power, rather than a broad increase, is the likely scenario. That raises the bar for anyone hoping to find the next big winner among the myriad of speculative coins.

Popular Meme names are under pressure

A number of headline tokens led the decline. Dogecoin (DOGE) gave up support levels it had previously defended, and PEPE showed higher volatility as major managers cut positions.

Official Trump (TRUMP), a politically-linked token linked to US President Donald Trump, has bounced back significantly from its initial high after disappearing initially.

The oversupply of several wallets left these projects vulnerable to rapid volatility, and some gains from the previous year were quickly wiped out.

Related Reading

Watch the Crowd’s Turning Point

Contrarian traders will point to the reception of defeat in all social feeds as a possible sign to start looking down.

That way is dangerous. Losses can deepen before the market finds a bottom, and sellers can recover from any short-term gains.

However, history shows that extreme pessimism can precede meaningful rebounds, especially when broader market pressures ease and liquidity returns.

Featured image from Pexels, chart from TradingView