£7,500 invested in Tesco shares in the last 1 month is now worth…

Tesco (LSE:TSCO) shares spent a decade in the wilderness following a shocking accounting scandal in 2014. However, they have started to fall sharply in recent times, gaining 119% in five years and now at a 14-year high.

Recent performance has been fluctuating, with FTSE 100 up 16.7% last month. That’s enough to turn a £7,500 investment made four weeks ago into around £8,755.

But there has been little company-specific news from the supermarket in the past few weeks. So what’s going on here?

Image source: Getty Images

Every little bit helps

From what I can see, there are a few minor and minor factors that have been driving the stock up. First and foremost, the FTSE 100 has been on fire, jumping about 23% in the 12 months and about 7.8% year to date.

Usually, a rising tide can lift all boats (assuming they didn’t hit holes, which Tesco didn’t).

Next, UK grocery inflation fell to 4% in the four weeks to 25 January, the lowest rate since April 2025. This will come as a relief to inflation-weary consumers, especially after the budget-straining Christmas period.

Lower inflation obviously gives consumers more confidence, which may lead to larger baskets and impulse purchases of high-end products ( The best range, clothes, toys, etc).

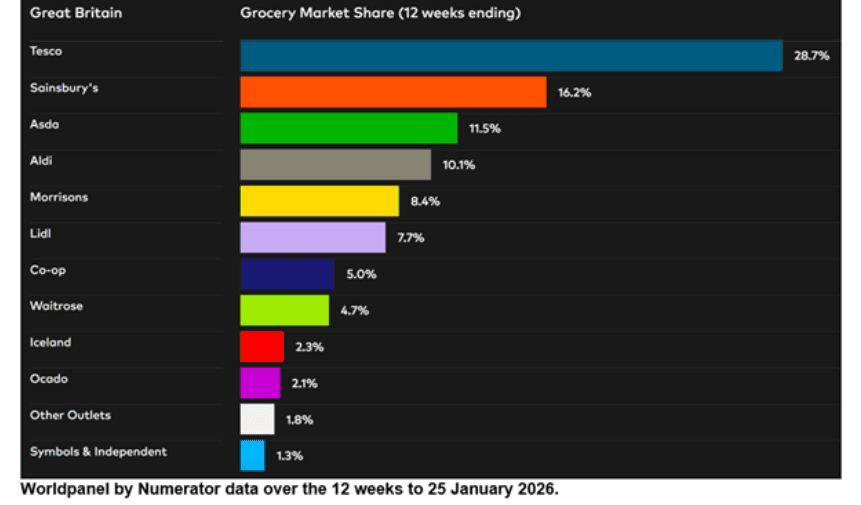

In the 12-week period to 25 January, Tesco sales rose 4.4% year-on-year, according to Worldpanel by Numerator. It also increased its market leading position, and its share increased by 20 points to 28.7%. That’s up from 26.5% in 2020.

It is estimated that Tesco earns more than £1 in every £10 spent on retail in the UK. Could it be that we are heading back towards the days of ‘Tescopoly’? However, there is still some way to go to get back to the 31.6% market share it held at its peak in 2007. But Tesco continues to break away from other rivals.

Meanwhile, the share buyback is ongoing. Since launching its plan in October 2021, the supermarket giant has bought shares worth around £4bn. Buybacks can help support the price, and Tesco has doubled since then.

The beneficiary of AI

Finally, there has been a sudden round of software/data output that may be vulnerable to AI disruption. Investors have turned more and more to stocks called HALO, which stands for heavy / difficult assets, low expiration (risk).

Tesco can certainly fit into this HALO category. It owns real things (hard goods) and is highly vulnerable to AI disruption.

Indeed, business uses technology itself to be efficient. For example, it has developed internal tools to find the most efficient journey for each Tesco truck and delivery van, shaving around 100,000 miles a week.

Should I buy Tesco stock?

Tesco’s earnings for 2026 are now over 17, which looks like a reasonable price to me. At this price, any lead lags may be penalized. And the forecast yield of 3.2% is not ambitious enough for me personally.

That said, considering the factors I mentioned above (increasing market share, reduced liquidity, rising FTSE 100, and continued HALO trading), I think Tesco stock can continue to do well.

The 3.2% dividend yield is very well supported, so I expect payouts to continue to rise healthily. On this basis, the stock is still worth considering for long-term investors.