Did The Fear Of Quantum Computing Crash Bitcoin? NYDIG says No

Quantum Computing has become the latest all-purpose explanation for Bitcoin’s recent traction, but NYDIG says the numbers don’t support the narrative. In a research paper dated Feb. 17, NYDIG head of research Greg Cipolaro argues that “quantum fear” is loud, but not the main driver of sales when looking at search behavior, asset correlation, and broader risk exposure.

Quantum Panic Didn’t Sink Bitcoin

NYDIG frames “Quantum Computers as Scripturally Appropriate” as end-game risk investors continue to circle. The problem is that market behavior doesn’t seem to be re-pricing an imminent threat.

First, Cipolaro points to Google Trends. Search interest in “quantum computing bitcoin” rose, he wrote, but time is of the essence. “Search interest for ‘quantum computing bitcoin’ has increased, but notably this has occurred alongside bitcoin’s rally to the upside, not before continued weakness,” the note said.

“In other words, the heightened search for quantum risk coincided with price strength rather than weakness. If the market were calling bitcoin an imminent technical threat, we would expect search momentum to lead to or amplify lower risk, not to coincide with the timing of gains.”

Related Reading

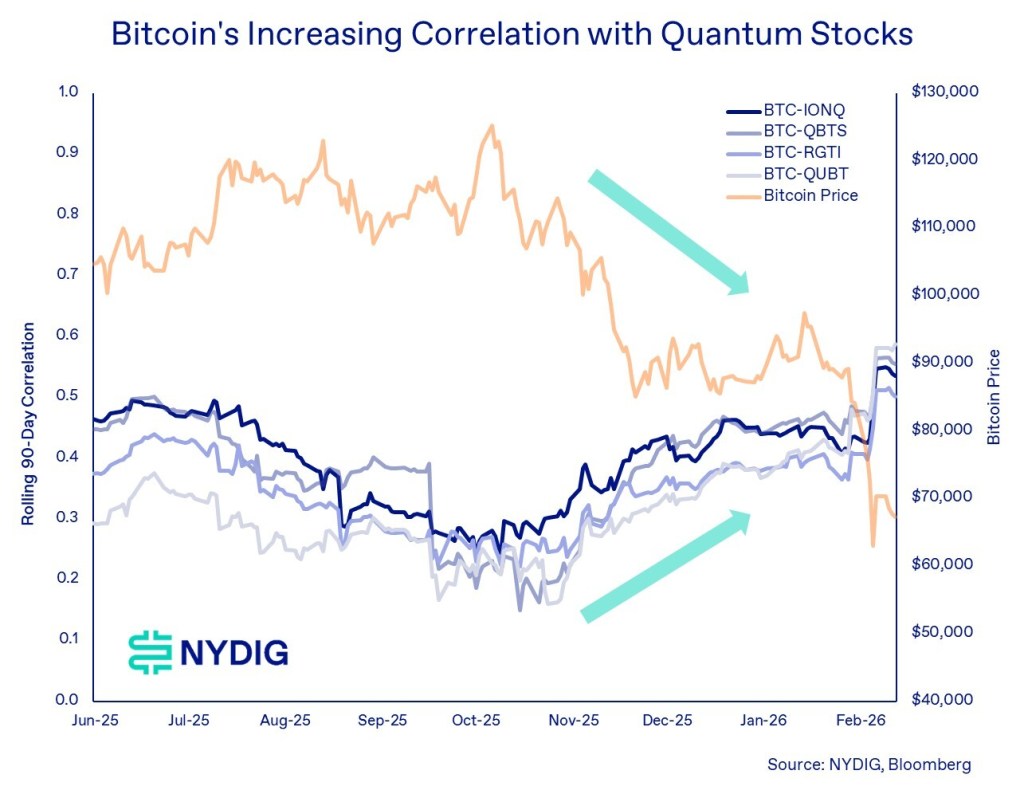

Second, NYDIG looks at how Bitcoin has traded against publicly-listed cryptocurrencies, specifically IONQ, QBTS, RGTI, and QUBT. If investors were shifting out of Bitcoin because a quantum leap was “in reach,” you’d expect quantum-linked stocks to break even as Bitcoin falls. NYDIG says it saw the opposite. Bitcoin was positively correlated with those stocks, and that correlation strengthened during the drawdown, suggesting a shared driver rather than direct quantum-to-Bitcoin causality.

The conclusion of the NYDIG is ambiguous on that point. Cipolaro wrote: “A plausible explanation is a broad repricing of risk among long-term assets, driven by expectations. Bitcoin’s recent decline appears to be more related to a shift in risk appetite than any technical catalyst.”

Related Reading

The way NYDIG highlights it is familiar to anyone looking at spending patterns. Quantum computing firms, he says, are long-term, anticipation-driven assets with low revenues and high EV/earnings multiples. Bitcoin, although structurally different, is often traded as a long-term bet on future earnings and currency strength. When appetite contracts are compromised, the two can collide.

Meanwhile, NYDIG is flagging differences in derivatives markets that, in its view, better capture the current tape than quantum titles. The 1-month annual basis on the CME “continued to trade above” Deribit, which is used by NYDIG as a proxy for the US onshore versus offshore position.

A structurally higher CME base means US desks remain largely positive, while Deribit’s sharp decline in the monthly base points to increased caution overseas and reduced appetite for long exposures.

At press time, Bitcoin traded at $66,886.

The featured image was created with DALL.E, a chart from TradingView.com