TPG RE Finance Trust Q4 2025 Real Earnings: Unexpected Portfolio Momentum Emerges

TPG RE Finance Trust, Inc. (NYSE: TRTX) Q4 2025 earnings announced strong results. The loan portfolio reached $4.3 billion, marking a significant increase in the portfolio. The company maintained a 100% operating rate while securing $927 million in new loans. These results show the consistent use of real estate finance.

Financial highlights for Q4 2025

- The loan portfolio grew to $4.3 billion in total commitments.

- Received $927 million in new mortgage loans.

- It received $378.3 million in loan repayments.

- Maintained a 100% efficient loan portfolio.

- Average loan-to-value ratio of 65.7%.

- Average average interest rate is 2.66%.

Quarterly Loan Portfolio Growth

TPG RE Finance Trust, Inc. Q4 2025 showed an expansion of the loan portfolio for the quarter, with commitments reaching $4.3 billion by the end of the year.

TPG RE Finance Trust, Inc. Q4 2025 Benefit: Accelerating Loan Activity

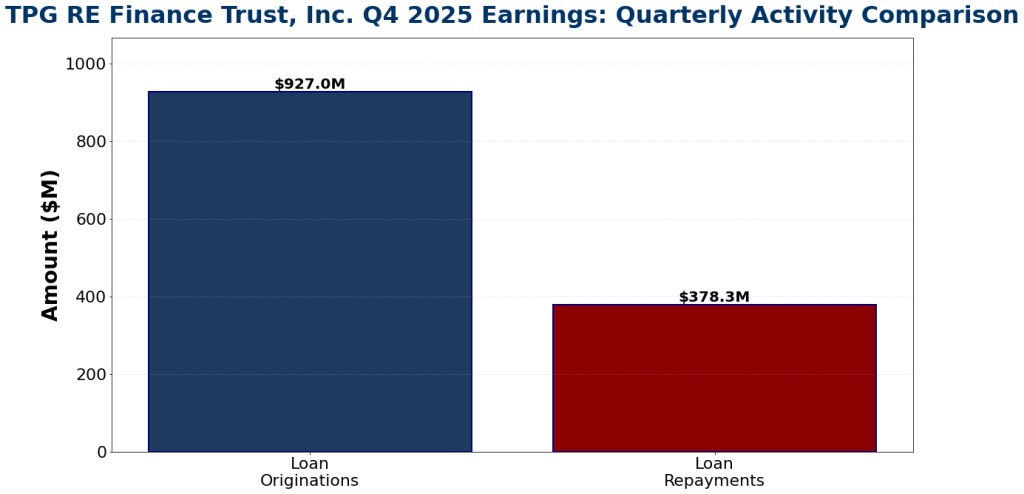

The fourth quarter showed strong activity in both loan originations and repayments. Total new loan commitments of $927 million reflect the company’s ability to spend. Loan repayments of $378.3 million generated healthy cash flow from portfolio maturity. This balance between origination and repayment indicates effective portfolio management.

Loan originations exceeded repayments in Q4 2025, reflecting overall portfolio growth.

Performance Overview for the Full Year 2025

For the full year 2025, TRTX Q4 2025 earnings showed consistent annual performance. Total loan commitments reached $1.9 billion with repayments of $987.9 million. Distributable earnings totaled $76.8 million, supporting $77.9 million in stockholders’ equity.

Portfolio Quality and Risk Management

The company has maintained a strong credit quality throughout 2025 with 100% loan defaults. The salvage hazard ratio remained stable at 3.0. The credit loss reserve reached $77.4 million, equivalent to 180 basis points. The portfolio has shown resilience across all types of real estate.

Key Business Drivers

- Fixed loan origination rate of $927 million in Q4.

- A diverse portfolio across major metro areas.

- Focus on first mortgages with solid collateral.

- Efficient portfolio management with equal payments.

- Disciplined management with a debt-to-equity ratio of 3.02x.

- Access to various financing sources, including CLO issuance.

TPG RE Finance Trust, Inc. Q4 2025 Profit: Growth Trajectory

The company ended 2025 with $143 million in cash and an extended credit facility in February 2028. Management increased the $85 million secured revolving credit facility to a total of $375 million. This positions the company to continue to receive compelling loan opportunities. A strong balance sheet and diversified funding sources support the growth potential of the loan portfolio in the future. Management expects continued growth in real estate lending.

Key Takeaways

- The loan portfolio expanded to $4.3 billion in total commitments.

- Q4 2025 originations of $927 million reflect consistent deal activity.

- The portfolio remains 100% active throughout the year.

- Distributable earnings of $76.8M based on stable dividends.

- Improved financing and expanded credit facilities support growth plans.

About TPG RE Finance Trust, Inc.

TPG RE Finance Trust, Inc. is a commercial finance company that originates, acquires, and principally manages first mortgage loans originated by institutional properties in the primary and secondary markets. The company is owned externally by TPG RE Finance Trust Management, a division of TPG Real Estate. For more information, visit

Click Here to visit the AlphaStreet website.