Walmart Q4 FY26 Earnings Report: 24% eCommerce Growth Dominates

Walmart Inc. (NASDAQ: WMT ) reports Q4 FY26 earnings with revenue of $190.7 billion, up 5.6% year over year. Walmart’s Q4 FY26 earnings show that the company is executing its omnichannel strategy. Global eCommerce sales increased 24%. Operating income increased by 10.8%. This report marks a revolution in retailing.

Click Here to visit the Walmart Inc. website. Investor Relations.

Walmart Q4 FY26 Earnings: Market Position

Walmart holds the top position in US stores. The company serves nearly 280 million customers every week. Its shares trade on the NASDAQ under the ticker WMT. Walmart’s Q4 FY26 earnings confirm the retailer’s market dominance. Performance continues across all segments.

Walmart Q4 FY26 Earnings: Financial Results

Q4 FY26 delivered strong performance. Revenue reached $190.7 billion, up 5.6%. Again, this was over a year ago. Operating income grew rapidly by 10.8%. Therefore, the total margin is widened by 13 points. The company has achieved a better cost benefit. In fact, adjusted operating income grew 10.5% in constant currency.

Full Year Results for FY26

Walmart’s results for the full fiscal year 2026 show momentum. Total sales reached $713.2 billion, up 4.7%. Also, operating income grew 1.6% on a reported basis. On an adjusted basis it showed growth of 5.4% on a constant basis. Also, operating cash flow jumped $5.1 billion to $41.6 billion. Free cash flow increased by $2.3 billion to $14.9 billion.

Chart 1: Quarterly Revenue Trend

Walmart’s Q4 FY26 earnings show an increase in quarterly revenue momentum from Q4 FY25 to Q4 FY26.

Walmart Q4 FY26 Earnings: Growth in eCommerce

The growth of eCommerce continues to accelerate. Global eCommerce sales increased 24%. Therefore, this represents 23% of total sales. Filled in-store pickup and delivery stations grew by more than 50%. Also, market sales have been expanded to all regions. Membership revenue grew 15.1% globally. Also, advertising sales jumped 37%. Walmart Connect in the US is up 41%.

Segment Performance in Q4 FY26

Walmart US sales grew 4.6% to $129.2 billion. Comp sales (excluding fuel) rose 4.6%. Also, eCommerce’s contribution to comp sales reached 520 basis points. Operating income increased 6.6% to $7.0 billion. During that period, Walmart International’s total sales reached $35.9 billion, up 11.5%. Operating income jumped 36.0% to $1.9 billion. Also, Sam’s Club US net sales grew 2.9% to $23.8 billion. Operating income rose 3.8% to $596 million.

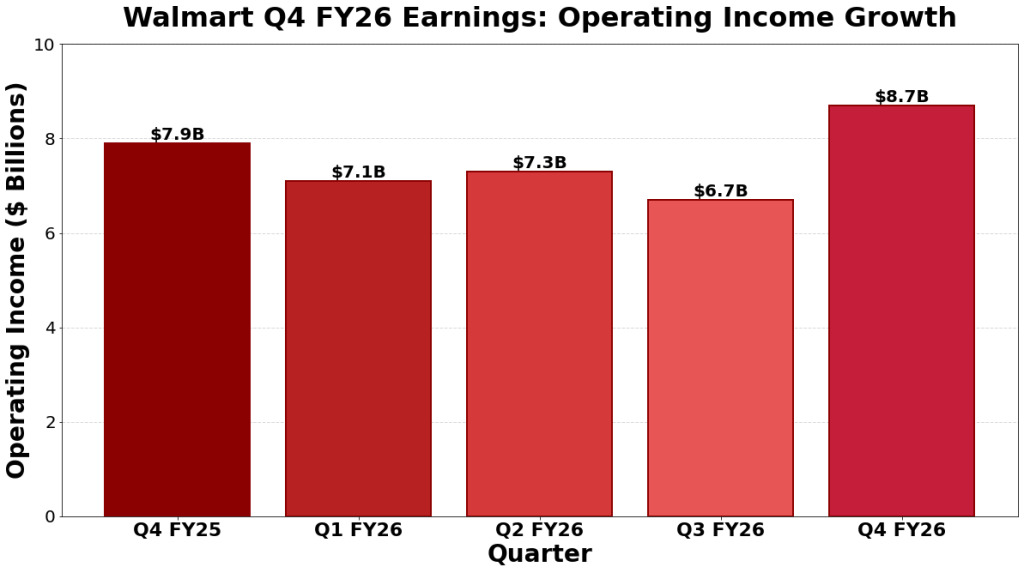

Chart 2: Operating Income Trajectory

Operating income growth reflects margin expansion and cost control in Q4 FY26.

Walmart Q4 FY26 Earnings: Forward Guidance

Management has provided detailed guidance for FY27. Net sales are expected to grow 3.5%-4.5% in constant currency. Also, adjusted operating income will grow 6.0%-8.0% in constant currency. Interest costs will increase by about $200-$300 million. Therefore, the effective tax rate is expected to be 23.5%-24.5%. Capital costs will be approximately 3.5% of net sales. Also, channel expansion continues to support long-term growth.

Key Takeaways from Walmart Q4 FY26 Earnings

Walmart continues to do well in a competitive environment. Also, the company uses omnichannel capabilities effectively. eCommerce remains the main driver of growth at 24% growth. Also, membership revenue and ad sales show diversity. In fact, the expansion of the margin shows the strength of the operation. Thus, management shows confidence in continued growth. Overall, the guidance for FY27 shows a healthy market position.