Hyperunit Whale Dumps $500M on Ethereum as Big Crypto Bet Turns Sour

Ethereum continues to struggle to regain the $2,000 level as persistent selling pressure and heightened volatility weigh on market sentiment. Repeated attempts to push higher have been met with resistance, reflecting a cautious stance among traders and broader uncertainty across the crypto market. While fluctuations around key sentiment levels are common during correction phases, the current environment suggests continued weakness, with liquidity conditions and derivatives playing an increasing role in short-term price volatility.

Related Reading

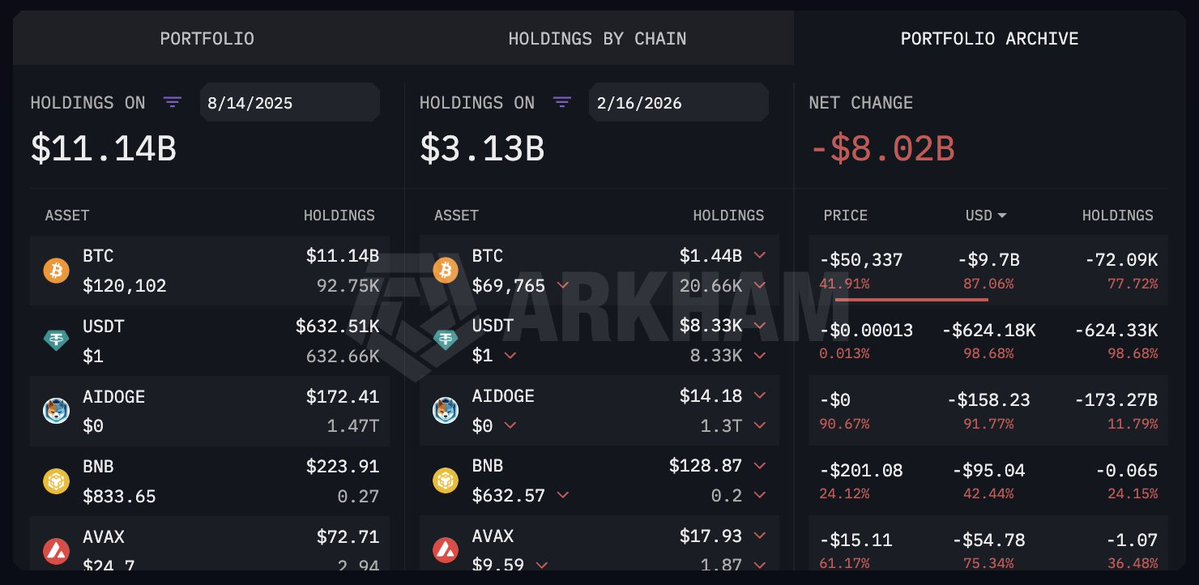

Adding to the pressure, the latest on-chain data from Arkham shows that the largest market participant – commonly referred to as the Hyperunit whale – has reportedly sold nearly half a billion ETH. A large transaction of this growth tends to attract significant market attention, as it can influence liquidity conditions, sentiment, and short-term volatility, even if it does not directly cause continued price declines.

Such moves do not automatically indicate a broader market reversal, but often reflect a strategic reorientation by large owners amid uncertain conditions. Historically, similar episodes have coincided with periods of transition, when markets reassess direction following periods of strong trends.

Hyperunit Whale Rotation Adds Content to Ethereum Market Pressure

Additional data from Arkham provides further context to the massive ETH sales recently seen on the chain. The entity commonly referred to as the “Hyperunit whale” is believed to hold a large Bitcoin, possibly of Chinese origin, whose wallets accumulated more than 100,000 BTC in early 2018, when those assets were valued at $650 million. For several years, the strategy seems straightforward: invest in Bitcoin and maintain a long-term holding position, with more than 90% of those coins reportedly untouched for nearly seven years.

At the peak of on-chain exposure, Arkham estimates that the whale controlled about $11.14 billion of BTC. However, in August 2025, approximately 39.738 BTC – with a value close to $ 4.49 billion at that time – was reported to have been transferred in a movement that is interpreted as circulation in Ethereum. The subsequent rally brought the ETH holdings to around 886,000, worth more than $4 billion at the time.

Since that change, the performance seems to be decreasing. Estimates suggest approximately $3.7 billion in losses related to enhanced ETH exposure and combined BTC/ETH spot holdings, and approximately $1.2 billion in unrealized losses on concentrated ETH. In total, Arkham’s data shows a decline of close to $5 billion from the portfolio’s peak levels.

Related Reading

Ethereum Price Holds Up As Downtrend Pressure Continues

Ethereum’s price action continues to show continued weakness, with the chart showing a clear sequence of lower highs from the end of 2025 to rise above the region of $4,000. The recent decline to the $2,000 psychological level highlights persistent selling pressure, while the inability to reproduce strongly suggests that buyers remain cautious despite oversold conditions.

Technically, ETH is trading below its key moving averages, which are now moving downwards – a configuration more often associated with bearish momentum than a short-term correction. The collapse below the mid-range consolidation seen late last year has accelerated bearish volatility, accompanied by a noticeable increase in trading volume. Such volume expansions often indicate overshoots or forced downgrades, rather than normal profit-taking.

Related Reading

The current stability around the $1,900–$2,000 area may indicate an early attempt to build a short-term base, but confirmation will require a sustained close above nearby resistance levels, especially the $2,200–$2,400 range, where previous support has turned into resistance. Until that happens, upside efforts run the risk of being corrective bounces within a broader downtrend.

From a structural perspective, maintaining the $2,000 zone is critical for sentiment, while a significant decline could open the door to a deep pullback to historical support levels.

Featured image from ChatGPT, chart from TradingView.com