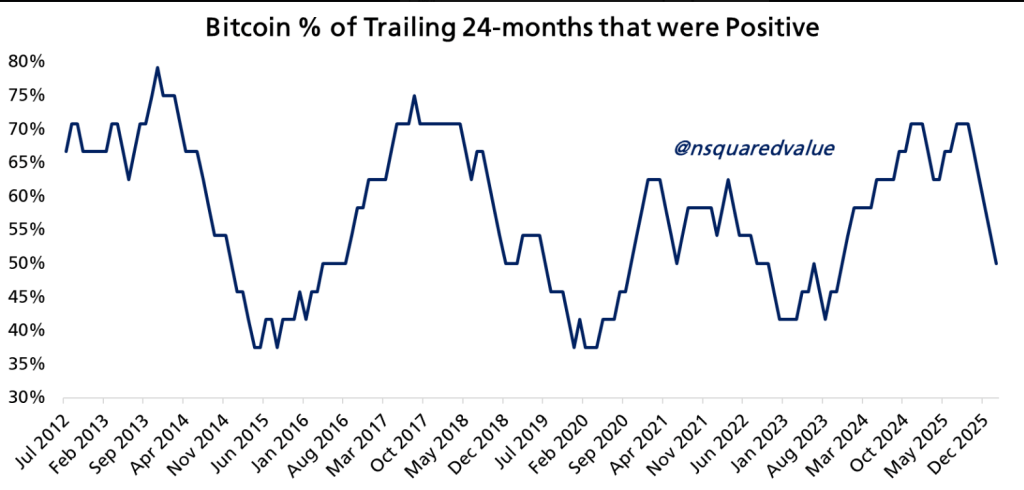

12 Months Green Out of 24

A humble claim. A bold number. Both are on the table for Bitcoin this week as the debate over how to read short-term streaks in price gains heats up.

Related Reading

Crypto analyst Timothy Peterson indicated that part of the last 24 months showed a positive return. Based on the reports, he then gave about 90% chance that Bitcoin will be higher in 10 months.

That jump from simple calculations to solid probabilities is the subject of this article. Careful questions must be addressed about how the constraints are calculated and what assumptions are built into the model.

Counting Good Months

Peterson based his opinion on a review of monthly performance data. Statistics compiled by CoinGlass show that Bitcoin closed six months of 2025 in a positive position, while the remaining six ended at the bottom.

According to the data, 50% of the last 24 months ended with gains. Peterson said he tracks this two-year window to identify potential turning points in price trends.

50% of the past 24 months were optimistic.

This means an 88% chance that Bitcoin will be higher 10 months from now.

Average return expires(60%)-1 = 82% => $122,000.

The data goes back to 2011. pic.twitter.com/ZxfTyequjt— Timothy Peterson (@nsquaredvalue) February 21, 2026

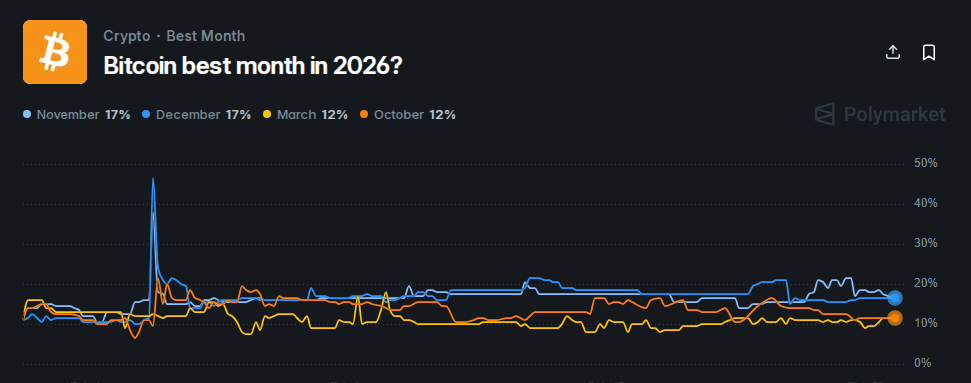

Market Odds and Betting

Betting exchanges show a very different perspective. Polymarket currently rates December as having a 17% chance of being the best month of 2026, with November even higher.

Those numbers answer a different question from Peterson’s: they reflect the market’s bet on which month will outperform the others, not whether the price will simply go higher at a future date.

Betting markets can be crude tools, but they pack the combined view of many traders into one number.

Bitcoin price action

The price never calmed down. Bitcoin has traded in a band around $67,000–$68,000 this week as regional tensions in the Middle East intensify.

Safe-haven assets like gold and oil jumped on the news, and Bitcoin felt the squeeze as some buyers retreated. At the same time, live tickers showed the token about 20% below its level at the beginning of the year, a reminder that the percentage of the title hides wide intraday changes.

Analysts Differ

The words from the trading table are different. Michael van de Poppe suggested that green candles are near, urging traders to watch for a ride. On the other hand, Peter Brandt said that the deep decline may not come until the end of 2026.

Both views rely on different sets of signals – one on strength and chart structure, the other on long-term cyclical patterns and the risk of a major shock.

Feeling Low

Meanwhile, flow data from spot ETF purchases, derivative positions, and on-chain liquidity figures can add weight to any forecast.

Related Reading

Peterson’s prediction comes as sentiment in the crypto market continues to decline, with reports noting that discussion and activity around Bitcoin predictions has slowed. Traders appear cautious, weighing past trends against current market uncertainty.

Featured image from Vecteezy, chart from TradingView