Clean Harbors Q4 2025 Profit Soars: Momentum Stuns Market

Clean Harbors Inc. (NYSE: CLH) revenue delivered improved results. The company reported revenue of $1.5 billion. This marked an increase of 5% compared to the previous year’s quarter. The benefits exceed expectations. Net income rose to $86.6 million. Adjusted EBITDA increased 8% to $278.7 million. The full year results highlighted the milestone. Revenue reached a record $6.03 billion. The company also achieved free cash flow of $509.3 million.

Click Here to visit the Clean Harbors Inc. website. Investor Relations.

Clean Harbors Q4 2025 Benefits: Financial Results

Revenue growth accelerated in the fourth quarter. Total revenue reached $1.5 billion. This compares to $1.43 billion in Q4 2024. The 5% increase exceeded market expectations. Operating income reached $158.4 million. This marked a 16% gain from the same period last year. Thus, the momentum continued throughout the business.

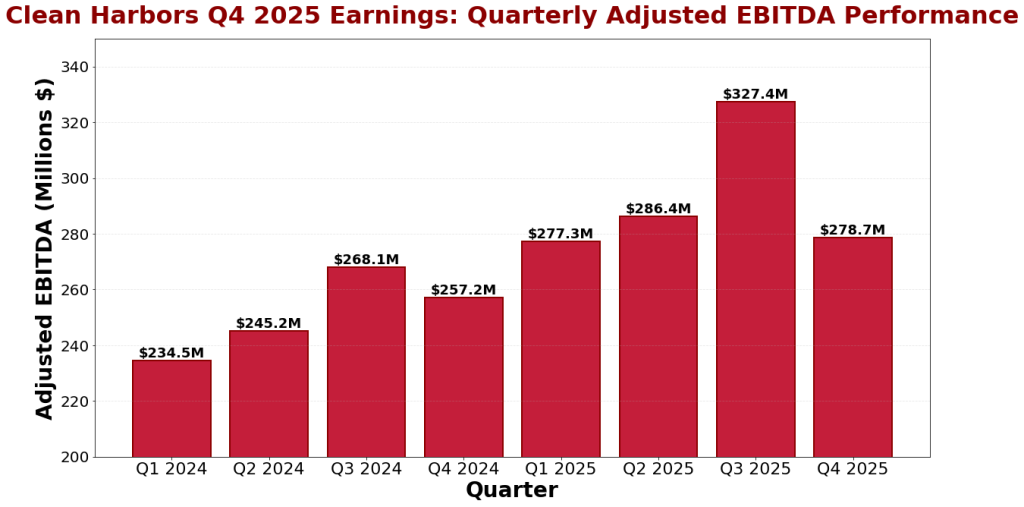

Profitability metrics have improved significantly. Net income reached $86.6 million in Q4 2025. This compares to $84.0 million in Q4 2024. Adjusted EBITDA grew 8% to $278.7 million. Last year it was $257.2 million. Also, adjusted EBITDA margin expanded to 18.6%. This reflected the price dynamics and cost behavior.

Clean Harbors Q4 2025 Salaries: Working Full Year

Full-year results underscored consistent performance. Also, revenue by 2025 has reached $6.03 billion. This represented a 2% increase from 2024. The previous year had $5.89 billion. Operating income for the full year reached $673.4 million. This compares to $670.2 million in 2024. Also, adjusted EBITDA grew 5% to $1.17 billion.

Money production appears to be abnormal in 2025. Operating income reached $866.7 million. Adjusted free cash flow reached a record $509.3 million. This is more than a year ago. Last year it made $357.9 million. The improvement came from highly adjusted EBITDA. Working capital management also helped the results. Therefore, the company makes a lot of profit for the shareholders.

Quarterly Revenue Performance

Figure 1: Clean Harbors Q4 2025 quarterly revenue style chart showing results from 2024 to 2025

Business Segment Performance: Growth and Margin Expansion

Environmental Services led the results this quarter. Also, this segment delivered revenue growth of 6%. Adjusted EBITDA margin expanded 50 basis points to 25.8%. Technology Services gained 8% on healthy demand. Demand for disposal and recycling services remains healthy. Project volumes have increased significantly. Also, the expansion of the PFAS service continued.

Safety-Kleen Environmental Services also did well. In fact, revenue in this unit increased by 7%. Price improvements and higher volume have led to gains. Vacuum services are taking market share. Incineration utilization reached 87%. Waste disposal capacity increased by 56%. Field Services revenue jumped 13%. Major emergency response projects boosted sales.

Adjusted EBITDA Performance: Effective Performance

Figure 2: Clean Harbors Q4 2025 earnings adjusted quarterly EBITDA performance chart showing profit growth

Key Growth: Capital Remittances and Receivables

Allocation of funds remained strategic and systematic. Also, the company has repurchased $250 million of shares in 2025. The board expanded the repurchase program by $350 million. Clean Harbors has announced plans for a $130 million acquisition. The agreement is aimed at Depot Connect International businesses. The acquired works cover three regions. Five locations operate in Ohio, Louisiana, and Texas.

Strategic investment in fleet expansion also began. Clean Harbor has committed $50 million to increase trucking. This two-year program supports growth plans. The company expects a five-year payback. Cross-selling opportunities should be highly profitable. Also, management guidelines for acquisition work in 2026.

Outlook 2026: Management Guidance and Strategic Direction

Management provided full-year guidance for 2026. Therefore, adjusted EBITDA is expected to reach $1.20-$1.26 billion. The midpoint is $1.23 billion. This assumes that profit growth continues. Adjusted free cash flow guidance ranges from $480-$540 million. The midpoint stands at $510 million. Therefore, Clean Harbors expects cash generation to remain healthy.

Near-term momentum looks good for Q1 2026. Adjusted EBITDA for Environmental Services should grow by 4%-7%. This shows a year-over-year comparison. Consolidated adjusted EBITDA is guided higher by 1%-3%. The company highlighted several growth drivers. Recovery trends should support disposal capacity. PFAS remediation projects offer additional opportunities.

Clean Harbors Q4 2025 Earnings: Key Takeaways

- Revenue reached $1.5 billion, up 5% year over year.

- Operating income jumped 16% to $158.4 million.

- Adjusted EBITDA increased 8% to $278.7 million.

- The rating for Environmental Services increased to 25.8%.

- Full-year revenue reached a record $6.03 billion.

- Adjusted free cash flow reached a historic $509.3 million.

- Share buybacks could reach $250 million by 2025.

- Strategic acquisitions enhance the growth portfolio.

- $50 million invested in fleet expansion.

- The 2026 guidance expects continued growth in adjusted EBITDA.