Earnings preview: What to look for when Netflix (NFLX) reports Q4 2025 results

Netflix, Inc. (NASDAQ: NFLX ) is expected to report Q4 results on January 20, amid expectations of strong profit and earnings growth. The company navigates an ever-changing broadcast landscape where subscriber momentum, content creation, and monetization strategies are constantly under scrutiny. After a year marked by both operational progress and stock volatility, investors will be watching to see how the streaming giant balances content investment and profitability while protecting its leadership position in a crowded market.

Stage Set

The video streaming giant headquartered in Los Gatos, California, is preparing to reveal its fourth quarter numbers on January 20, after the closing bell. On average, analysts following the business expect earnings of $0.55 per share in the December quarter, which should be up 28% year-over-year. The positive base forecast shows an estimated 16.8% growth in Q4 revenue to $11.97 billion. That is broadly in line with recent management guidance.

Netflix stock has fallen slightly since hitting a record high in mid-2025, paring back several months of gains. The downtrend continued this week, and shares closed the last session below the 52-week moving average of $109.84. NFLX has lost nearly 30% over the past six months. Meanwhile, experts see a strong upside for the stock, with their consensus price target indicating gains of around 45%, currently.

A Good Show

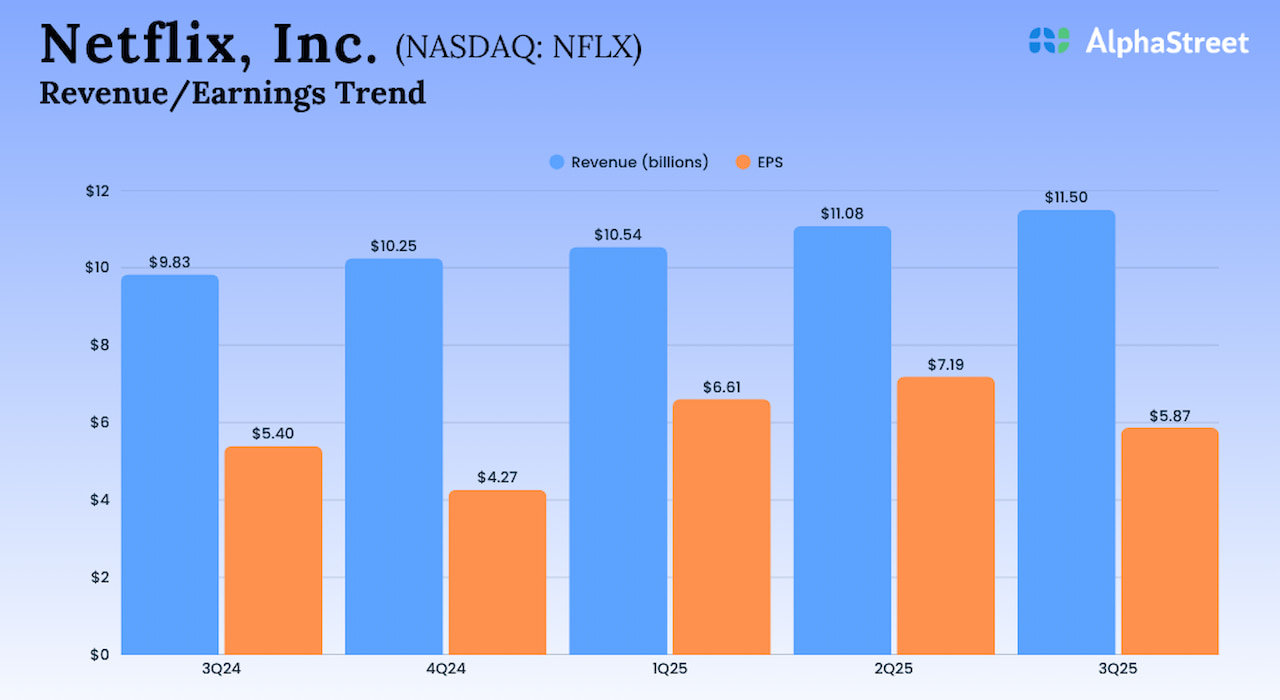

In the third quarter, the company’s revenue rose 17.2% to $11.51 billion from $9.82 billion in the same quarter of fiscal 2024, broadly in line with estimates. Net income rose to $2.55 billion or $5.87 per share in Q3 from $2.36 billion or $5.40 per share in the year-ago quarter. Earnings fell short of Wall Street expectations, marking the first miss in seven quarters.

From Q3 2025 for Netflix Earnings:

“I’m trying to figure out how to incorporate the latest technology, including AI and Gen AI. We’re trying to figure out how to create a better product experience that can better serve consumers around the world. What about customer acquisition and retention? How do we improve global payments? How do we improve global partnerships? There’s so much and we want to improve those things, all these things we need to get the best of those things. Yes, you have to do that with the hard work of improving those skills in the trenches every day.

Next Action

In a recent statement, Netflix said that for the fourth quarter, it expects revenue to be $2.36 billion or $5.45 per share and an operating margin of 23.9%. The company has made significant progress in its marketing capabilities recently. It is targeting ad revenue to more than double in FY25, after recording the highest ad sales for the latest quarter. Most recently, the company agreed to acquire Warner Bros., including its film and television studios and HBO for approximately $82.7 billion.

On Thursday, NFLX opened slightly lower and traded higher near the $90 mark during the session. The stock has fallen by about a third after hitting a record high in June 2025.