Crypto Bleeds Third Straight Month, First In History: Analyst

Reports say that an on-chain analytics account called Rand has marked a new milestone: the cryptocurrency has recorded three months straight for the first time on record.

Related Reading

That arrangement stands out because it breaks the pattern of periodic withdrawals and returns that have marked previous market cycles. Many investors are taking a closer look.

Output Reaches Historic Inflection Point

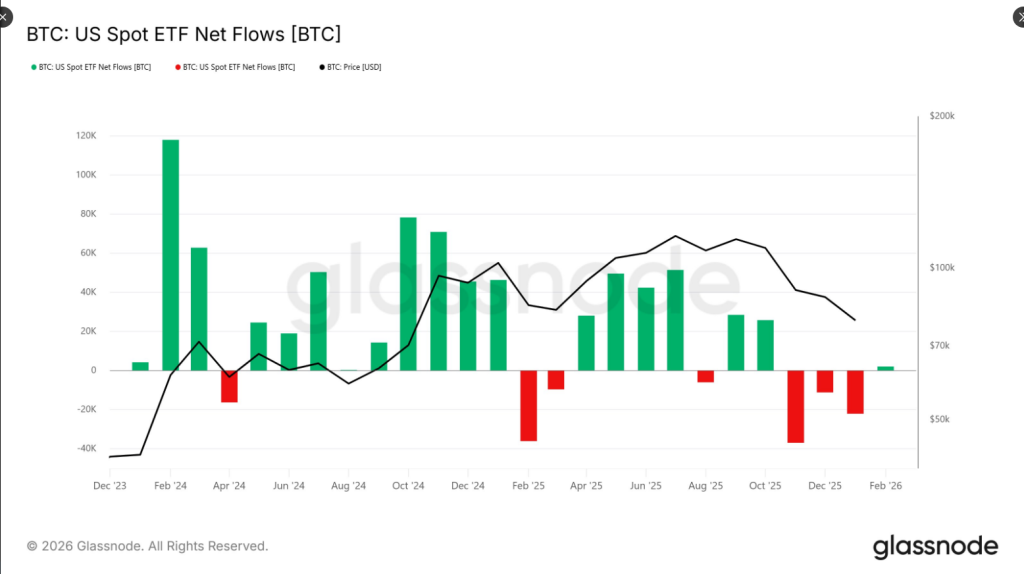

According to market watchers, the withdrawal includes both retail and institutional flows. Spot Bitcoin exchange-traded funds (ETFs) in the US have been the focus of attention, with once-large revenues now declining.

Some of the early gains that accrued in ETFs have been partially reversed, leaving holders with paper losses that many are currently seeing as painful.

US 🇺🇸 area #Bitcoin The ETF has recorded 3 consecutive months of net outflows.

It is the first time in history that there have been 3 consecutive months of withdrawals. pic.twitter.com/WusDpXuSSm

– Rand (@cryptorand) February 3, 2026

ETF Investors Hold Their Basis

Reports say that several prominent analysts have pointed out that, although the recent bleeding looks alarming, ETF holders have not yet run away.

James Seyffart noted that the owners are living in a large property despite losing the papers.

Jim Bianco also weighed in, suggesting that the ETF ratio is underwater by a reasonable margin but still held.

This is not a complete selloff; a bit of a step back for now. Large funds entered the market during the leading months and those inflows offset recent outflows when measured over the long term.

The feeling has changed, but the conviction doesn’t change.

What the Numbers Show

Over 30 days, watch the price of Bitcoin drop by a large amount, and that drop helped push ETF positions into the red. Reports show that some owners face losses of around 40% down, while short windows show a big turn.

The math is simple: big profits came quickly, and some of that profit was returned. At the same time, net positions remain large and a fair share of previous income is still parked in ETFs.

Long Term Benefits Versus Short Term Pain

According to some market analysts, the big picture still favors those who kept the faith during the rally years. Starting in 2022, Bitcoin’s upward trajectory has surpassed several traditional stores of value, say analysts who follow long-term performance.

That record is raised as a counterpoint to the current issue. Some investors see the current weak expansion as a temporary pause; others see it as a warning.

Related Reading

Next

The three-month outflow is a sobering sign. It shows that caution has spread beyond a handful of traders and extended to products that many thought would slide into volatility.

The money can come back as fast as it went, or the trickle can continue. At the moment, reports and data both show the market in a rare position: damaged, but not drained.

Featured image from Unsplash, chart from TradingView