Pitney Bowes Shares Increase Following 2025 Full-Year Results

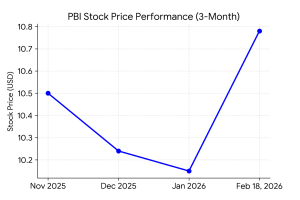

Pitney Bowes Inc. (NYSE: PBI) shares rose 1.89% in Wednesday trading following the release of financial results for the fourth quarter and full year 2025. Pitney Bowes has a market cap of $1.65 billion as of February 18, 2026.

Fourth Quarter Results

Fourth quarter revenue was $478 million, representing a 7% decrease compared to $516 million in the year-ago period. GAAP net income for the quarter came in at $27 million, an improvement from a net loss of $37 million in the fourth quarter of 2024. Adjusted earnings per share were $0.45, compared to $0.32 in the same period last year.

Best photos of the category:

- SendTech Solutions (Core Mailing): Revenue for the segment was $289.5 million, a decrease of 7.4% year over year. The decline was due to structural changes in the email installation base and product migration.

- Presort Services: Revenue in this division was influenced by volume fluctuations in the third and fourth quarters, with a focus on manufacturing and transportation.

- Pitney Bowes Bank (Financial Services): The segment has maintained stable financial receivables and credit quality, contributing to the overall cash flow profile of the organization.

Financial trends

Summary of Full Year Results

For the full fiscal year 2025, Pitney Bowes reported revenue of approximately $1.9 billion. The company achieved a strong net profit for the year, reversing from a net loss of $204 million recorded in the 2024 fiscal year. The operating results show a trend of increasing profits and structured costs following the exit of non-core business lines.

Business & Operations Update

Pitney Bowes completed the divestiture of the Global Ecommerce (GEC) reporting segment in early 2025. The company has eliminated approximately $120 million in annual costs by the end of 2024 and increased the total annual savings target to a range of $170 million to $190 million. These plans include the standardization of personnel and the simplification of the organizational structure.

IM&A or Strategic Moves

On August 8, 2024, the company began a series of operations to facilitate the exit of the Global Ecommerce business. This included the sale of a majority interest in GEC’s businesses to subsidiary Hilco Commercial Industrial, followed by the Chapter 11 bankruptcy filing of those entities. The company also completed the sale of its fulfillment services business to Stord during the restructuring.

Equity Analyst Commentary

The installation of the Pitney Bowes facility remains unique. Bank of America began covering the company with an underperform rating. Citizens began to cover the rate of passing the market, while Goldman Sachs maintained a neutral position. Research reports from these institutions highlight the company’s cash flow and the ongoing impact of cost reduction programs.

Direction & Outlook

Management issued financial guidance for fiscal year 2026, forecasting revenue between $1.8 billion and $1.9 billion. Adjusted earnings per share are expected to range from $1.40 to $1.60. Factors to watch include the continued stability of the SendTech segment and the execution of remaining cost-balancing objectives.

Performance summary

Shares of Pitney Bowes soared higher following the release of fourth-quarter earnings. The company reported a 40% increase in adjusted earnings per share and a return to positive GAAP profit. The segment’s performance remains focused on mailing and frontline services as the company moves forward with its restructured balance sheet and revised cost base.