Bitcoin Capitulation or Buy Property? On-Chain Data Display

Bitcoin is sitting at a “critical point,” where traders are torn between two familiar scenarios: a full capitulation event, or the first innings of a protracted capitulation process. In a February 15 video analyst, CryptoQuant analyst Maartunn argued that the data is starting to be the last order, but with the clear caveat that anything lower is likely to be a grind rather than a snapback.

Is Bitcoin Bottom in?

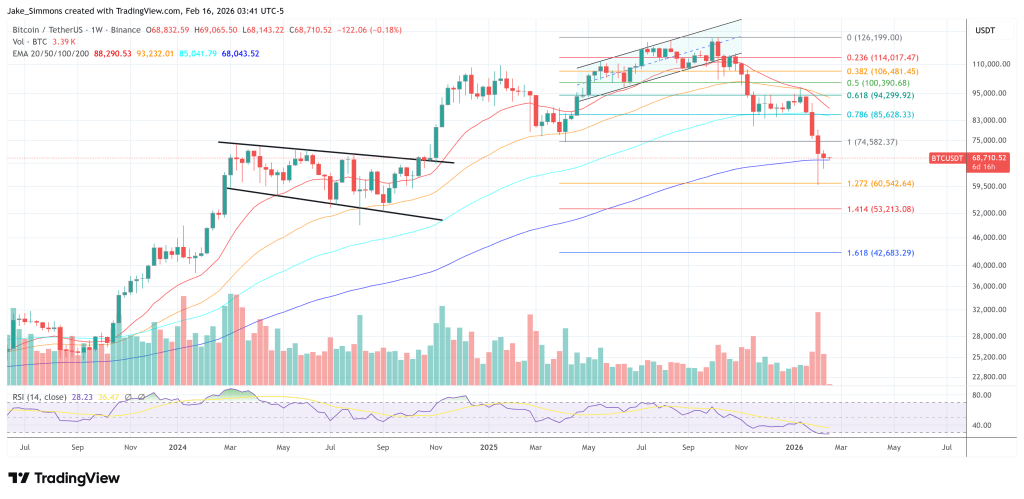

Bitcoin is currently trading about 50% below its all-time high, a decline that looks terrible in isolation but is still less than the 70%+ declines seen in previous bear markets, Maartunn said. The most pressing question, in practice, is not whether the market can slow down but whether the ingredients that usually precede a turn are emerging.

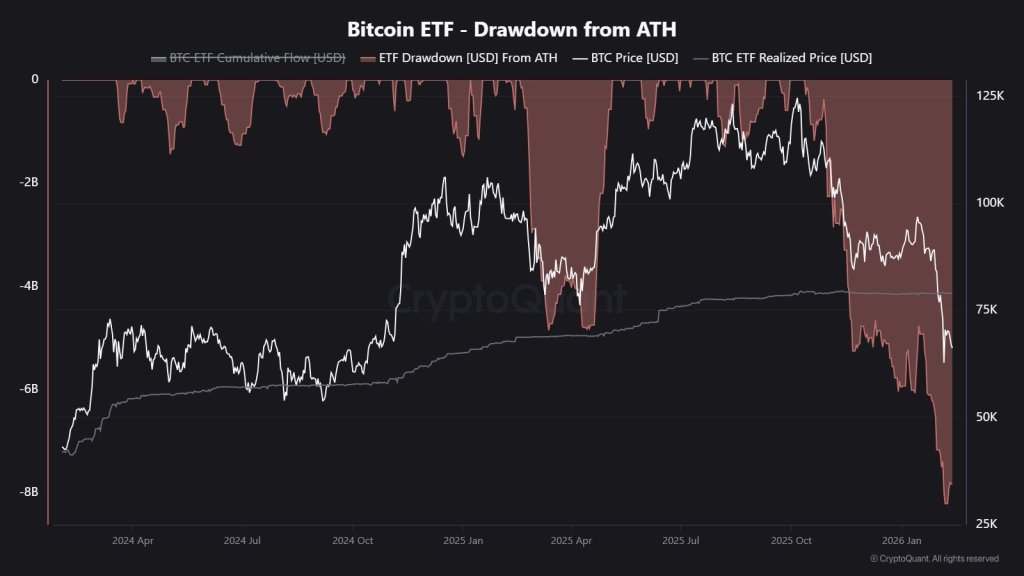

Maartunn points first to what he describes as “structural selling pressure” tied to ETFs. According to his calculations, the new ETFs have released 8.2 billion dollars in high holdings, “the largest in history”, creating continued selling pressure. He adds that the current price is about 17% below the average purchase price of ETF owners, which puts a significant portion of that group under water and may be encouraged to reduce exposure.

