Saber Q4 2025 Earnings Release: Epic EBITDA Margins Soar

Saber Corporation (NASDAQ: SABR) reported earnings for Saber Q4 2025. The results exceeded expectations. Revenue reached $667 million. It increased by 3% year-on-year. Also, the company showed strong results. The momentum is building.

Saber Investor Relations

Saber Q4 2025 Earnings: Market Performance

The stock responded well to the results. The company went well. Margins are up. Bookings are increasing. Also, EBITDA increased by 10%. It reached $119 million. In addition, cash flow increased by 90%. It reached $116 million. In fact, this was good news. The company received results.

Saber Q4 2025 Earnings: Monthly Results

Q4 revenue was $667 million. Last year it was $645 million. This is a 3% increase. Operating income reached $21 million. The average was 3.2%. Also, bookings reached 83 million. Growth was 3%. Airline bookings increased by 4%. In addition, passengers increased by 4%. The total was 176 million. In fact, the booking fee has increased. They went from $6.17 to $6.31

Full Year of Operation 2025

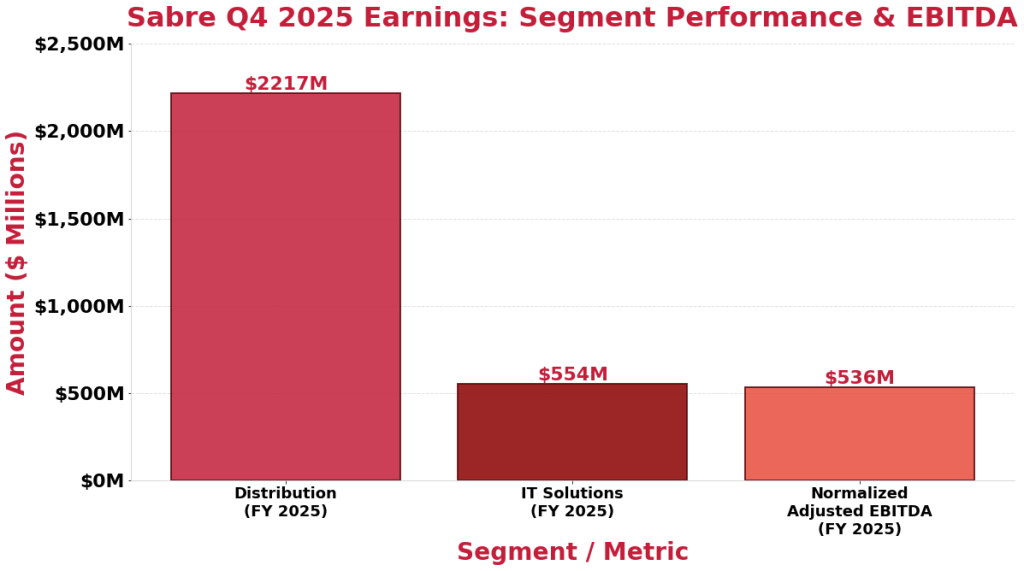

Revenue for the full year was $2,771 million. It was up 1% from $2,745 million. Operating income increased by 22%. It reached $295 million. The margin increased to 10.7%. It was up 190 points. So, real growth was good. Also, EBITDA increased by 10%. It reached $536 million. Meanwhile, margins increased to 19.3%. Also, bookings reached 365 million. Growth was 1%. In fact, the year was strong for the company.

Saber Q4 2025 Earnings: Segment Breakdown

The Distribution Division reached $2,217 million. It is up 2%. Bookings reached 365 million. Growth was 1%. But the flight booking was not straightforward. Growth was 0%. However, December was good. Air bookings increased by 7% that month. So, this is a good sign for 2026. Also, hotel bookings jumped 5%. They hit 42 million. Also, hotel rates increased by 130 points. For now, the momentum is clear.

The IT Solutions division had a tough year. Revenue was down 3%. It went from $571 million to $554 million. The decline came from lost customers and lower volumes. However, management sees hope. The new platforms should help soon. All in all, the company is looking forward to better times ahead.

Saber Q4 2025 Revenue Outlook

Saber Q4 2025 quarterly earnings show consistent performance across 8 quarters. The chart shows quarterly revenue tracking from Q1 2024 to Q4 2025.

Saber Segment Performance and EBITDA Growth

Saber’s Q4 2025 earnings chart shows segment revenue performance and adjusted adjusted EBITDA for the full year 2025. Distribution dominates revenue, while EBITDA reflects a healthy margin profile.

2026 Guidance & Outlook

The company has forecast mid-single-digit revenue growth for 2026. EBITDA is seen at $585 million. This is 9% more than 2025. Therefore, the company sees ahead. The volume should increase significantly. Also, air bookings should rise in the mid-single digits. At the time, cash flow was negative at $70 million. Paying bills causes this. However, the future looks good. Margins should be much wider. In fact, the path is clear by 2026.

Key Takeaways

The advantages of the Saber Q4 2025 reflect the efficiency. Revenue reached $667 million. That’s a 3% increase. Margins are up. EBITDA hit $536 a year. And December showed heat. Air bookings increased by 7% that month! The company looks to 2026 with excitement. Mid-digit growth is planned. Also, AI technology will help sales. Moreover, the recovery is clear. In short, the travel company is on the right track.

Click Here to visit the AlphaStreet website.