Related Reading

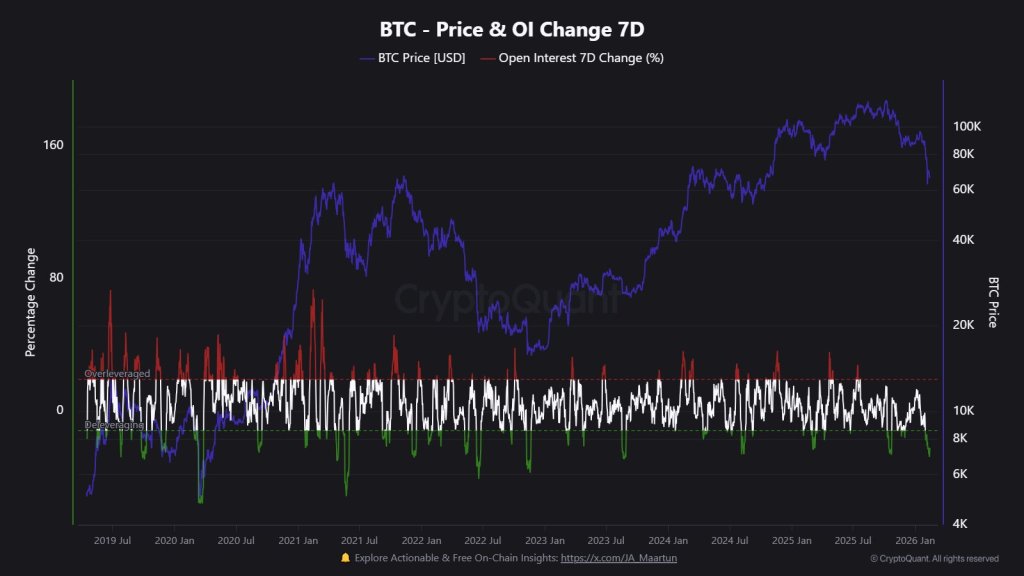

He then related that story to the mechanical reset of the derivative. Open interest was “cut in more than half,” falling from $45.5 billion to $21.7 billion, a 27% drop in open interest in the past week alone. Maartunn describes this as an extensive damping-off event, painful in real time, but historically accompanied by conditions that allow low formation.

“Look, it’s really painful for anyone who has overgrown, but removing all that speculation is a necessary step to create a truly sustainable market,” he said. “This is a sign of a massive washout due to over-speculation.”

To gauge whether the decline translates into capitulation-like pressure, Maartunn focuses on short-term holders. He cites a short-term MVRV ratio of 0.72, which means that the short-term owner ratio is down about 28%, “in deep water” as a group. To his credit, that’s not a typical reading: the lowest level since July 2022, and a band that has historically been associated with times of great financial pain.

“This level of financial stress is historically rare, and often occurs during periods of high fraud,” Maartunn said. “Now, for sure, could this rate go down even further? Sure. But history shows that when we get down to these levels, Bitcoin’s risk-reward profile starts to look a lot better.”

Related Reading

Maartunn also frames the current as a retest of a major support cluster – where the all-time high of the previous cycle crosses the upper boundary of the old trading range – an area that is often sensitive to changes in the previous cycle. From there, he moves on to time-based analogs, suggesting that the length of the bear market means a broad window between June and December 2026, with the last two cycles converging tightly between September and November.

His closing point is that bottoms are rarely one-day events. In his view, ETF-driven structural selling, price volatility, pressure among short-term managers, and a reevaluation of key levels could all converge in a long bearish process — with emotion as the last word.

“The real market… that’s often overlooked,” he said. “When the chatter on social media is completely dead, your timeline is silent, and frankly, no one seems to care. That moment of complete disinterest is often the point of the biggest payoff.”

Overall, what Maartunn’s framework says is straightforward: the data may change to low formation signals, but confirmatory evidence, especially with flow and sensitivity, may still come in stages, with volatility and ongoing stress tests along the way.

At press time, Bitcoin traded at $68,710.

The featured image was created with DALL.E, a chart from TradingView.com